Slack Investor has blogged about financial advice before – and although an advocate of trying to do as much as you can by researching finance world yourself, it can be a very difficult journey to be across all the fields of saving, mortgages, investment loans, insurance, superannuation, taxation, and investment.

Most people want financial advice but the problem is that it is so expensive. MoneySmart.gov.au outline a case study where “Rhett” has $400 000 to invest – He might be hit with fees of $13 600 in his first year of advice . These fees include a Statement of Advice and Insurance premiums and layers of platform and investment advice fees.

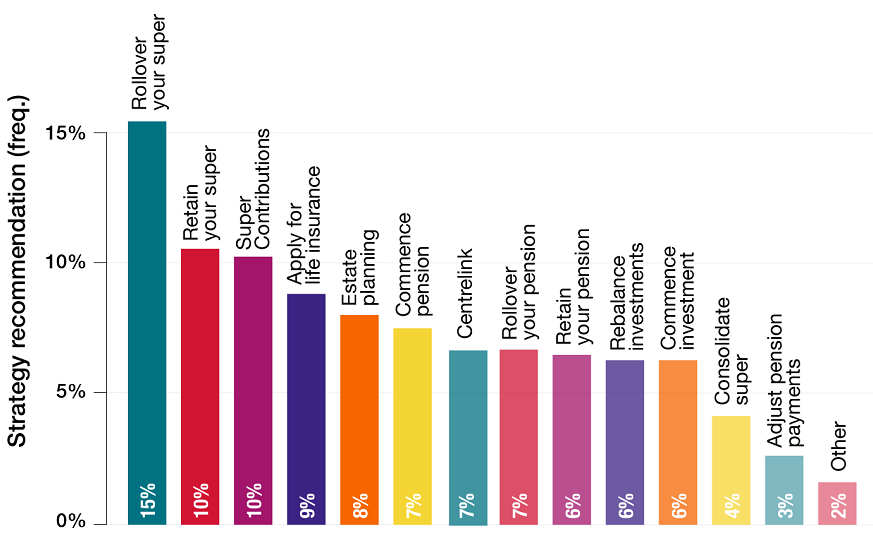

Where to invest your money is the easiest thing to sort out for yourself – with the key words being diversification and low fees. There are cost-effective ways of investing in a diversified way that will suit your risk tolerance without involving a financial advisor (e.g. Stockspot, Pearler). But some people (Not Slack Investor Readers!) need a trigger to just start investing. Finance world is much more complex than just investing your money. Slack Investor can see the need for finance professionals

Things a Financial Advisor might tell you

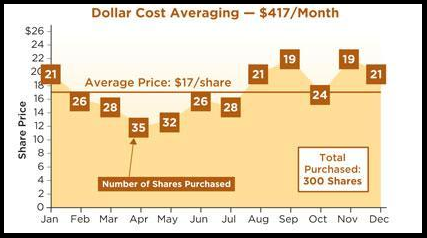

Firstlinks have trawled the data to determine the most recommended strategy used by financial advisers – the most common of these are listed below.

Let’s just have a look at some of these in more detail.

Rollover Your Super – “Rolling Over” your superannuation is just a way of describing the transfer of your “protected” super into another protected super fund. Slack Investor readers will be all over this one – Of course it makes sense to put all of your super with one provider to avoid multiple administration fees. Combine your super into one fund – preferably an industry fund (lowest fees) with a good 5-10 yr performance record.

Retain Your Super – This is again good advice for the long-term accumulators of wealth. Unless under extreme hardship, resist all attempts for early access to your super. During the COVID-19 outbreak, $4 billion was paid out to 456,000 people under the early super access scheme. This would have helped distressed businesses and individuals in the short-term but may not have been a great idea in the longer term.

Super Contributions – This is a more complicated area and, it might be good to have advice on when, and by how much ,you should boost your super contributions above those which are compulsory. This is tricky when you have competing loads on your take-home pay (Family, Mortgage, etc). Slack Investor was big on maximizing his super contributions once he had a firm grip on his home mortgage.

Apply for Insurance – When you have a family or debts (home loan?) to cover, life and disability insurance is a good idea. You don’t need an advisor to tell you this. Insurance through your super fund is usually the most cost effective way to do this.

Estate and Aged Care Planning – This area is really complicated for the layman. Professional Advice, or much research, needed.

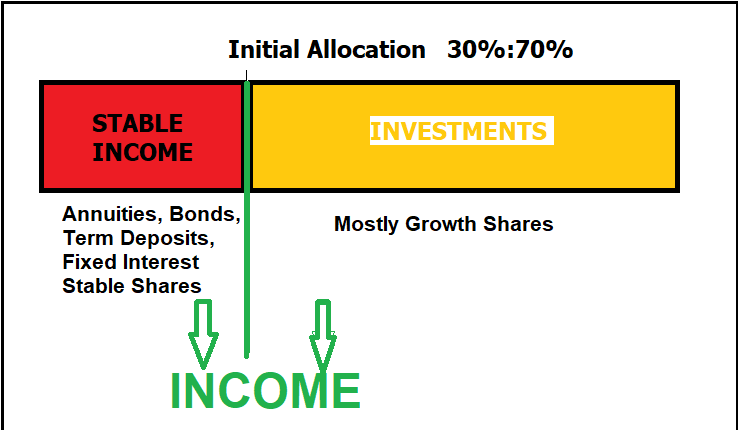

Commence, Rollover, Retain Pension – You may need advice here if planning to mix aged-pension and super to fund retirement. If there are no aged-pension issues, Slack Investor believes that it is best to start an account pension (from your super) as soon as possible and re-contribute any surplus funds as non-concessional contributions.

Commence, Rebalance Investment – An old truth – Best time to start investing? 20 years ago. Next best time to start investing? Now! Rebalancing can be done automatically with cost-effective platforms e.g., Vanguard Super, Stockspot.

What Types of advice Do You Really Need?

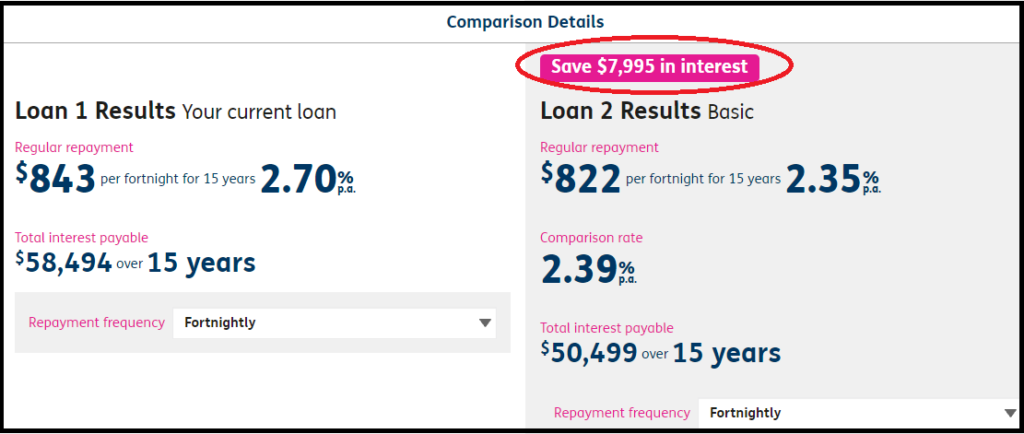

The current financial advice system is complicated by well-meaning regulations that are in dire need of reform. In 2022, the Australian Treasury provided a consultation paper seeking feedback on changes to the regulatory regime that would allow financial advice on specific matters without the obligation that the advisor should know everything about your financial situation – No need for the expensive Statement of Advice (SOA).

Ideally, in a future world, you could get advice at various stages in your life from finance professionals at an hourly rate – perhaps in the same way you would consult a medical specialist about a problem. For Instance

- Early/Mid-Career Advice: Am I on track with my savings, super contributions and retirement plan? What strategies should I employ to achieve my goals?

- Pre-Retirement: Am I ready? Taxation Issues? Aged-pension/Super mix?

- Estate and Aged Care Planning: Complicated – Many issues to discuss here.

Alternatively, you could just turn your financial future into a hobby (Like Slack Investor did), and use the internet and books to educate yourself.

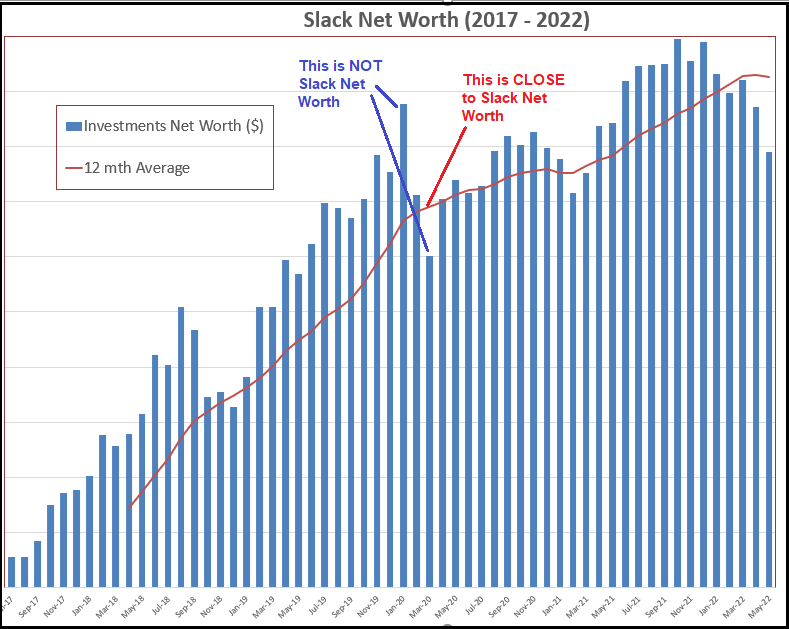

May 2023 – End of Month Update

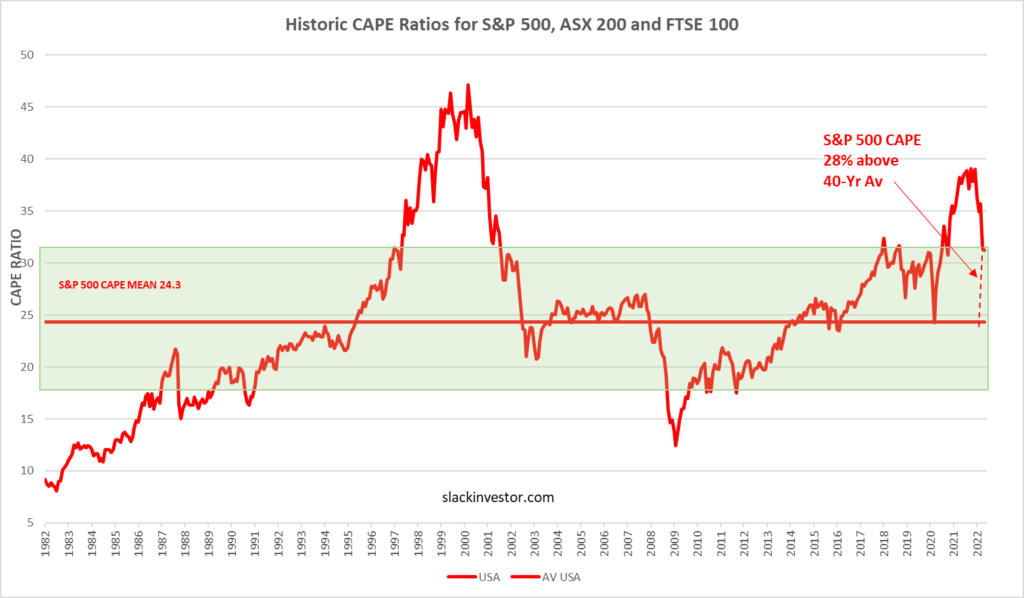

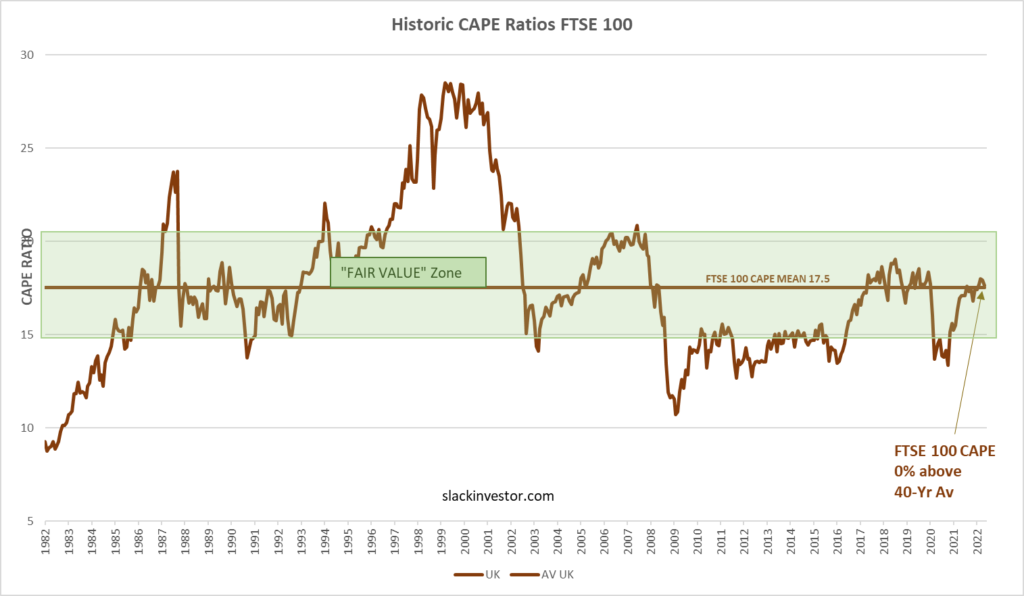

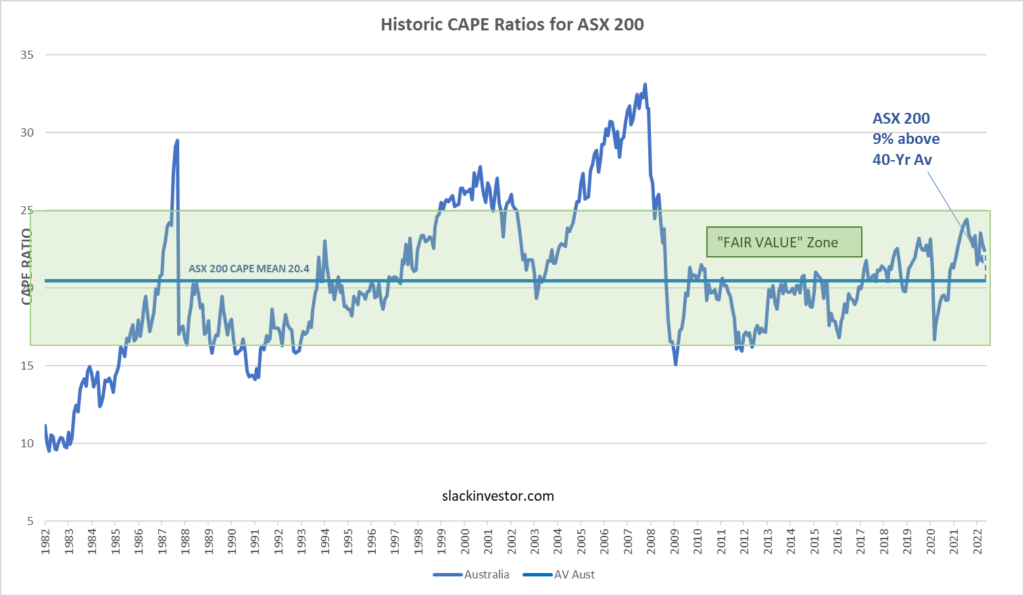

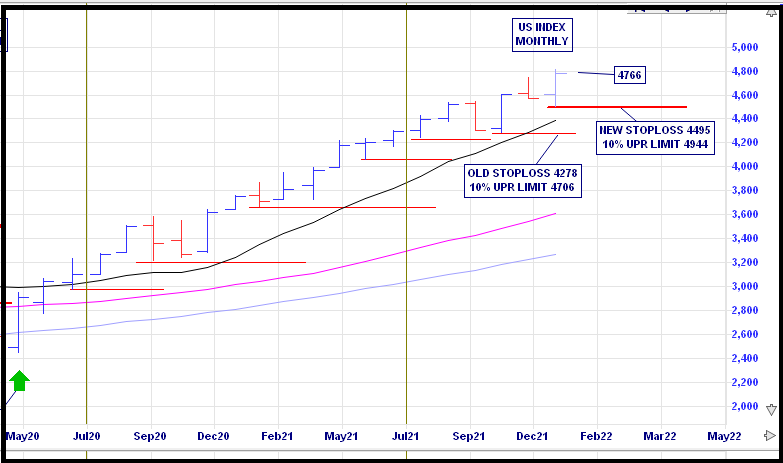

Slack Investor remains IN for Australian index shares, the US Index S&P 500 and the FTSE 100. It was a dreary month for the Slack Investor followed markets. The ASX 200 performed poorly this month – down 3.0%, and the FTSE 100 even worse – down 5.4%. The S&P 500 was flat (+0.2%) for the month.

In this month of turmoil for stock indexes, the Slack Portfolio did quite well. This is because it is heavy with technology stocks that are having a moment in the sunshine. The Nasdaq 100 index was up 7.7% for the month of May.

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index).