Fear and greed are part of the human condition, these traits have evolved over time.

Without the right dose of fear, we would expose ourselves to unreasonable threats and, without the right dose of greed, we would forego opportunities to secure the resources that we need to live.

Fear and Greed: a Returns-Based Trading Strategy around Earnings

Announcements

The fluctuations of the stock markets are just a symptom of these traits. There is a lot of general panic and selling when the stock market starts consistently falling. Stock owners become fearful of further losses and press the sell button. This sets up a chain reaction and the markets fall even further.

A “Herd Effect” exists in the financial markets when a group of investors ignore their own information and, instead, only follow the decisions of other investors.

The herd effect in financial markets – Quantdare.com

It is easy to see how herd behaviour evolved as copying what other individuals are doing can be useful in many situations. For example, if there is an immediate threat, that you haven’t noticed and the herd has – it might save your skin to follow the herd.

Then, of course, there are the good times when the stock market is pumping – the buyers start piling in regardless of the fundamental foundations of the stocks. Asset bubbles often result and a good example of this greed was the “dotcom” bubble in the late 1990’s when big prices were paid for any company that mentioned the internet in its prospectus. Nobody wanted to miss out on, what looked like, easy money.

But these herd behaviours are the opposite of what the astute investor should be doing. We must fight these evolved traits and develop our own behaviours that keep us on the right path.

Savings Automation and Dollar Cost Averaging

Slack Investor has written before about automating your savings. There are also huge advantages to automating your investing – particularly when you are just starting out in the investing world. The first stumbling block that new investors face is to start investing. Then they must develop the habit to keep on investing. There is always a reason to use the money somewhere else or, you might think that right now is not a good time to invest. This “paralysis” must be over come and the best way to do it is through automation.

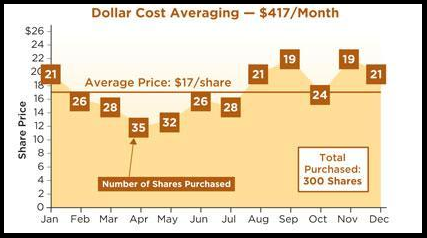

With auto investing, you don’t have to make the decision when to invest, it just happens automatically when your savings reach a pre-determined point. This opens up the delights of “Dollar Cost Averaging” where, if the market is relatively expensive, you will buy few shares – and if the market is undervalued at the time, your set amount of dollars will buy more shares.

You are buying in the good times and bad . This doesn’t matter – the important thing is that you are buying into companies and accumulating your wealth. Your purchasing is relentless, no decisions, no procrastination – Warren Buffet would be proud!

Pearler and Auto Investing

A new kid on the block in the broking business for Australian and US shares is Pearler with distinguishing points of a flat $9.50 brokerage charge and the use of the Chess system for attributing shares to individuals. This means that you are issued with a Holder Identification Number (HIN) and you have direct ownership of your shares. Slack Investor likes this model rather than the custodial model of many other new broking players. Pearler also offers free brokerage on the purchase of selected ETF’s (provided that you hold them for a year).

However, Slack Investor thinks the absolute best feature of the Pearler platform is that it encourages Auto Investing and makes the process simple. If you are serious about your investing journey, you need a broker and why not make it Pearler.

There are some well researched and comprehensive reviews of Pearler and its many features by Captain FI and AussieDocFreedom.

Auto Invest through Pearler is an excellent way to combat the cycles of fear and greed and take the emotion out of your investing decisions.

Other than just opening an account with them, Slack Investor has no affiliation with Pearler.