Slack Investor has not too many attributes … but one of his few features is self-awareness and the constant need to review techniques on the way to financial independence.

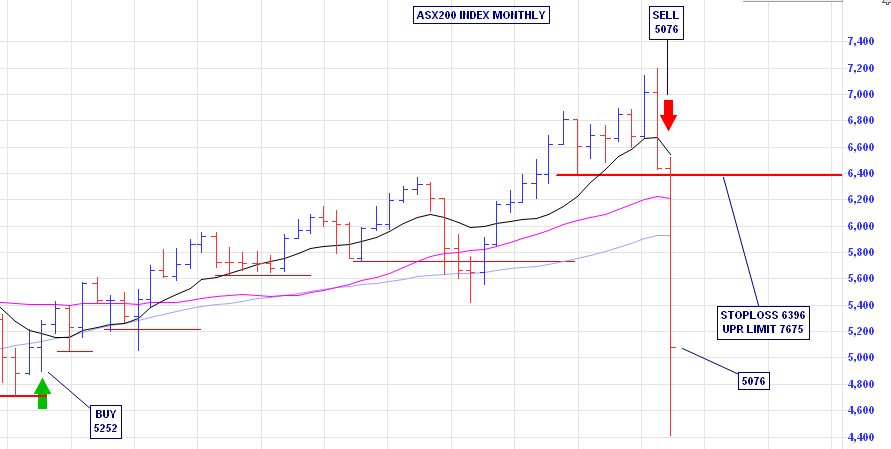

I have been trying to run a timing strategy with my index funds since 2004. With some success, but I would only give a “try harder” sticker to the results.

The average yearly gain for the Slack Monthly “market timing” method over the alternate strategy of “buy and hold” (leaving funds in the ASX Index, UK Index, and the US Index), is respectively is 2.7%, 2.3% and 0.3% (At March 2020). Check out the charts, trades and the gains at the page links for each index.

Although these figures show outperformance for the Slack “market timing” method. These gains might have been outweighed by share dividends if I had held the shares instead of trading out to cash. At the moment cash returns are very low (0.5 – 1.5%) and, at the current average ASX 200 yield of 5.2%, shares make a lot of sense – But being in stocks is not for the faint-hearted.

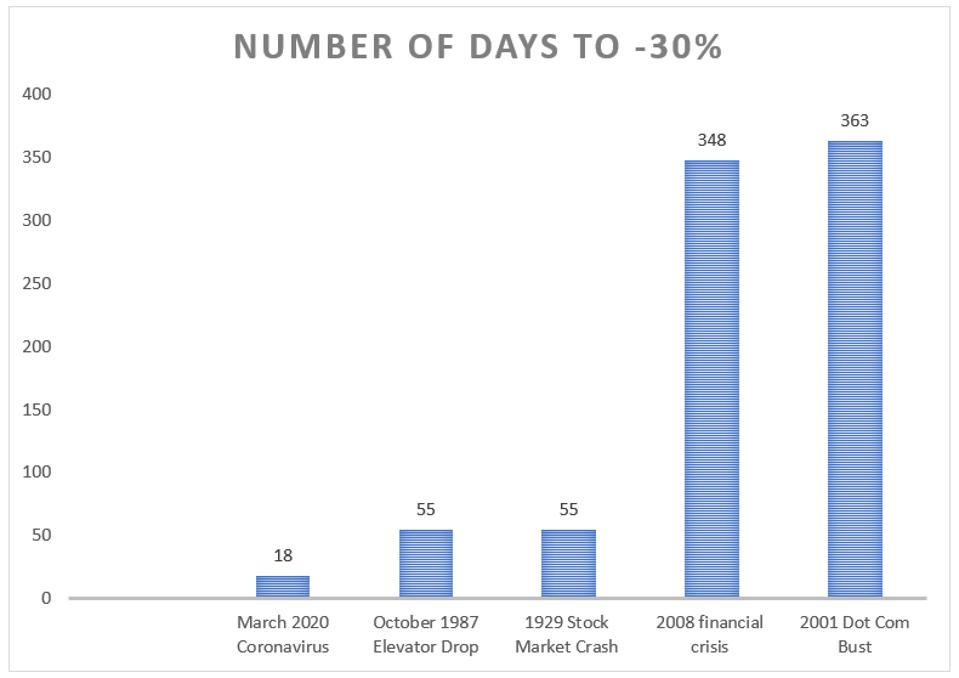

2020 has been the financial equivalent of the “Battered Sav” with wild swings in the stock market – and the fastest fall in stock market prices in history. The ASX fell 20.5% in 14 days to enter “Bear Market” territory on March 11. It was down 30% from its peak by March 16. It is the speed of the market falls that is making Slack Investor starting to question his monthly timing strategy. For the US Dow Jones index, the rapid fall of 30% in just 18 days during March 2020 has set new records.

Things are getting freaky!

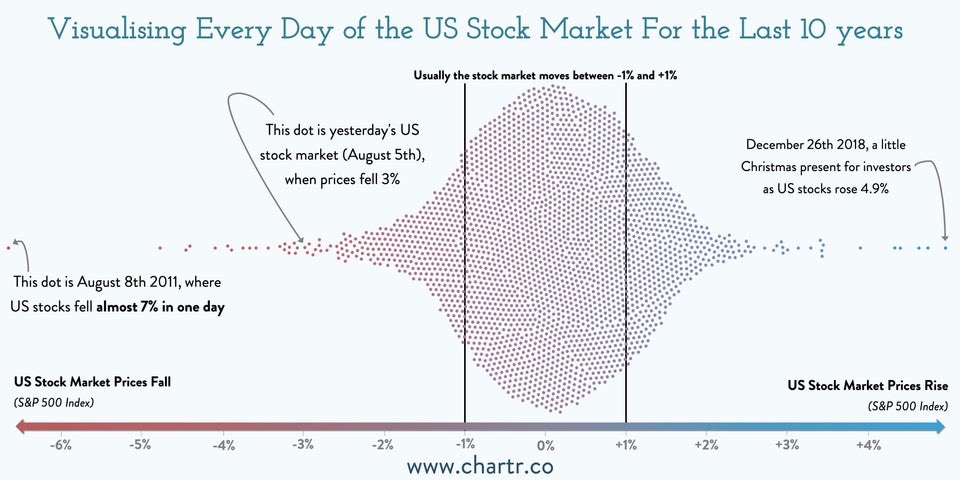

A visualization of the daily moves for the US Market 2010-2019 shows that usually most daily movements are less than 1% either way – This is Slack Investors comfort zone. But, occasionally, the market moves much more in a day. I think these large moves are getting much more common with the increased prominence of high frequency trading.

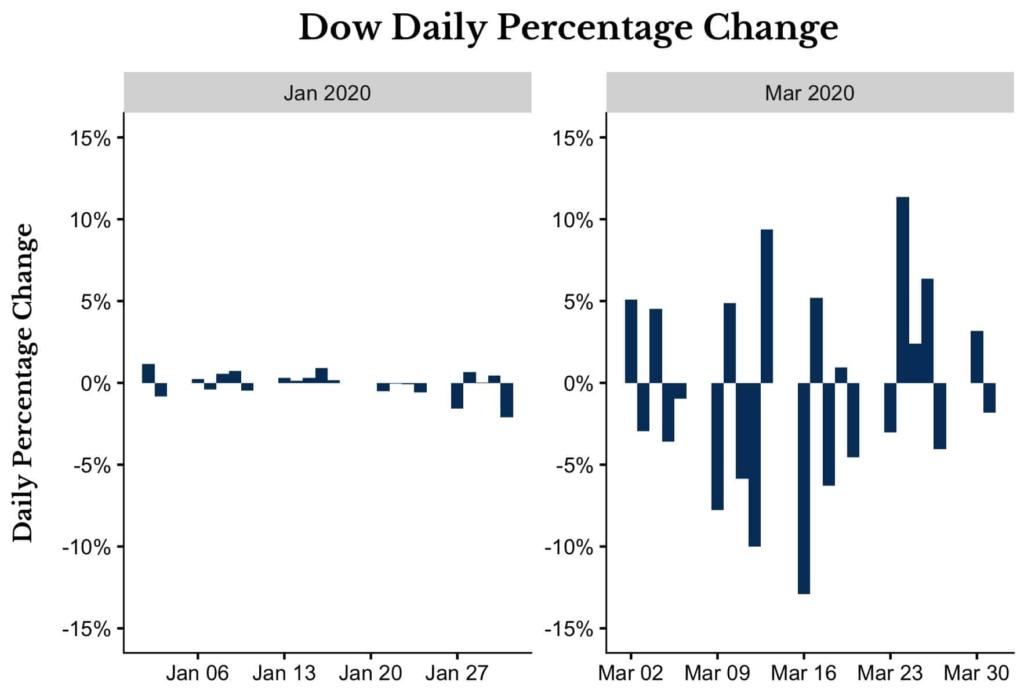

Compare the size of daily movements on the US market in January 2020 with March 2020 – where most days had changes more than 3%.

Large share brokers and investment firms use trading systems that automatically buy into rising markets and sell into falling markets. These trades are executed by computers that use a defined set of instructions known as an algorithm to place a trade. If the market is moving up or down then these trading systems inflate the movements of the market as they try to get in or out of a trade. These computer trades make it hard for individual investors as their trades happen in microseconds. Algorithmic trading is growing rapidly at 11% per year.

“fundamental discretionary traders” accounted for only 10 percent of stock trading volume

JP Morgan quote from 2017

That means that we individual traders are up against the machines for 9 out of every 10 trades.

“Investors may have to get used to big, sudden moves in the stock market due to fewer institutions pushing equities to attractive valuations while hedge funds reach unprecedented levels of employing computerized momentum-based strategies. The result will be “faster and deeper” corrections.”

JP Morgan

I will keep my market-timing experiment for index funds (Less than 3% of my Portfolio) going for another 4 years (to make it a 20-year trial). My feeling is that by waiting till the end of the month, sometimes the market has corrected too far. However, for the bulk of my stocks, my message is to embrace the volatility of the stock market … it is what it is! The share market is still one of the most convenient way to build wealth for the investor.

Slack Investor cannot beat the computers in a momentum trade. But I do have some advantages over the the machines. I can try to judge what a business is worth. Does it have barriers to entry for other companies? Is it growing? Does it have too much debt? Find yourself some good growing companies with a track record of increasing earnings. Do a little “tweaking” to suit the times … and stay safe in these troubled times.