A month ago, if you asked Slack Investor what these people are doing, I would have scratched my head. However, in the spirit of trying to know a little bit about a few things, I have been researching the Esport phenomena. I would have guessed that Esport has something to do with multiplayer video gaming … but I have found that Esports are much much more than this – a jumble of entertainment, video gaming, sports, and media. For a brief insight into this strange world of competitive gaming, check out even a few seconds of this Youtube video of an Esports gathering in Paris.

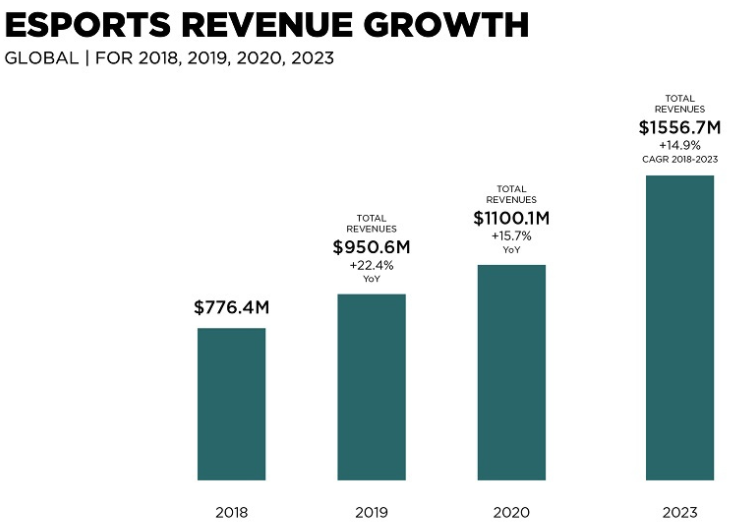

Esports have evolved from the recreational to the competitive and, putting aside arguments of what constitutes a sport, in the world where Chess is considered an Olympic Sport, Esport is the world’s fastest-growing “sport”. There are now more than 2.7 billion active gamers worldwide. Incredibly, the video game business is now larger than both the movie and music industries combined. The top Esports tournaments are transmitted live and are where fans meet and socialise with friends. They draw crowds rivaling the World Cup football and the Olympic Games.

Once you drill down to the specifics of Fortnite or League of Legends, I am lost – but when it comes to growth prospects, Slack Investor pays attention. China is the largest market by revenues, followed by North America. It is not just PC-based games, Esports on smartphones are showing strong growth in Southeast Asia, India, and Brazil.

Although the big stadium Esports events are suffering due to COVID-19 separation rules

The upward trajectory for gaming brought on by the pandemic has accelerated what was already a growth industry, with Australian estimates suggesting demand for esports has at least tripled since the coronavirus outbreak.

From The Guardian

How to invest in Esports

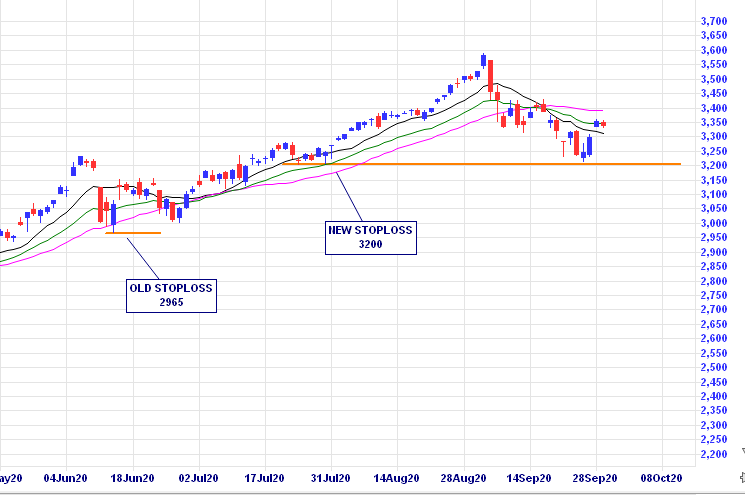

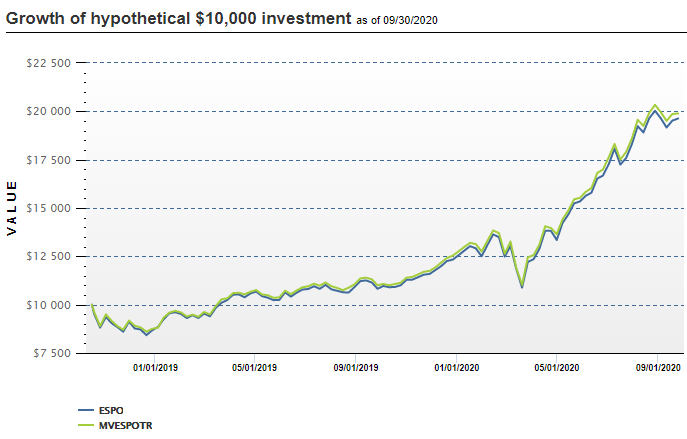

Slack Investor has been generally ignorant on the details of this new phenomena, but I can recognize growth. In October 2018, the fund manager and ETF provider VanEck started an Esports ETF in the US (also called) ESPO . They aimed to replicate the Global Video Gaming and Esports Index by investing in the whole industry. I have watched this ETF from afar and, after a shaky start, the chart below shows that they have been doing OK.

In September 2020, VanEck have introduced an Australian-listed Video Gaming and ESports ETF (ASX:ESPO) offering exposure to the larger global Esports connected companies. The fund’s top holdings include Nintendo, AMD, Tencent and Nvidia. The management expense ratio is higher than I would like (MER 0.55%), but it is a convenient way to get involved.

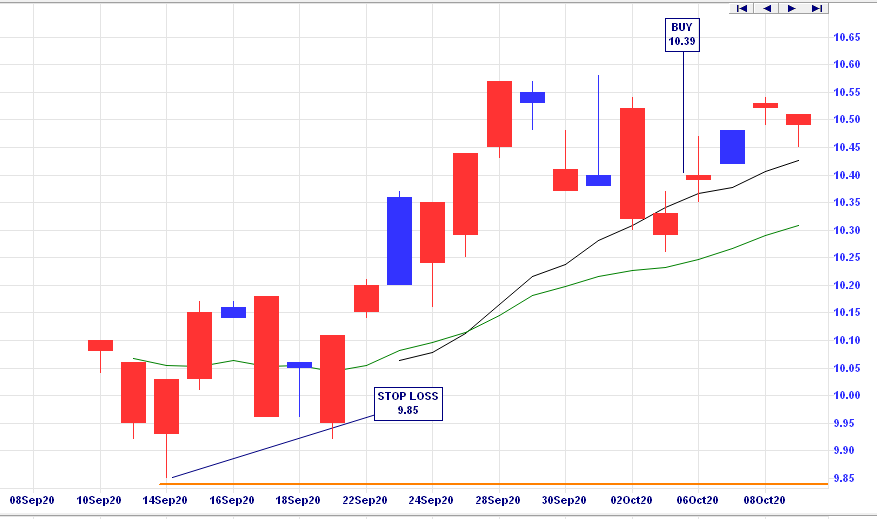

Usually Slack investor makes his decisions on weekly or monthly charts. The ESPO ETF was listed on the ASX less than a month ago (at an initial price around $10) and there is not enough information on the larger time scales. The Daily chart is presented below.

This is not advice, but Slack Investor bought in at $10.39 and set a stop loss at $9.85 at a previous minimum point (“Higher low“). I try to keep initial stop losses at less than 10% of purchase price at a point on the chart that “makes sense” to me. I will check this stock on a weekly basis … and, if ESPO is below the stop loss at close of business on Friday, I will try to sell it on the next Monday – unless it is rebounding strongly!

In many ways, Slack investor has an “actions per minute” at the opposite end to Esports gamers … but, when it comes to smelling growth, Game On!