“….when you cannot measure it, when you cannot express it in numbers, your knowledge is of a meagre and unsatisfactory kind…”

Lord Kelvin, a Science “Hall of Fame” member was right … Particularly so when it comes to your investments. As well as some notable scientific discoveries, including the invention of the absolute temperature scale which defines the lowest possible temperature – at which atoms stop moving (-273.15C) – The wise Lord Kelvin showed a respect for measurement … and the nerd in me remembers the graffiti homage from Physics Lab toilet doors …

Absolute Zero is Cool!

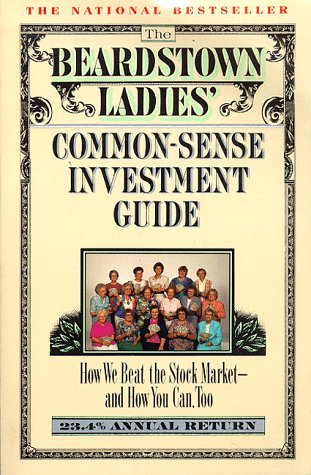

Slack Investor takes the measurement of investment performance very seriously and puts some effort into doing it right. Slack Investor is old enough to recall the famous case of the Beardstown Ladies Investment Club – a club that published a book in 1994 that claimed a market-beating investment performance from a group of talented, but amateur, investors from a small town in Illinois, USA.

The Beardstown Ladies are a group that are still going, a 14-woman investment club that hit the financial headlines with their “The Beardstown Ladies’ Common-Sense Investment Guide” which included a seemingly astounding financial performance that beat the best of Wall Street with their investment returns of 23.4% pa between 1984 and 1993.

This gave other amateur investors a real kick and did wonders for their book sales. It was far better than the 14.9% gained by the index S & P 500 and almost twice the 12.6% return of the average US stock mutual fund.

However, after an independent audit, according to the LA Times, in 1998, their was a recalculation of their the performance figures amid questions about accuracy. The ladies, sadly, have an audited revised portfolio return of a 9.1% a year – a great effort … but lagging the index!

The problem was, the lovely ladies from Beardstown had innocently forgotten to account for their cash flows into the fund (Contributions) and these had been added into their portfolio performance to give an inflated figure. Their book is still for sale … and they have published four others … The US loves winners(?)!

The Slack Investor message is to not always believe what you read … wait for the independent audits … and, like Lord Kelvin, to avoid “meagre and unsatisfactory knowledge”, take some time in your measurement of portfolio performance. More of this next month …