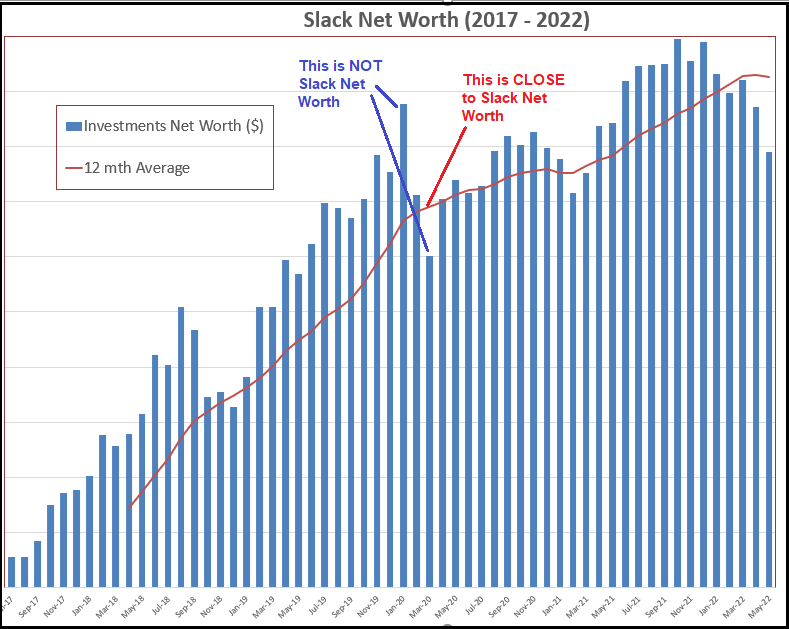

While the market is doing what it does and there is the feeling of Armageddon in the price of stocks, Slack Investor knows that he has no control over market sentiments and, as a welcome distraction, he is having a look at some of the things he does have control over – the fees that he pays for financial services. Superannuation fees are still too high – some of the highest in the OECD. This is a recurring theme for Slack Investor.

I like to think that the Slack fund is a pretty trim ship – but, there is always room for improvement. Slack Investor runs his family super through a Self Managed Super Fund (SMSF) – but this is not the best option for those who are time poor or, don’t want the stress of the management of your own retirement. On the plus side, for larger balances, if you use a low cost provider, it is relatively easy for a SMSF to restrict fees to less than 0.5% of funds under management.

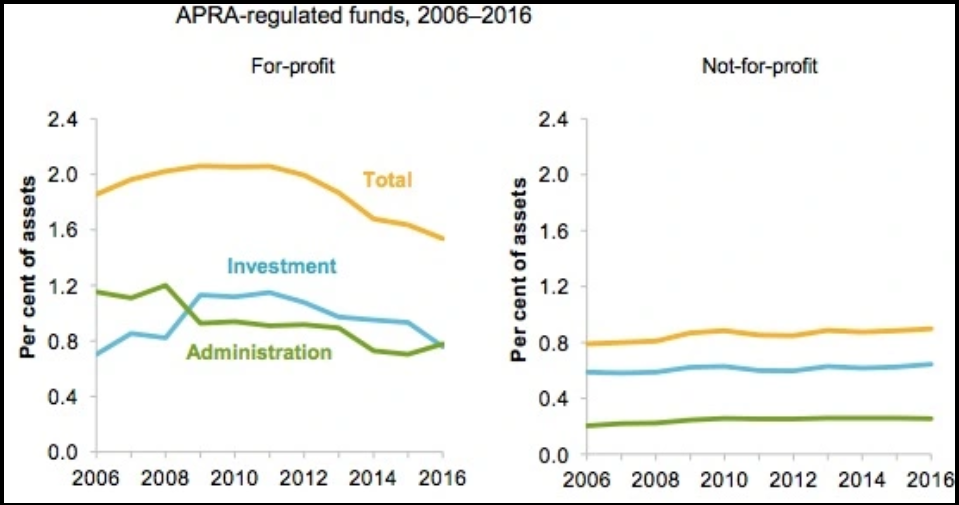

High super fees linked with underperformance

Fees are the other most important factor when choosing a superannuation fund. You can’t control how markets perform, but you can control how much you pay for the management of your hard-earned money.

Stockspot Fat Cat Report 2021 – Annual Report on Superannuation funds by Stockspot that sorts each fund into “Fit Cats” (Good) and “Fat Cats” (Bad).

As a general rule, for profit (Retail) super providers charge fees in the 1.4-1.8 % and the not-for profit funds charge 0.8-1.0 %. For larger balances (>50K), if your annual fees are more than 1.0% of your total super balance then it is time to look elsewhere – try to get your super fees below 1.0%.

There is a clear correlation between high fees and long-term underperformance in superannuation.

Stockspot Fat Cat Report 2021

What to do?

I recommend all Australian readers to drag out their latest annual super statement and find the total amount of fees and charges. Divide the total fees by your total super amount (x 100) and you will have the percentage of your super that you are paying in fees.

Canstar have compiled a 2022 Outstanding Value Superannuation Award winners report that allocates a star rating for superannuation funds. based upon 5-year performance (after all fees) and features of each account. A four or five star rating is good. Their top rated funds for value in 2022 are all Industry funds and are listed below – these would be on the shopping list if I wanted to change my super fund.

| Super Fund | Type |

| Australian Retirement Trust | Super Savings |

| Australian Super | Australian Super |

| Aware Super | Personal |

| Cbus Super | Cbus Industry Super |

| Hostplus | Personal Super |

| UniSuper | Personal Account |

| VicSuper | Future Saver / Personal Saver |

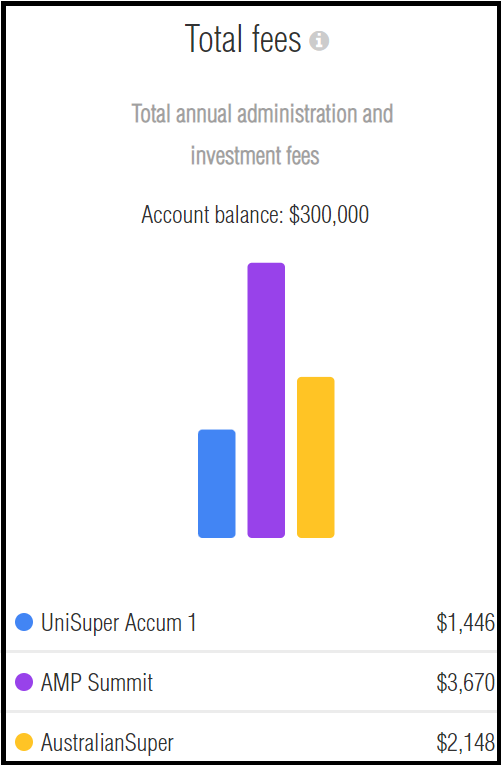

For more detail on how your super compares with others, there is a fantastic bit of superannuation comparison software, designed by Chantwest, called Apple Check. You have to give up some contact details for the form and access it through individual super fund sites … but they have provided great comparison info on super products to Slack Investor with no spamming. Worth doing if you are considering a switch and want to be fully informed of a fee comparison that applies directly to your situation.

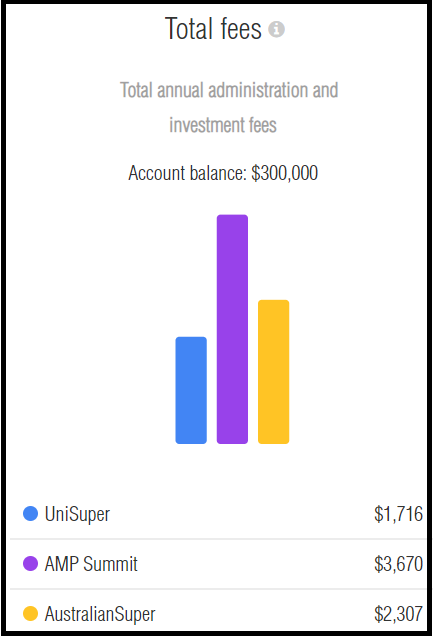

I have compared two non-profit Industry funds (UniSuper and AustralianSuper) with a for-profit Retail fund (AMP Summit) for a nominal $300K account – in both Accumulation and Pension mode. Clearly AMP Summit has higher fees for both an Accumulation a/c and a Pension a/c. I would be happy to pay higher fees of a retail fund (AMP Summit) if there was an established increase in performance. However, the Apple Check report shows a 10-year net return (investment returns after all fees) of the retail fund is at least 10% worse than either industry fund.

Market downturns are never easy, but Slack Investor knows that this time will pass – and in the meantime, I will pursue the distraction of fine-tuning the financial fees that I do have control over.