In a week where I have received a polite letter from my electricity provider that the daily rate and cost per Kilowatt-hour will be increasing by 27% from August 1, 2023 – it is always good to take a step back and realise that a bloke should count his blessings.

Every year the economic wonks at Credit Suisse produce the Global Wealth Report. It takes a bit of time to gather the figures worldwide, and the latest report available is from 2022, and gives an insight into the Covid-19 times using economic data from 2021. There is some good news, in that the global wealth per adult seems to be on an increasing trend.

The global median wealth per adult was just USD 1,613 ($2358 AUD) in the year 2000. By 2021, it had risen to USD 8,296 ($12 130 AUD), a five-fold increase equivalent to average annual growth of 8.1%.

Credit Suisse Global Wealth Databook 2022

There seems to be an expansion of the “middle class” in the developing world, but, sadly, the key indicator of wealth inequality is on the rise. In the prophetic words of Midnight Oil “Read About it (1982)”.

The rich get richer, the poor get the picture

The bombs never hit you when you’re down so low

Some got pollution, some revolution

There must be some solution but I just don’t know

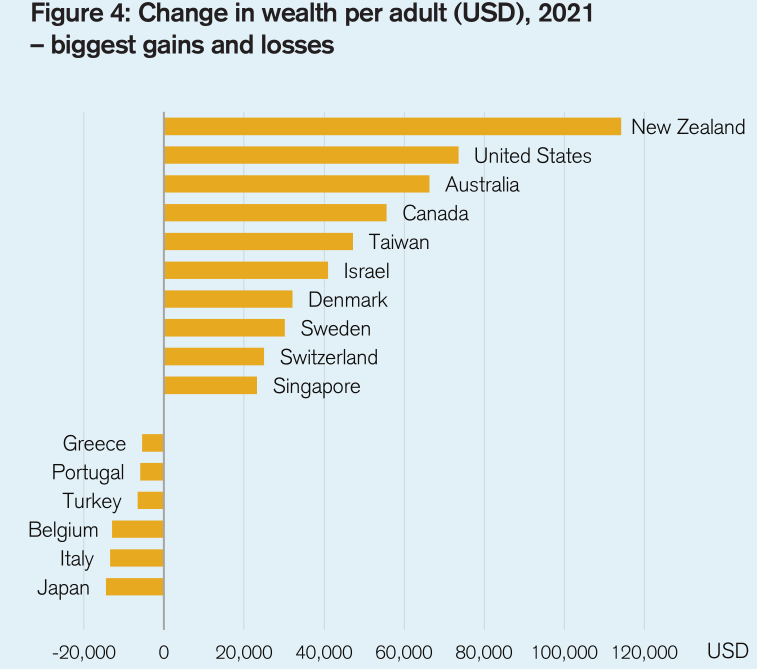

2021 was a bumper year for New Zealand, the US and Australia, probably due to the rapidly increasing house prices during COVID-19, and the relative strength of local currencies against the US dollar in 2021. The wealth losses recorded by a few countries were relatively low and reflect currency depreciation against the USD.

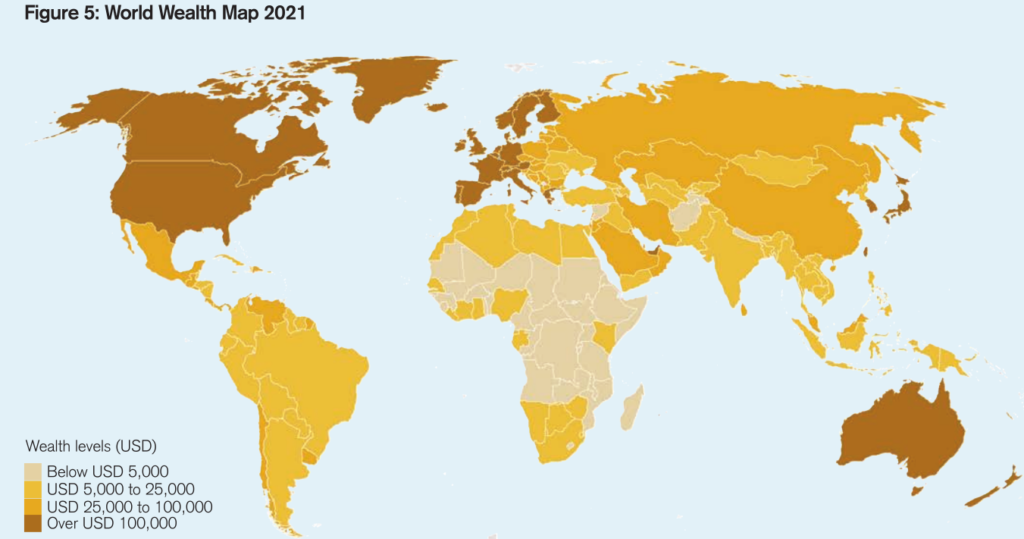

World Distribution of Wealth

In 2021, Australia tops the table with a USD median wealth (median Net Worth) of $273 900 ($400 497 AUD) – again probably due to the ridiculously high real estate prices in this country. A reminder of the unequal distribution of worldwide wealth is that the global median wealth per adult was just $8296 USD ($12 130 AUD) in 2021.

The median wealth is used below as it reflects how the normal person is doing. The mean or “average” can be misleading in countries with a large wealth inequality. For example, in the US, due to some very rich individuals, the mean wealth per adult in 2021 was $579 050 USD. but the median wealth was $93 270 USD.

The 1%

Our calculations suggest, for example, that a person needed net assets of just USD 8,360 ($12 224 AUD) to be among the wealthiest half of world citizens at end-2021. However, USD 138,346 ($202 289 AUD) was required to be a member of the top 10% of global wealth holders, and USD 1,146,685 ($1 676 685 AUD) to belong to the top 1%.

Credit Suisse Global Wealth Databook 2022

A net worth of $8360 USD ($12 224 AUD) would put you in the top half of the world wealthy, and a nudge over a million USD ($1 676 685 AUD) would put you in the top 1%.

Perhaps I will just have to take this latest utilities price rise on the chin … and reflect on my good fortune by the geographical accident of birth in a western country.