From Brian Kersey

From Brian Kersey

Easy does it Ladies and Gentlemen … slide back in your seats … there has been a correction in the S&P 500 … the world is not ending … Yet!

The market volatility has been driven by the US market which was overvalued due to stellar gains of 22% in 2017 and big gains in 2016. According to AMP Capital, as of early February, European shares have fallen 8% and Australian shares have lost 6% – there have been substantial recoveries in all markets since.

On Feb. 6, 2018, the (US) stock market officially entered “correction” territory. A stock market correction is defined as a drop of at least 10% or more for an index or stock from its recent high. –from fool.com referring to the Jan/Feb 2018 correction in the US S&P 500 index.

The stock market is a wonderful way to accumulate wealth … but it does not always behave rationally. The driving force behind increased stock prices is company earnings … if they are rising then “generally” the price of the stock increases. But rationality is not a common trait where the share market is concerned – as the market is combination of buyers and sellers with differing motivations.

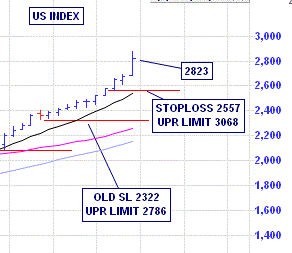

I often find it useful to take a step back from the daily price fluctuations, the chart below shows the last 5 corrections of the S&P 500 US market (in dark grey) since the market crash (>20%) of 2008/9. It has been a couple of years since the last correction and the US market has made some substantial gains since then.

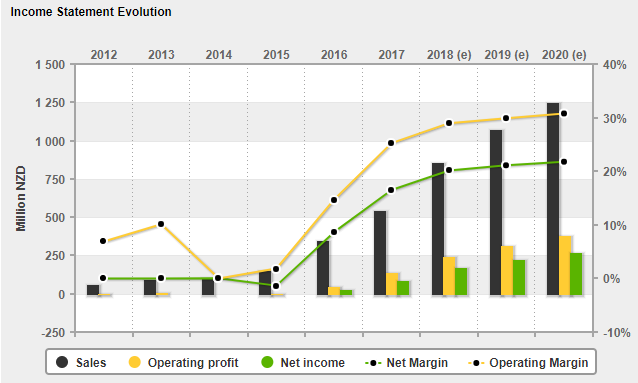

Corrections are a normal part of stock market growth and the chart below (In logarithmic scale – representing percentage increases on the same vertical scale) shows how Australian share market values have continued to increase over all – despite the many world crises that have presented in the last century.

The chart below sums up why Slack Investor is happy to be predominantly invested in shares at the moment. The “Grossed up dividend yield” is the effective yield “after tax” that Australian shares are returning to the investor – around 6%, compared with the safe term deposit rate which languishes at around 2%. While the gap in annual earnings between Australian shares and bank deposits remains high I am happy to stay with the “risk on” options of shares – The price of shares, or capital value, may fluctuate temporarily but the annual dividends should continue to be paid. In any case, my downside risk is protected by monthly stop losses. The economic news from around the world remains mostly positive pointing to a growing global economy. So, … stay optimistic – but be ready to bail if the charts start turning south in a significant way!

Corrections in the order of 5-15% are normal; in the absence of recession, a deep bear market is unlikely – From Shane Oliver AMP Capital