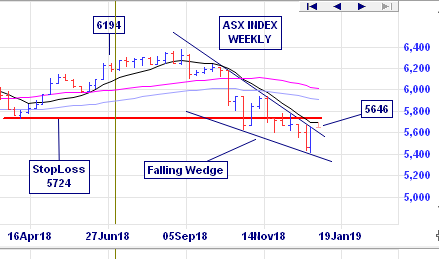

The “Wedgie” is a classic Australian image that brings delight to the Slack Investor. Last post, I referred to a breakout from a “falling wedge” in the ASX 200 weekly chart. There are all sorts of patterns that technical (using charts) investors use. Slack Investor concedes that, as the pattern was longer than 3 months – he should have referred to the pattern as “breaking a long-term downtrendline“. However, this term is not as engaging to the eye, or as dead set funny, as the “Wedgie”.

The breakout from a long-term downtrend on a share price chart is one of the classics and the technical signal has more validity on a weekly chart than a daily one. Slack Investor loves this pattern and has been patient over the last few months as stocks have been sinking worldwide. He has trimmed his portfolio and has some cash and feels now is the right time to test the waters. This breakout from a long downtrend has the potential to be a trend “reversal”.

There comes a time when stock prices fall to a price that buyers start coming back into the market and the share price comes back up. If it is sustained, this is called a “reversal”. In “Technical Speak”, a new trend is only established when a new “higher low” is established – so, this is an early call – supported by the establishment of a stop loss on all buy orders.

Trading the long term downtrend breakout

Admittedly, these trades just make the definition of a long term downtrend – but it has been a steep fall!

To be considered a long term trendline, the trendline should be at least 3 months. The longer the trendline the more bullish it will be when the stock breaks above the trendline.

From Dstockmarket.com

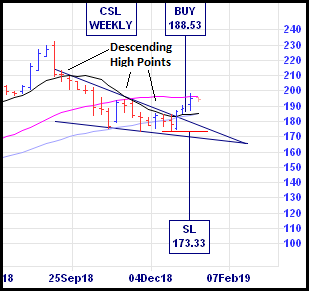

The wedge pattern can be seen on the CSL chart. The critical part of this shape is the upper line of the wedge on your chart software. I highly recommend the free (if using day-old data) Incredible Charts to do this type of stuff. This upper line connects at least 2(and preferably 3) descending high points (that establish the downtrend) on your weekly chart. To get into this trade early, buy whenever the closing price breaks above the top downtrend line. Technically, a new uptrend has not been established yet. Confirmation of a new trend comes when a new “higher high” and “higher low” has been established. A more conservative entry point is when the new trend becomes obvious. An established trend trading rule is

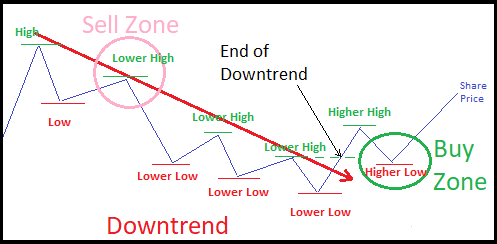

Buy the Higher Low and Sell the Lower High

A full explanation of this confusing set of words can be found in the Tyler Yell article at dailyfx.com or, shown schematically below

Image demonstrating the trend trading zones for the “Buy the Higher Low and Sell the Lower High” strategy. It boils down to selling when a downtrend is established (Lower High) and buying when a new uptrend is established (Higher Low). More trend stuff in a previous post The Trend is Your Friend.

But, enough of the theory.

Normally, I would wait until the new uptrend is a bit more entrenched, but the companies below have been on Slack Investors watch list for some time and they have a track record of increasing dividends. They have high P/E ratios as they are growth companies (and their projected growth is factored into their price). But what really impresses me is the way they use their capital. From Marketscreener.com, COH has a forecast 2020 Return on Equity (ROE) of 44%; RHC 23% and CSL 38%. If I put money into a bank deposit, I might get a paltry 3%. These companies are very good at getting returns on their investment (equity) – and I want to be involved!

There are other Australian stocks on my Growth Stocks watchlist that show this downtrend breakout pattern. They include ALU, APX, CAR, CCP, FPH, SEK, and A2M. Unfortunately, my investment funds are not limitless. Not all of them will be winners, this is not advice, but I’d rather invest in companies like them – than get a “wedgie”.

I will report back on all of these “buy signals” in a year.