Hang on Slack Investor … What are you saying? Oprah, the font of lifestyle guidance … has a rival! How can the Australian regulatory authority APRA match Oprah wisdom that spouts such useful advice as this …

You can either see yourself as a wave in the ocean – or you can see yourself as the ocean – Oprah Winfrey – Source

Wheras Oprah has been an inspiration to millions, Slack Investor has a different, more researched, inspiration … he has fallen in love with an Australian statutory body – APRA is the Australian Prudential Regulation Authority.

Oh APRA …. I do love you … You are the Ocean … it’s the indifference that you show me … the complete lack of spin … just information …. Oooohhh! you may have let us down in the distant past (HIH collapse, 2001), but your new muscular stance on differentiating between superannuation products is appealing … it gives me hope for all statutory bodies. One of APRA’s duties is to collect information on the superannuation sector and report. They report the total superannuation assets in Australia grew to $2.7 trillion in the year to June 2018. The Self Managed Super sector has a staggering 27.7% of these funds. Slack Investor is gladly part of this self managed sector and enjoys the flexibility of an SMSF. Last years average rate of return for all super funds was almost 8%.

The chart shows some great annualized Australian super returns for the past 5 -years of 7.9%

The Productivity Commissioner and Slack Investor hero Karen Chester argues that there is a need for the Super system to look after the default member who is likely to remain disengaged.

“what workers need is not “bells and whistles” – which bring with them higher fees – but “low-cost, top performers” with a “balanced investment strategy” Karen Chester From The Guardian

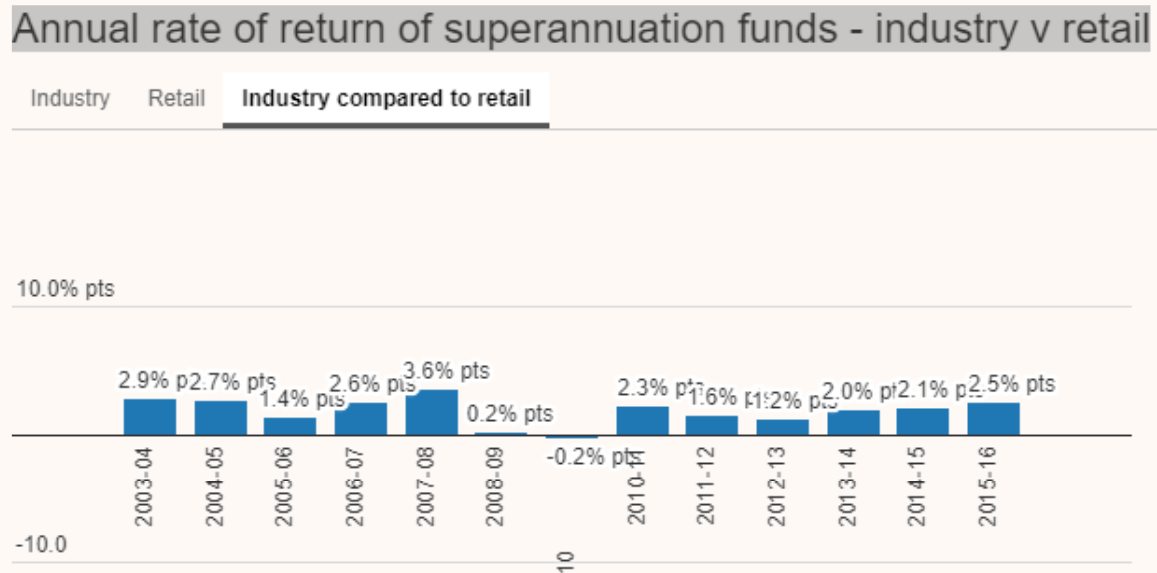

APRA continues to monitor performance of Industry vs Retail Funds and the yearly percentage advantage of having Industry funds(rather than Retail) is shown above.

While we wait for the politicians to act on these matters, get engaged and consolidate your super into one fund – and it should probably be an Industry fund. If Slack Investor can’t motivate you – then perhaps Oprah can … Right On Oprah!

“If you’re sitting around waiting on somebody to save you, to fix you, to even help you, you are wasting your time because only you have the power to take responsibility to move your life forward.” Oprah Winfrey – Source