Fish swim, birds fly, humans think, create and innovate. Thinking is not something that people do because we like it, we do it because it is our way of surviving.

José Luis Álvarez – From KnowledgeWorks

An amazing trait that we humans have is the ability to innovate. Slack Investor admires the innovators and the intellectual capital that they bring to businesses. Ideas and research are a vital part of a growth company. Research and Development (R&D) may lead to more efficient production processes or better products that give a company future growth. I have long been a big fan of companies with a high spend on R&D and I am happy to invest in these stocks.

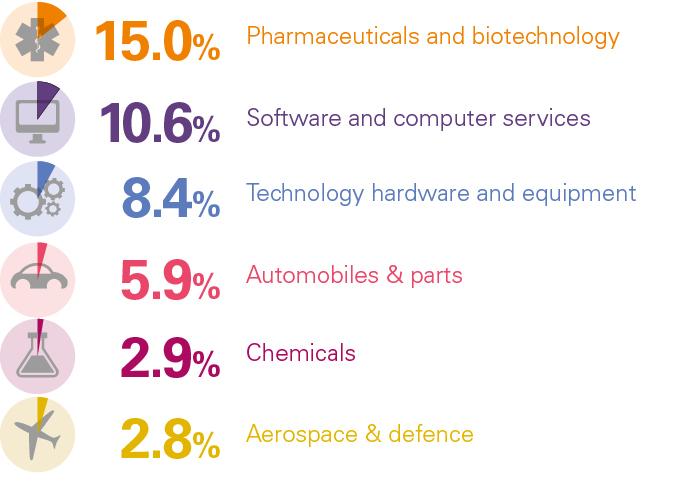

According to the data from EFPIA, in the percentages below, the big spenders are in just a few sectors. The survey looked at 2,500 companies around the world. Technology companies usually have a big R&D budget, but the pharmaceutical and biotechnology industry lead by spending 15% of revenue on R&D. NASDAQ figures for specific companies, show R&D expenditure for Google (Alphabet) was 15% of its revenue in 2020, CSL about 11%, and Microsoft 13%. Apple was a relatively low 7% – but they have a very small range of products.

Just because a company has a high R&D spend does not always guarantee success. As well of the discovery of ideas that might be useful in the business, a company must be really good at the Incubation, and Acceleration of these ideas. It is important to look for an established record in the way a business brings new products to fruition.

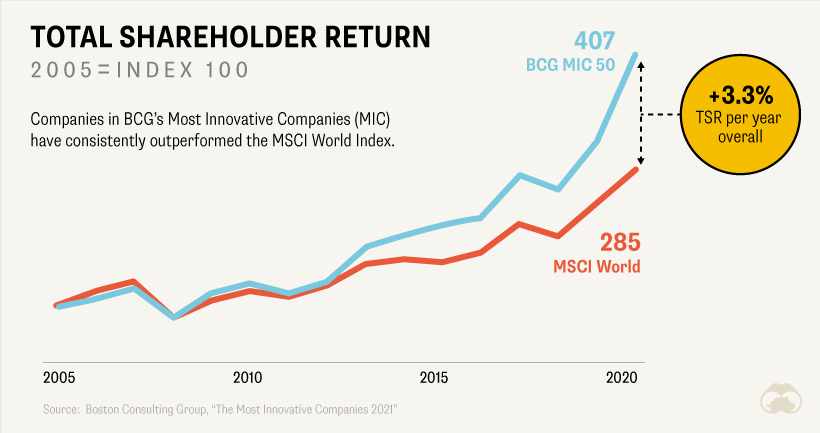

However, there is a broad link between innovation and value. The Boston Consulting Group(BCG) compile a yearly list and map the performance of the 50 most innovative companies. In 2021, they found that the more innovative businesses had an average Total Shareholder Return (TSR) premium of 3.3% over the MSCI World Index.

“If I have 1,000 ideas and only one turns out to be good, I am satisfied.”

Alfred Nobel

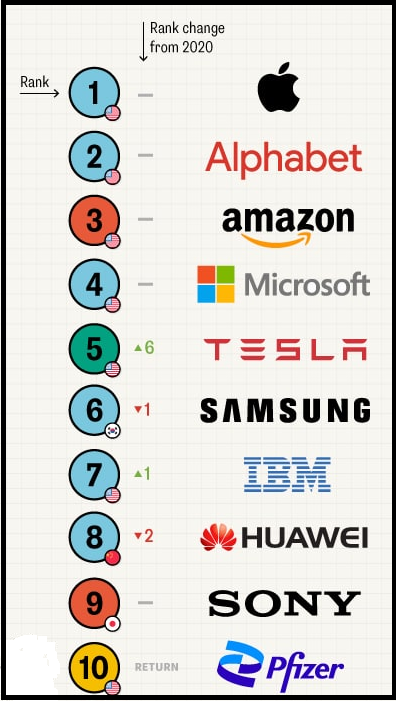

The full list of top 50 innovators is worth a look and is a reminder that these are the companies that a lot of people interact with every day.

I have been a continual investor in the Betashares NASDAQ ETF (ASX: NDQ) that gives me access many of these great innovative companies. Every time that Slack Investor looks at the businesses that make up the NASDAQ 100, I think that this technology area must be where growth is still happening – and I want to be invested here.

According to GuruFocus the 12-mth forward PE of the NASDAQ 100 is 27 (A bit expensive) but the Return on Equity is at 18% – and growing (This is good).

Slack Investor also owns a slice of the Asian Technology giants with BetaShares Asia Technology Tigers ETF (ASX: ASIA). The heavy hand of Chinese government interference in some tech stocks has led to a pullback in price this year. But I have maintained my holding because Chinese companies like the search engine Baidu, the e-commerce giant Alibaba, and the technology beast Tencent will not be held back for long.

A good compromise, if you want a more whole world approach, is the ETFS Morningstar Global Technology ETF (ASX: TECH). This ETF has holdings distributed across the United States (89.6%), Australia (5.8%), Japan (2.4%), and Germany (2.2%) and has a “moat” filter that will only select companies that have built a competitive advantage around their businesses. All of this for a Management fee of less than 0.5%.

Innovative company shares do not always go up. An example of this is is the new Cathie Wood disruptive innovation stocks ETF – (ARKK). Early investors are very happy, recent investors not. However, with a 3-5 year time frame, exposure to the whole NASDAQ index – the top 100 of the (mostly) great NASDAQ companies must be a good thing.

This is not advice, but if I cant buy pizza scissors for Christmas – I might as well top up with some more NDQ or ASIA, or expand into TECH.