I was recently delighted when my 14-yr old nephew asked me what I thought he should invest in with his earnings from his part-time jobs.

Firstly, it is a compliment to an old bloke to be asked anything, and secondly, it is testament to the financial maturity of this fine young man that he would be thinking about the world of the share market while still at school.

If he was older and in a steady full-time job I would advise he automate his savings as much as possible and lash into index funds via a platform such as Stockspot, Pearler, Vanguard Personal, or Raiz)

His first investment would be in the order of a few thousand hard-earned dollars from part-time jobs. It is vital that the investment has good prospects and unlikely to lose money over a 5-yr period (no guarantees though!). Given that he would not feel the need to access the money for 5 years (hopefully longer!)

For a first investment, I would add the criteria that it should be a well-known Australian company that might appear in the news occasionally and remind him that he is a part-owner … and an investor!

If he was already 18, it would be “off to the races” and we would immediately set up a broker account in his own name and he would begin to experience the magic of being a shareholder. Being under 18 complicates things a little as minors are not allowed to directly own shares- we need to enlist his parent’s help.

If the parent already has a broker account the best way to start is for the parent to buy the shares on his behalf. When he turns 18, my nephew can start his own account with a broker (e.g. Self Wealth, Commsec, Pearler) and the parent can use an off-market transfer (get the form from the broker) to get the shares into my nephew’s hands as a “gift” including any dividends earned. During this brief holding period, any dividends and any capital gain will count as taxable income in the parents name – but this is a small price to pay to tap my nephew’s enthusiasm.

Alternatively, you could open a broker account in their name (as the trustee for “Nephews name”). The process is a little more complicated and is explained in detail by SelfWealth.

The Nuts and Bolts of Stock Selection

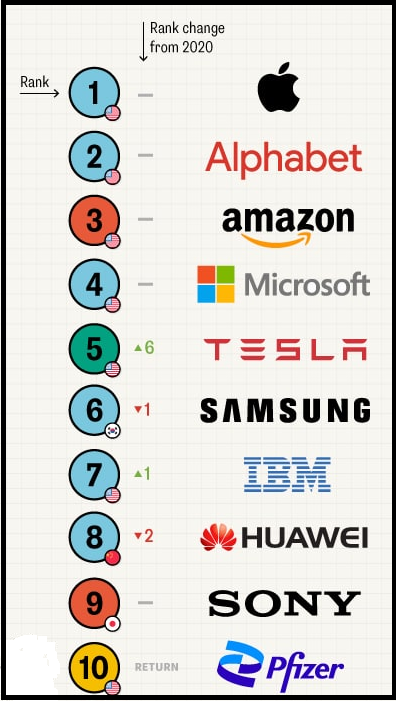

Naturally, I would address this problem in a methodical way and set up a list of Slack owned companies – I couldn’t recommend a company that I didn’t own myself. Some of my favourite stock metrics are gathered from the excellent Market Screener site on the financials page for each stock.

My number one metric for looking at companies is their Return on Equity (ROE), estimated for the year 2024 – Slack Investor is looking forward. This gives me an idea about whether a company is making an investment dollar grow. Higher the better, I start getting curious about a company when ROE is above 15%.

The projected Price Earnings ratio in 2024 is next – I don’t like the P/E Ratio to get above 40, as this indicates the current price of the company is 40 times its earnings (expensive) – but some exceptions are made if the company is growing fast (High ROE). The yield (dividend) is not that important to a young investor, it is the total growth that counts.

| Stock | Symbol | 2024 ROE | 2024 P/E | 2024 Yield | Price 30/06/23 | % Price below consensus |

| CSL Ltd | CSL | 18% | 30 | 1.5% | $277.38 | -18% |

| Wesfarmers | WES | 30% | 22 | 3.9% | $49.34 | Fair Value |

| Coles | COL | 31% | 22 | 3.9% | $18.42 | Fair Value |

| Altium | ALU | 32% | 41 | 1.9% | $36.92 | -6% |

| Macquarie Bank | MQG | 13% | 14 | 4.2% | $177.62 | -10% |

| Car Sales | CAR | 10% | 28 | 2.8% | $23.82 | -3% |

| RealEstate.com | REA | 29% | 41 | 1.3% | $143.03 | -7% |

Looking at the figures, even though the stock price of CSL hasn’t really gone anywhere in the last 3 years, it would be my first pick as it is currently 18% below its fair value price (by a consensus of analysts). It is such a strong Australian company that really thinks of the future by continuing to increase its spend on research and development each year.

Wesfarmers (Bunnings, K-Mart, Officeworks, etc) and Coles look OK too because of their high Return on Equity (ROE) – they also have the benefit that you can continually pop in to see how your business is going. Altium has languished in price this last few years but remains a great company for the future – if my nephew was interested in the “tech” space.

This isn’t advice, Unless, of course, you are my nephew!

June 2023 – End of Month Update

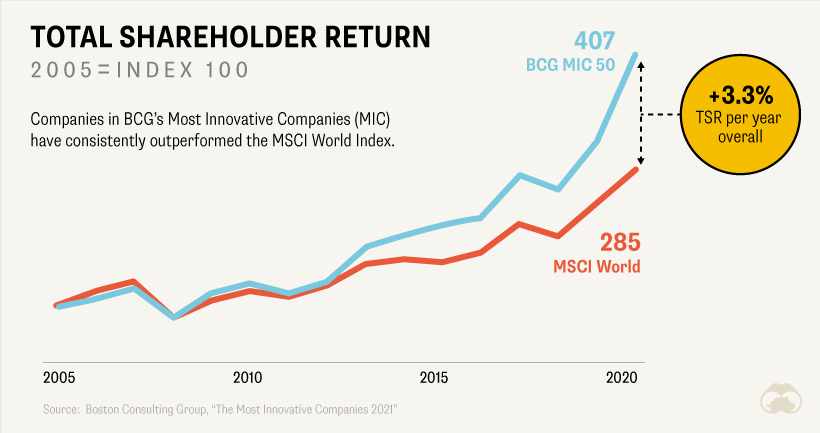

The financial year closes and looking at the 12-month charts for FY 2023 – Slack Investor concludes … “It was better than last year”!

Slack Investor remains IN far all followed markets. The ASX 200 (+1.6%) and FTSE 100 (+1.1%) drifted slightly upward for the month. It is boom-time in the US with the S&P 500 rising 6.5%. The US index had moved more than 15% above its stop loss, so I have moved the stop loss upward to 4048.

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index). The quarterly updates to the Slack Portfolio have also been completed.