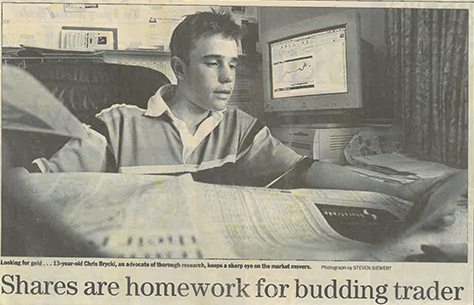

Slack Investor will admit to being less than young … but I am still capable of being a “Fan boy” when I see something impressive happening in the financial world.

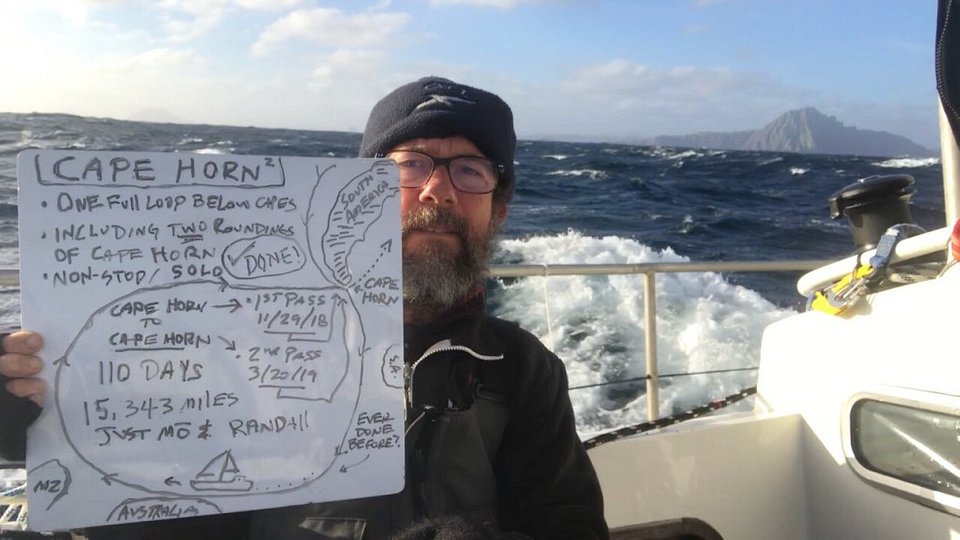

After a series of schoolboy stock picking successes – winning the ASX’s Share Game a remarkable 3 times and, at university, he entered the JP Morgan Trading Competition, which he also won several times. The talented Chris “the Brick” Brycki, launched into a career with stockbrokers and financial houses. After a while, he started to question the long term performance of fund managers.

“… The problem is that over time, even by being right, the value added is not big enough to counteract the 1% fee that a lot of these fund managers charge.”

Chris Brycki – Stockspot – Livewire

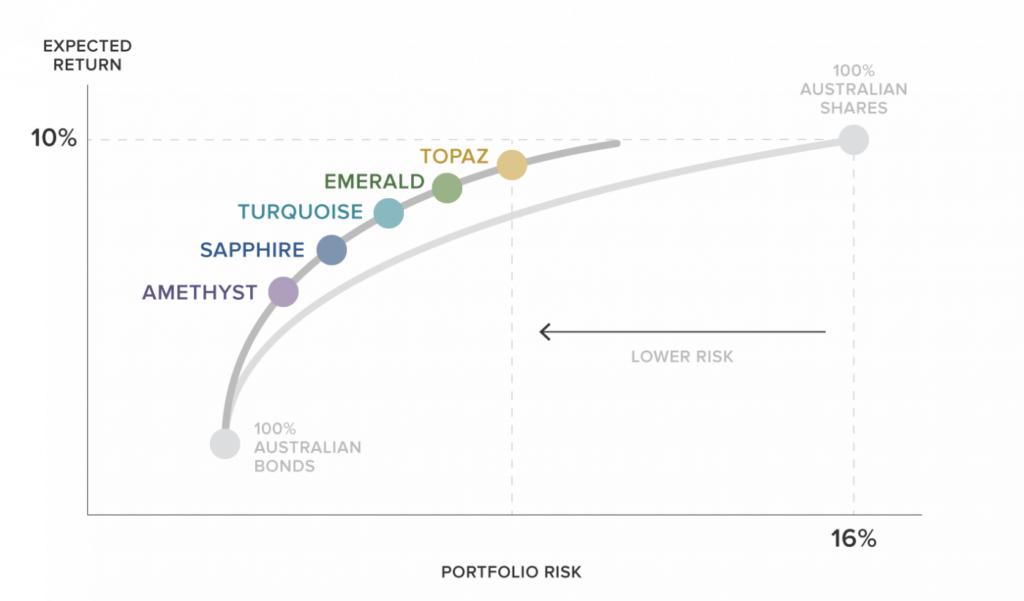

Chris founded Stockspot in 2013 as an alternative way to invest. Their Robo Advice model offers a low-cost automated alternative to traditional fund managers and advisors. After a simple online survey to determine your investing stage and risk tolerance, an investment portfolio type is recommended to you.

Stockspot Building Blocks

Chris (and Stockspot) have come up with the breathtakingly simple, yet genius (Both Slack Investor and Donald Trump have a loose definition of genius), strategy. After researching thousands of ETF’s and, based on exposure, performance and low fee costs – Stockspot has selected just 5 of them as the building blocks for a range of different portfolios. The portfolios are based on risk tolerance, financial situation and the investor’s appetite for volatility. The five component ETF’s are in Australian Shares (VAS), Global Shares (IOO), Emerging Global Markets(IEM), Australian Fixed Income (IAF), and Physical Gold (GOLD).

| ETF | Symbol (ASX) | 1-yr Performance | Growth since Inception | Management Fee |

| Vanguard Australian Shares Index | VAS | -7.92% | 8.25%p.a (13+ years) | 0.10%p.a. |

| iShares Global 100 | IOO | -4.43% | 7.37%p.a. (15+yearsr) | 0.40%p.a. |

| iShares MSCI Emerging Markets | IEM | -20.59% | 7.18%p.a.(19+ years) | 0.69%p.a. |

| iShares Core Composite Bond | IAF | -11.42% | 2.73%p.a.(10+ years) | 0.15%p.a. |

| ETFS Physical Gold | GOLD | +7.34% | 7.75%p.a.(19+ years) | 0.40%p.a. |

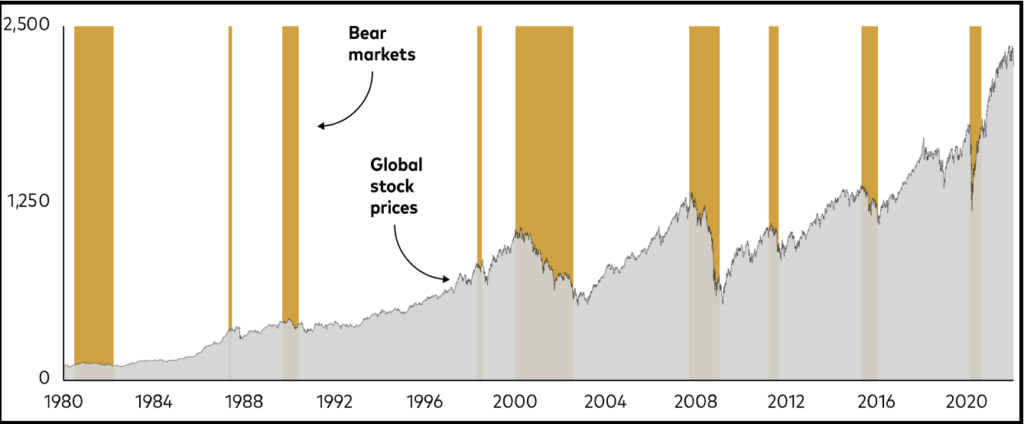

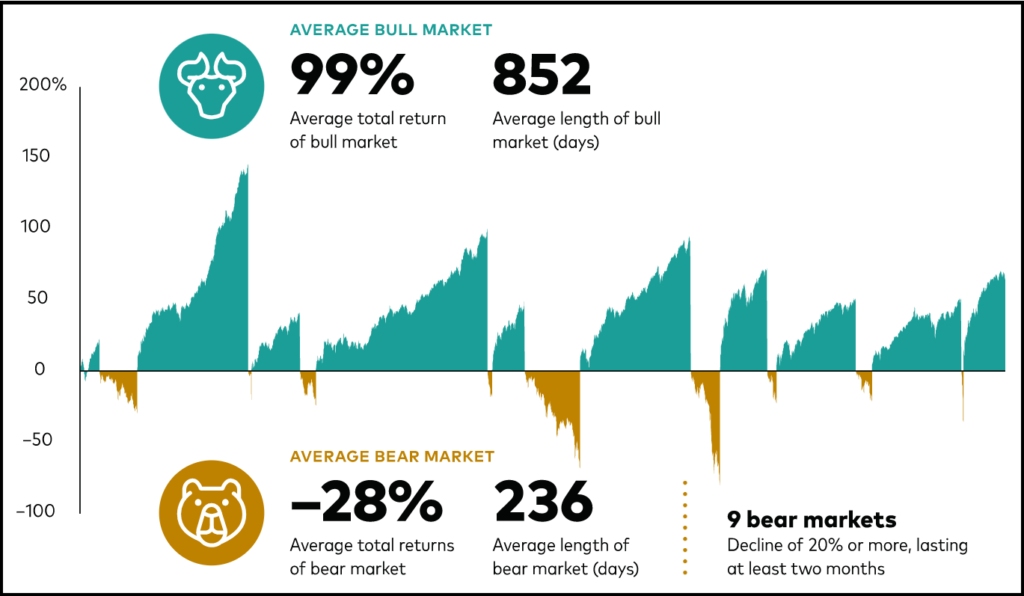

It is best to disregard the above 1-yr performance – It has just been a bad year for most assets. The ETF management fees are low (depending on ETF complexity), there is good long term performance (Growth since Inception) and they have selected Physical Gold for inclusion.

Slack Investor does not naturally lean into Gold as it is a speculative, non-income producing asset. However, I might have to change my mind here. The reason Stockspot include Gold in all their portfolios is based upon historical data and the way gold tends to outperform in times of crisis. The results in this last year performance of +7.34% for Gold, speak for itself – as other asset classes flounder.

Mixing it all up

Slack Investor has written about Stockspot before in terms of Robo Advice and their valuable Superannuation reports. By using these 5 ETF’s in various combinations, Stockspot is able to give their customers a combination of returns and risk at a relatively low cost. There are even sustainable versions of each of the below portfolios available. As an example, the moderately conservative Sapphire portfolio is constructed with the following portions.

VAS: 27.2%

IAF: 35.2%

IEM: 14.4%

IOO: 7.9%

GOLD: 14.8%

After fees, over a 5-yr period, Stockspot has outperformed 99% of similar funds over 5 years.

| AMETHYST Conservative | SAPPHIRE Moderately conservative | TURQUOISE Balanced | EMERALD Growth | TOPAZ High growth |

| 3.1% p.a | 4.8% p.a | 5.3% p.a | 6.1% p.a | 6.8% p.a |

There are fees involved for Stockspot to manage your money. For a balance of $200000, they amount to 0.66%. At first blush, these fees (on top of the ETF fees) sound a bit steep to Slack Investor. However, for all types of investors, with a time horizon of at least 3-5 years, for a stress-free place to put your money, this might be exactly what they are looking for. Stockspot do a tailor-made portfolio construction, all the re-balancing of assets and, they take care of all brokerage costs – Not Bad! They even have zero management fees for children accounts up to $10,000 (for under 18s) and the ability to dollar cost average with regular top-ups.

Stockspot does not earn fees from or have a commercial relationship with the ETFs we recommend. We don’t pay professionals for recommending our service to their clients.

Stockspot

Slack Investor can think of lots of situations where people would like a decision-free, low-fee, diverse investment that is designed to grow in the long term. Well done Chris Brycki (and Stockspot), for advancing the investing cause with particular attention to keeping the fees down … you are a Slack Investor Hero.

October 2022 – Mid-Month Update

Despite the above discussion, my small-scale market timing experiment continues until its projected end in 2024. My frustration with this experiment continues – as it often goes against one of Slack Investors firm beliefs. If you can avoid it – Do not sell an asset when it is undervalued. Using historical CAPE values, at the end of September 2022, the UK Index (FTSE 100) was 13% below its long term mean, the US Index (S&P 500) was 9% above its long term mean, and the Australian Index (S&P 500) was 7% below its long term mean.

At the end of September 2022, Slack Investor was on SELL ALERT for Australian index shares (ASX 200), the US Index (S&P 500) and the UK Index (FTSE 100). Each of them had broken through their monthly stop loss.

I have a “soft sell” approach when I gauge that the market is not too overvalued. I generally will not sell against the overall trend but monitor my index funds on a weekly basis once the monthly stop loss has been triggered.

Well … I can see no obvious up-trend at the end of the week for the US and UK markets and will exit at the end of week price of 3583 for the S&P 500 and 6858 for the FTSE 100. I am still just hanging in with the ASX 200 as they had a strong finish to the week.

The Index pages and charts have been updated for the UK Index and US Index.