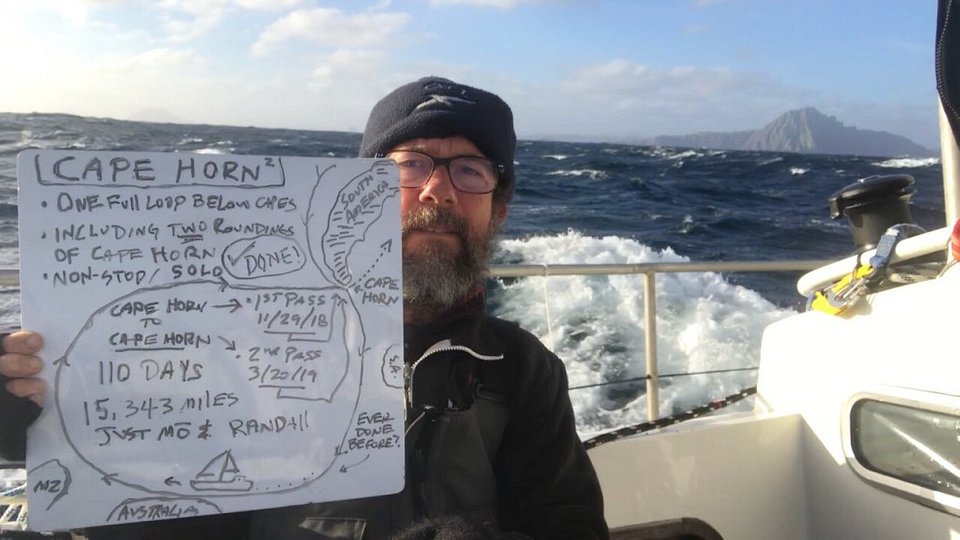

Slack Investor loves finding out about remarkable achievements. He came across the inspiring story of Randall Reeves who set himself the task of doing a solo “figure of 8” circumnavigation around the Americas and the Antarctic. This 64 400 km trip encompassed both polar regions and was achieved solo, in the 14m boat “Moli”, in 384 days.

… he (Randall) hit a severe storm in the Indian Ocean. Waves were breaking 200’ (61m) to 300’ (91m) in each direction, and his boat got knocked down so intensely his mast was fully submerged, breaking a window in the pilot house and flooding his electronics.

Extract from The Figure 8 Voyage – Randall Reeves

I mention Randall Reeves achievements as he set himself a difficult challenge, that no one had achieved before, and succeeded on his second attempt. All we investors have to do, is pick a course to financial independence – and just keep going. Our boat might suffer a few perils along the way …. but we trust that it is a sound vessel – and it will get us home.

Bear Markets

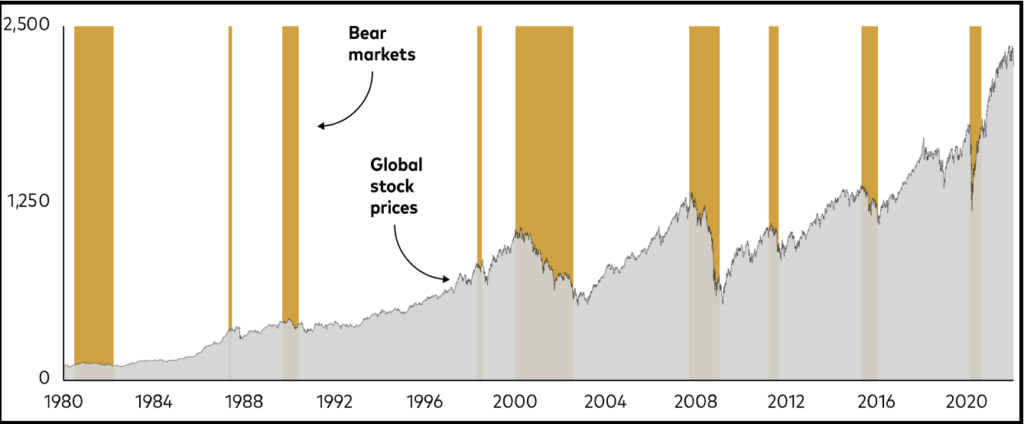

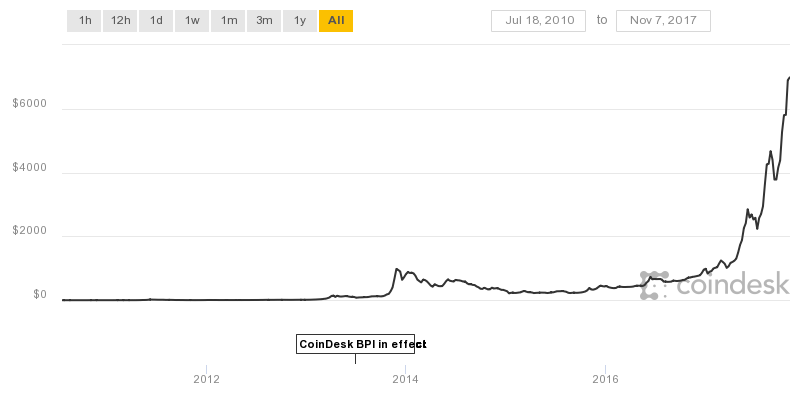

Downturns aren’t rare events: Typical investors, in all markets, will endure many of them during their lifetime.

Vanguard, 2022

Slack Investor can speak with some experience here, as I have been an investor through all of the above bear markets … and they are never any fun! But, I have learned that … they all pass – and the stock market recovers, and always reaches new highs. The sometimes frustration of just “holding on” to your shares in a falling market must be weighed against the stresses of trying to time the market.

Keep on Course

Slack Investor has had mixed success in his timing the market experiment. The experiment is limited to index funds (Less than 3% of my Portfolio) and will run for another 2 years to make it a 20-year trial.

At the end of September 2022, my Index Timing strategy has outperformed the Australian Index (+1.4% p.a.) and the UK Index(+1.9% p.a.), but underperformed the US Index (-0.3% p.a.). My current feeling is that when considering that “time out of the market” means a loss of dividends, it is not worth the stress and effort and I will probably abandon the experiment in 2024 – after a 20-yr trial. The bulk (97%) of my Investments portfolio is run with the strategy of trying to buy good companies that are growing, tinkering a little, but generally just holding on!

The world MCSI AC Index is dominated by US companies (61.3%). The current 2022 World MCSI ACWI bear market is not shown in the above chart. Also, there is some argument whether the 2020 “Covid Crash” qualifies under the generally accepted definition of a Bear Market – a decline of 20%, or over, that lasts at least 2 months.

We humans naturally feel the need to do something when we see our investments fall in value. Slack Investor does not know if the worst is over, probably not! Slack Investor does know that, if you can avoid it, it is generally not a good idea to get rid of your risk-exposed assets during times of downturns – you are selling your assets cheaply in these times.

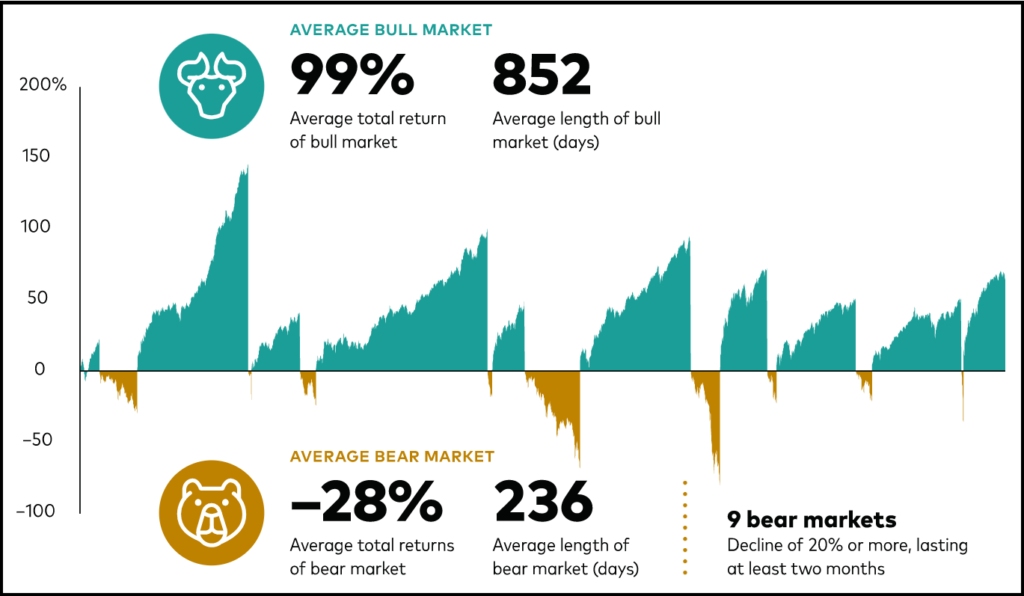

Vanguard have (below) kindly extracted the Bull markets (shaded in green) from the Bear markets (shaded in brown) for the MSCI All Country World Index since 1980 prior to January 2022. The Bull’s prevail and these pesky Bear markets will eventually pass – This chart is reassuring.

The World Index (MSCI AC), the S&P 500, the Dow Jones Industrial Average, and the Nasdaq are now in a bear market, and the S&P 500 has closed at a new 2022 low.

We might not be on a solo circumnavigation through dangerous waters … but the lesson here is to prevail. Tighten the belt if you have to, you have a plan! Endure the situation and try to distract yourself from the stock market with life’s enjoyable things.

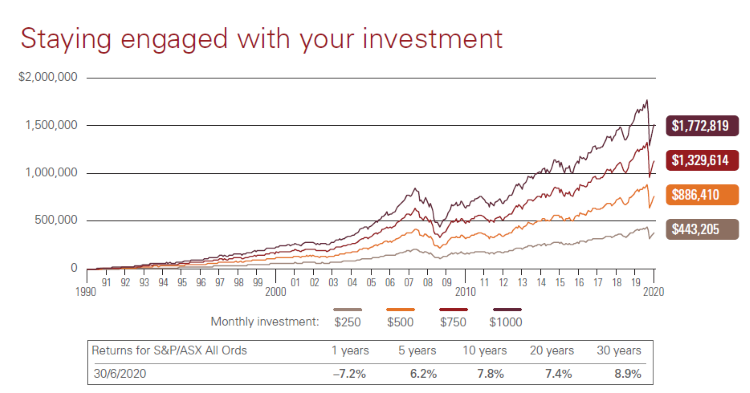

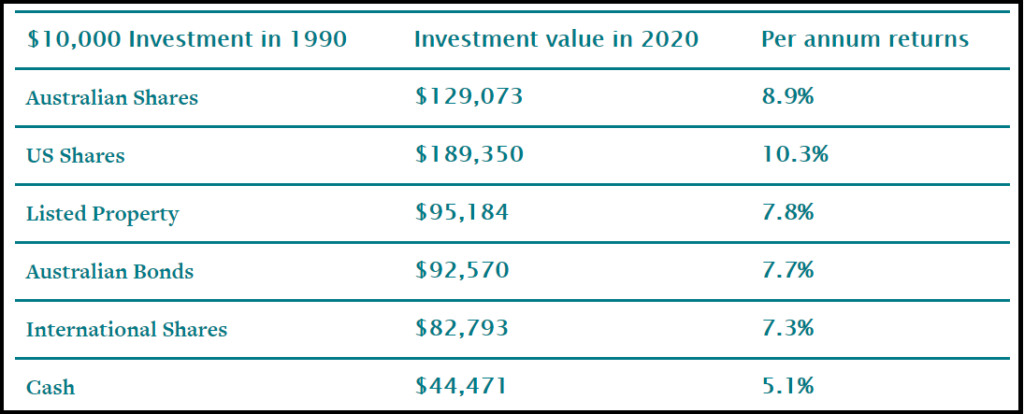

The stock markets will do what they always have done, oscillate between over-priced to under-priced. The long-term gains provided by holding shares are well established. If you are still working, your regular saving and investing will be buying lots of shares through dollar-cost-averaging.

If you are retired, in these tough times, you have your stable income pile to help with your living expenses. There will be better times.

September 2022 – End of Month Update

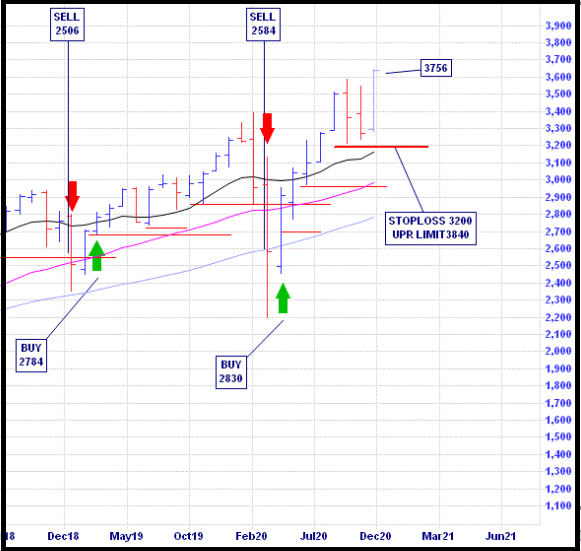

Despite the above discussion, my small scale market timing experiment continues. Slack Investor is on SELL ALERT for Australian index shares (ASX 200), the US Index (S&P 500) and the UK Index (FTSE 100).

I have a “soft sell” approach when I gauge that the market is not too overvalued. I will not sell against the overall trend but monitor my index funds on a weekly basis once the monthly stop loss has been triggered.

All my followed Index funds have fallen below their stop loss values. Big monthly falls for the ASX 200 (-7.3%), S&P 500 (-9.4%), and the FTSE 100 (-4.1)%. Time for some distraction from the market carnage. There will be better times.

All Index pages and charts have been updated to reflect the monthly changes – ASX Index, UK Index, US Index. The quarterly updates to the Slack Portfolio have also been recalculated.

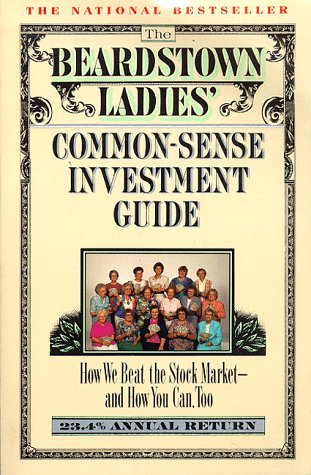

My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers.

My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers.