Slack Investor has long been in the school of “Educate Yourself” in financial matters and maintains this is the best way to do it – But a lot of people (Obviously not Slack Investor readers!) find financial organization very difficult. It is complicated to be across all the intricacies of saving, mortgages, superannuation, taxation, and investment. However, you can draw upon the wisdom of some smart financial bloggers here – Check out the Slack Blogroll – the internet is your friend.

If you must see a financial advisor, after the initial consultation, they will prepare a Statement of Advice – which should be the guiding document for your circumstances and contain a full disclosure of their fees.

According to the Productivity Commission, almost half of Australian adults need financial advice. With the industry coming under criticism for greed and conflicts of interest, it is difficult for consumers to be confident that they are receiving good advice.

from ABC News

Prepare for Layers of Fees

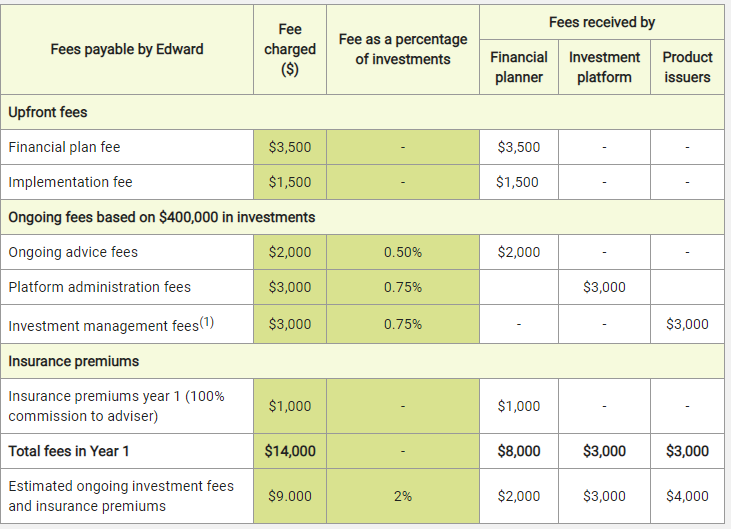

Let’s start with an example provided by ASIC – which I assume reflects typical financial advisor costs. Edward engages a financial planner to get a statement of advice together for his $400000 (including super). The adviser offers to put together a financial plan for $3,500 with a further implementation fee of $1,500. This almost doesn’t sound too bad so far – But, it is instructive to look at the full breakdown of costs below. Platform fees, ongoing advice fees, management fees and insurance premiums will result in poor Edward getting slugged $14000 in the first year and $9000 ongoing per annum. If these costs are typical, this is outrageous – He is paying 3.5% of his wealth initially, and then 2.3% ongoing. The fees can usually be paid separately or deducted from your investment income as part of your annual statement.

The Hayne Royal commission exposed many cases where advisors were conflicted by personal gains (commissions, etc) when giving financial guidance. A lot of the commissions have been banned now, but there are sometimes internal incentives to recommend certain products. I don’t want to besmirch all advisors here, but it makes sense that you would have the best chance of getting good advice if your advisor was truly independent – There aren’t many of these according to ABC news, only about 60 in Australia – All are registered with the Independent Financial Advisers Association of Australia (IFAAA). But even with the independents, be wary of costs.

Cartoon from the equally witty and prolific Randy Glasbergen from source

If you don’t want to take the full responsibility for the nuts and bolts of financial independence onto yourself, I can see real benefits in seeing a knowledgeable fee-for-service financial advisor to set up a one-off tax effective savings structure that will guide you through the mid-thirties through till retirement. Or, it may be wise to get help for specific situations e.g., Self Managed Superannuation strategies.

Where I don’t see value is the too common situation where people front up to the financial planners on the doorstep of retirement with their life savings. There is the potential for an avalanche of fees – as well as the up front costs, each recommended product will have its own management fees.

Alternatives

Naturally, Slack Investor looks to reduce fees where possible. If you don’t want to go it alone along the “full monty” self-education route, there are some cheaper alternatives to the traditional financial advice model emerging. These Robo-Advice structures show promise for some aspects of the financial advisor’s job – How to steadily accumulate wealth and then, how to turn this wealth into an income to support your retirement. It’s new, it’s exciting it’s … Robo, it’s coming next month.