We have 8 planets in our solar system (sorry Pluto!) all whizzing around the sun at different rates, occasionally they “align” when the planets line up or appear close together in a small part of the sky .

Planetary Alignment is a special thing, depending on which planets are involved – and their order. Sadly, Slack Investor wasn’t paying attention when 4 of the 5 planets visible to the naked eye (Mercury, Venus, Mars, Jupiter and Saturn) appeared in a line around the world on April 24 2022.

The bright string of lights in the morning sky (in April 2022) is thought to be a one-in-1000-year event.

Australian Geographic

Slack Investor is coming to the planetary alignment party very late and is now setting his sights on September 8, 2040, when five naked-eye planets (Mercury, Venus, Mars, Jupiter, and Saturn) will be within a circle of 9 degrees in the sky.

Investing alignment

Slack Investor may be a poor astronomer but one of his skills is noticing when two of the most important attributes in the stock market have an alignment – Value and Momentum.

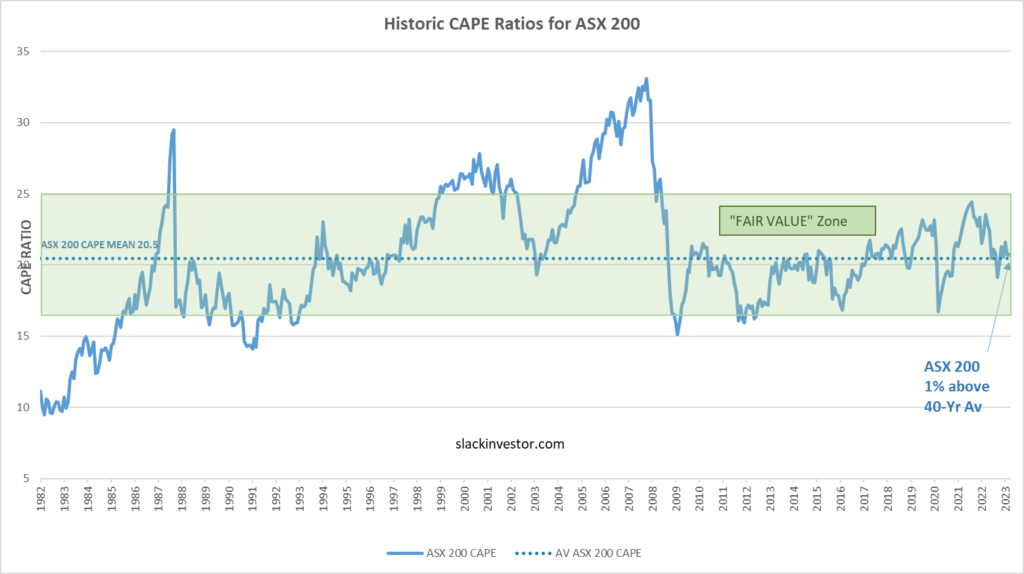

Value investing involves looking at stocks that appear to be trading for less than what they are worth using a value screener like “book value” or the Price/Earnings ratio. Slack Investor likes to use the Cyclic Adjusted Price Earnings Ratio (CAPE) as a broad indicator of value – the lower the CAPE, the better the value.

Momentum investing just uses charts and indicators to pick out the current movement of a stock. Based upon the theory that – If the trend is upwards … it is likely to continue upwards. This is tricky though … the trend is your friend … until it isn’t!

Because trend trading is difficult, I always like a bit of assurance or alignment with value. Ideally, I like value and momentum in a stock before parting with Slack cash.

Value

It has been 6 months since I produced a set of index value charts based upon CAPE to look at how the markets are travelling.

As with individual companies, the whole share market will oscillate between overvalued and undervalued. Slack Investor has written about the Cyclically Adjusted Price to Earnings ratios (CAPE) which use ten-year average inflation-adjusted earnings. By plotting this CAPE over a period of time, we can look at how the whole sharemarket is currently valued in terms of historical data.

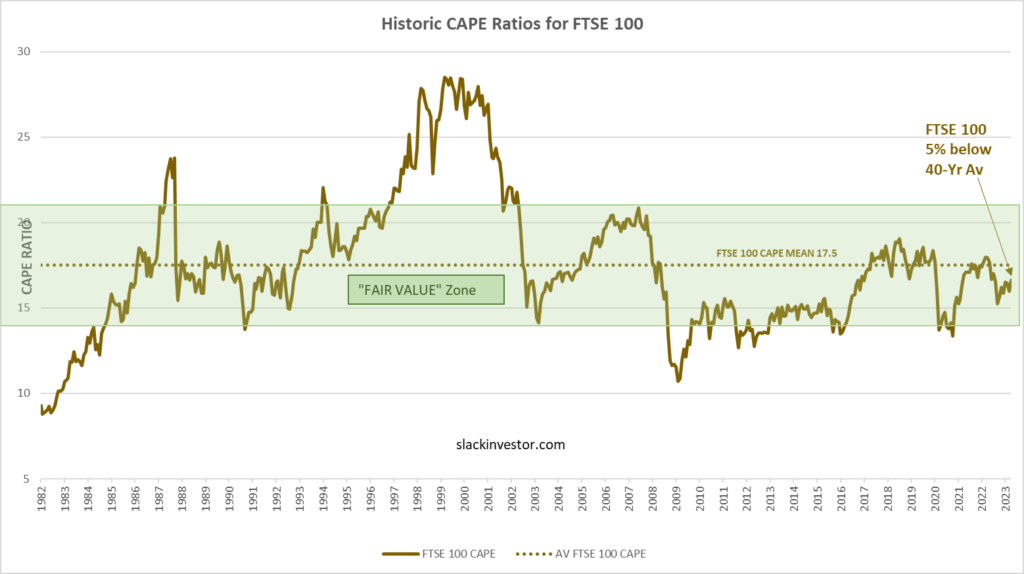

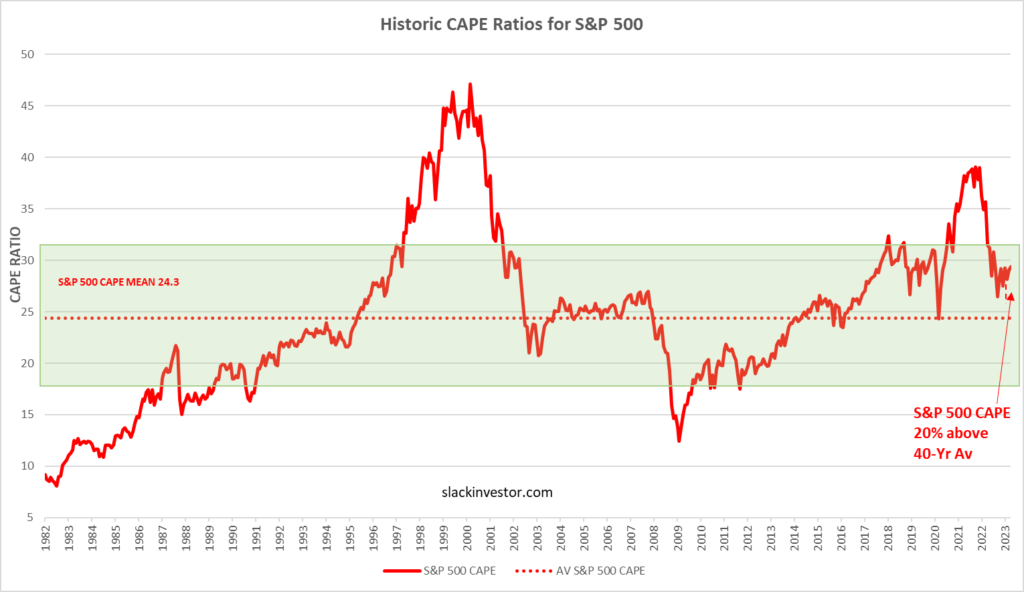

Using monthly CAPE data from Barclays, the 40-yr mean is calculated and plotted together with the CAPE values. A “fair value” zone is created in green where the CAPE is within one standard deviation of the mean.

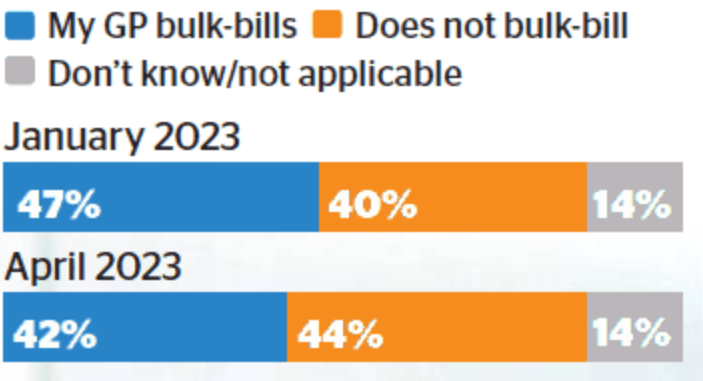

From the above, The ASX 200 is right on fair value (1% above av.) and the FTSE 100 is cheap (5% below av.). Both are worth looking at for the moment as their CAPE values are at, or below their long-term averages. The S&P500, is still in the “Fair value” range, but at 20% above the long term average – so, no bargain here.

Momentum

There are lots of stock indicators that track momentum. Slack Investor has blogged about The Coppock Indicator before. It has had an incredible track record in signalling the end of a “bear market”. The signal (Green Arrow) is triggered when the indicator (shown in the lower screens below as a white line) bottoms from under the zero line and then slopes upwards.

The ASX 200 (Since 31 Jan 2023) and the S&P 500 (Since 31 Mar 2023) are showing signs of recovery from the bear market with the is well into the Coppock recovery cycle. The FTSE 100 is also showing signs of recovery, but as the Coppock indicator did not get below the zero line, this is not a proper Coppock reversal.

Alignment of Value and Momentum Together

Slack Investor will again rant about how market timing is difficult and that the best time to buy stocks is “all the time” – by automating your investments so that their is no decision inertia. Use dollar cost averaging.

However, the Coppock Indicator has been reliable so far in predicting stock gains. This is not advice, but the ASX 200 currently has the alignment of both value and momentum indicators. Alignment is good … If I wasn’t already fully invested, I would have a crack!