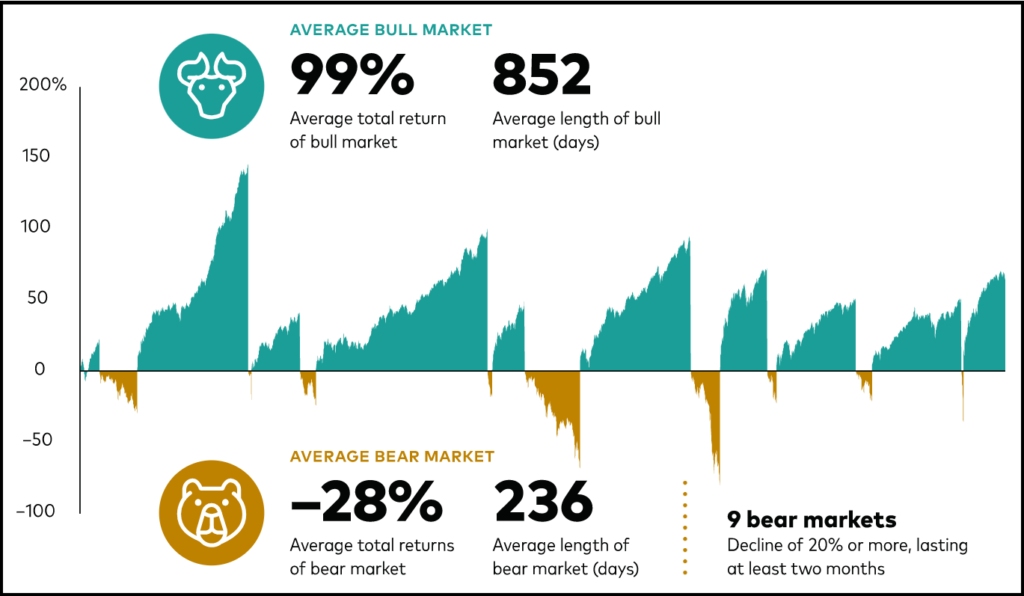

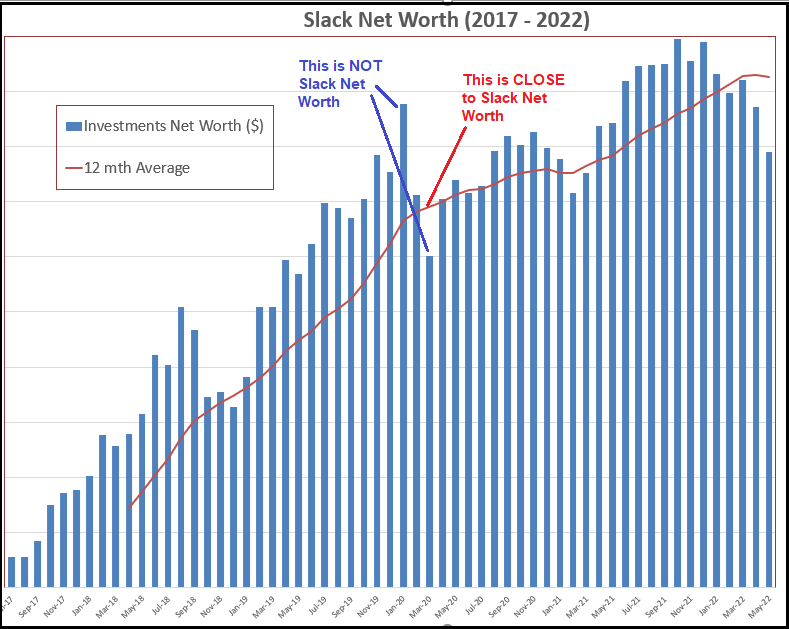

Slack Investor loves a good story – whether its true or not! I like the owning of stocks and I also admire anyone who can stick to their vows. All of this seems to intersect with the story of the Coppock Curve – a technical indicator that can be mapped on stock price charts that has a great track record for showing when the market has reached the “bottom” of a cycle.

When I first started to think a bit more seriously about financial things, I was going to an evening investment class in Townsville. The class was held by a personal Slack Investor Hero, Robbie Fuller, who put on these classes for no personal gain … he just wanted to educate people about the opportunities that lay waiting in the stock market. Robbie would teach us about fundamental analysis (trying to measure the intrinsic value of a stock) and technical analysis (charts and trends). There was always a particular beauty when fundamental and technical information aligned about a company.

The class was usually a lot of fun, but I remember a time around 2011 when the markets were going through a bit of a lacklustre period and we had all had a few recent losing trades – there was just not much excitement about stocks.

Robbie came bounding in one evening after 31 July 2012 with the news that the Coppock Indicator had just turned … it was a sign that “good things will happen”- He was right – It was the start of a 3-yr period where the Australian market was mostly rising. It is much easier to trade when the “tide is coming in”.

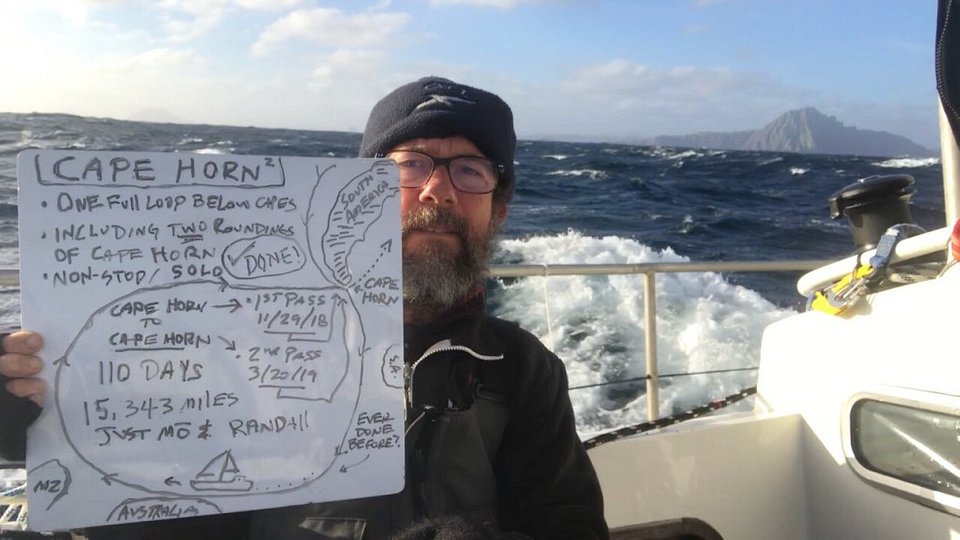

The Coppock Curve is a “smoothed” momentum indicator developed by the economist Edwin “Sedge” Coppock and published in in a 1962 issue of Barron’s. It all started when he was commissioned by the Episcopal Church to find long-term investment opportunities for the Church fund.

According to the legend, he asked a group of nuns (or bishops!) how long it took the bereaved to “recover” from their grief. The answer was 11 to 14 months. He took the radical step of thinking that something similar might happen in stock markets after a market high and subsequent downtrend. He assumed that because markets are motivated by emotion, they might be ready to “move on” after a period of 11-14 months of “grief”.

“Crowds do too much too soon”, he wrote. “They overdo. When they get an urge to speculate, their concerted demand forces prices up at a rate far greater than the growth of the company into which they are buying. Likewise, when they liquidate holdings or make short sales during a panicky decline, they ignore basic economic facts. They overdo because they are motivated by emotion rather than reason.”

Edwin “Sedge” Coppock – from Business Insider

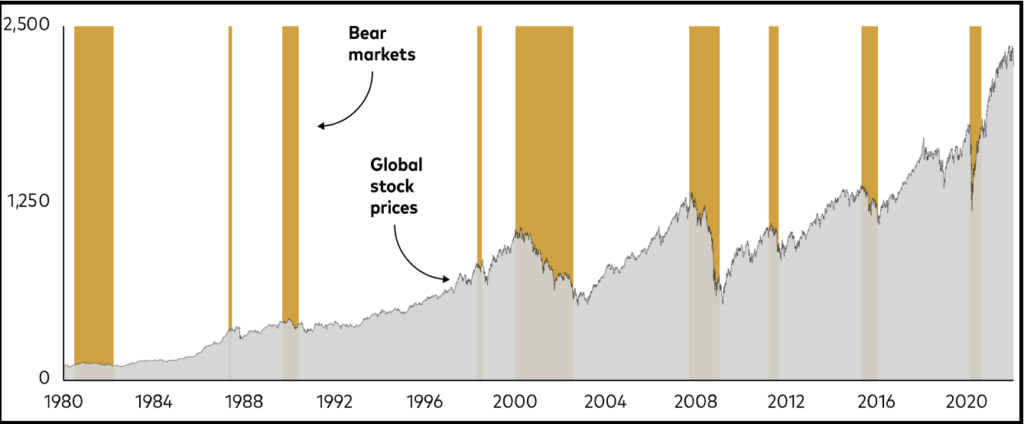

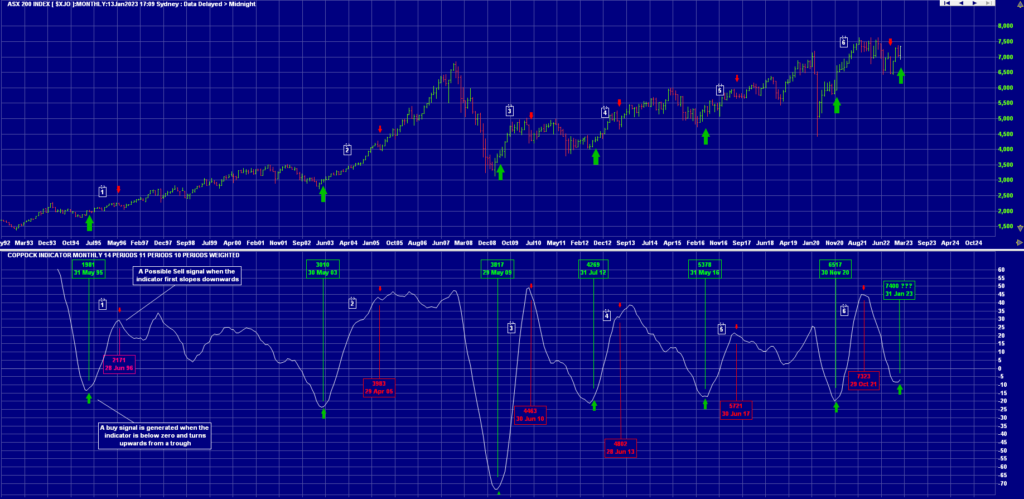

The Coppock Indicator has had an incredible track record in signalling the end of a “bear market”. The signal (Green Arrow) is triggered when the indicator (shown in the lower screen below) bottoms from under the zero line and then slopes upwards.

The indicator gives buy signals very rarely, only 6 times in the past 30 years for the ASX 200. But it has just given another one, signalling a buy for the ASX 200. The maths of the curve is a little complex, but it looks for the next uptrend after the market establishes a high and then goes through a 11-14-month “greiving” period.

Is Coppock’s Bollocks?

There is no perfect trading indicator. Coppock designed his indicator to try to establish a “bottom of the market” buy signal to identify long term investment opportunities. He didn’t try to use it as a selling tool. However, there is a trading strategy that uses this indicator after a BUY signal.

- SELL when the Coppock Curve takes its first downwards trajectory OR,

- SELL when the Coppock Curve falls below zero

I have trialled both methods and the strongest gain (p.a) results were with the first method. I have marked these sell signals on the chart above with red arrows and tabulated the gain results below.

| COPPOCK CYCLE | BUY DATE | ASX200 | SELL DATE | ASX200 | GAIN | PERIOD(yr) | GAIN (p.a.) |

|---|---|---|---|---|---|---|---|

| 1 | 31-May-95 | 1981 | 28-Jan-96 | 2171 | 10% | 0.66 | 14.5% |

| 2 | 30-May-03 | 3010 | 29-Apr-05 | 3983 | 32% | 1.91 | 16.9% |

| 3 | 29-May-09 | 3817 | 30-Jun-10 | 4493 | 18% | 1.09 | 16.3% |

| 4 | 31-Jul-12 | 4269 | 28-Jun-13 | 4802 | 12% | 0.91 | 13.7% |

| 5 | 31-May-16 | 5378 | 30-Jun-17 | 5721 | 6% | 1.08 | 5.9% |

| 6 | 30-Nov-20 | 6517 | 29-Oct-21 | 7323 | 12% | 0.91 | 13.5% |

| 31-Jan-23 | 7400? | ? | ? | ? | ? | ? |

Slack Investor uses Incredible Charts to do all his charting … but their indicator screen can get complicated. To easily follow the Coppock Indicator on any stock, just use the free, but great, StockCharts and put in the same chart attributes below.

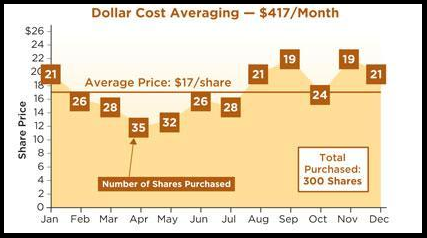

Slack Investor is a great believer that market timing is difficult and that the best time to buy stocks is “all the time” – by automating your investments so that their is no decision inertia. Use dollar cost averaging.

However, looking at the chart history of this indicator … and the GAIN results in the above table, this is not advice, but now looks like a good time to get into the Australian market. Although, officially, the Coppock results are based on the end of month data. In addition, using Slack Investor’s CAPE valuation method, at the end of December 2022 the ASX 200 was “fairly valued”.

Nuns are not infallible … but mostly wise.