There are many numbers to note in finance world – Fees, Investment returns, etc. However, there are two extremely important numbers when it comes to financial independence. Both are percentages and the first one is the 4% “rule of thumb” and the second is your savings rate.

The 4% Rule

All followers of finance blogs would have heard of this often quoted “rule” Slack Investor acknowledges that this magic number is arguable and depends on individual circumstances but, it is an excellent way to estimate how much you will need to retire. The 4% rule is a way to “roughly” link assets with income. For example, as an estimate, if you would like to generate a $40 000 yearly income, you would need to have investments assets of $1 000 000 to earn this income using the 4% rule (4% of $1 000 000 = $40 000).

Another way of looking at this 4% rule is that you need to save 25 x your annual spending for your retirement fund so it can generate an income to cover your spending. So, if you spend $30 000 a year, you need a portfolio of $750 000 (25 x $30 000). To get an idea about what your expenses are it is important that you track them over a year using a spreadsheet or finance software. If necessary, this investment income can always be supplemented by a government pension or a part-time job.

Bill Bengen originally came up with this “4% safe withdrawal rate” in 1994. He developed it by backtesting a conservative US portfolio with data dating back to 1920 and tried to get a safe withdrawal rate that would generate an income for at least 30 years. He is the first to admit that the 4% number was always treated too simplistically and has since updated the rate to be closer to 4.5%.

Slack Investor is a bit old fashioned in liking to hold on to most of the capital that is earning the money and has a flexible approach to how much to extract from investments each year. In a good year for the stock markets, I am happy to dig deep into the investments pile – using dividends, distributions and even some capital gains as income. When the market performs poorly, it is more complicated and I have to dip into my stable income pile. Most of the Slack fund is in Australian Investments and in 2021, the Australian Index has a 12-month forward dividend yield of 3.5% . Hopefully, the shares will also increase in value over time. Over the past 10 years, Australian shares had a total return of almost 7% – with growth shares you can aim higher, but prepare for volatility. In the good years, I will also take out a bit of capital gain for extra spending. All of this is in addition to the stable income component of my investments.

Your Savings Rate

“Wealth consists not in having great possessions but in having few wants.”

Epicetus

Using the 4% rule we estimate how much will give us a sustainable retirement. But there is another number to add to our arsenal.

Just as in Lord of the Rings there is ” one ring to rule them all…”, there is also one “percentage” to rule them all in the Financial Independence world – and that is the Savings Rate percentage.

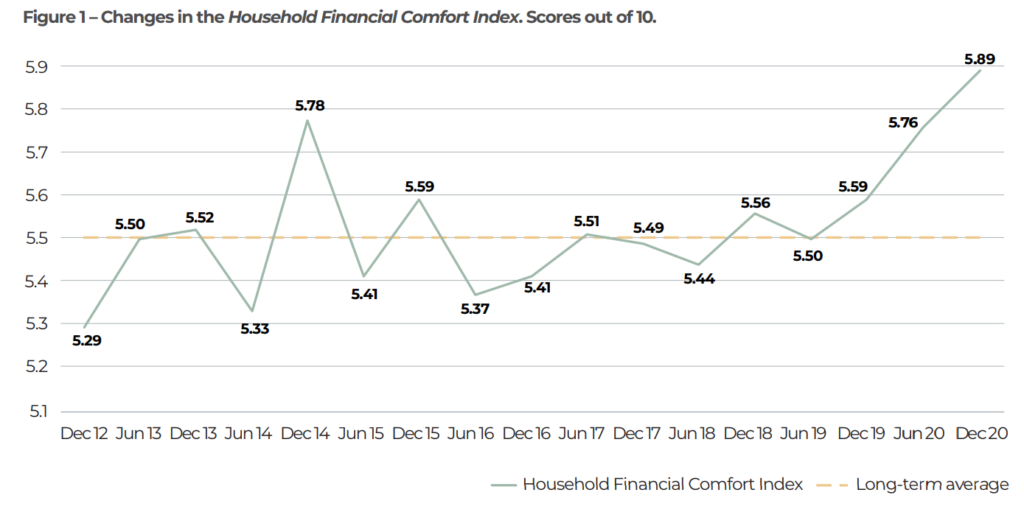

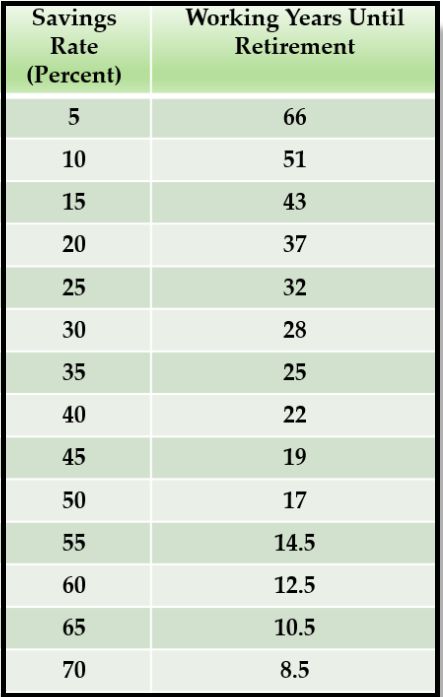

The annual expenses is critical here as this is the figure you are trying to generate out of investment income. Lets have a look at the effect that savings rate has on the number of years that you have to work until you can sustainably generate your expenses from your investments. The table below is from the great financial blogger Mr Money Mustache. There are a few assumptions used to generate this table

- Your investments earn 5% after inflation

- You can live from the “4% safe withdrawal rate” after retirement.

Here’s how many years you will have to work for a range of possible savings rates, starting from a net worth of zero:

At a saving rate of 10% you will have to work for over 50 years – we have to do better than that! There are some pretty heroic savings rates amongst financial bloggers e.g Aussie Firebug 61%; Dividends Down Under 61%; I have admiration for these savings rates and note that these bloggers are in a hurry to get to financial independence – and retire early. At 60% savings you can retire after 12.5 years of working and saving – but that sounds pretty hard.

Slack Investor was on a much slower train and lucky that he quite enjoyed his job – and didn’t mind spending 30 years saving for his retirement. I have always been a good saver but, when looking at my past savings rates, it was usually around the 30-40% level and, some years had dropped down to 20%. Raising a family and holidays are a delightful interference with savings and you just have to find a balance. In Australia, we have compulsory superannuation which currently adds a welcome 9.5 % to your savings rate.

A beautifully presented calculator at Networthify shows how the savings rate works and gives a yearly breakdown. It also shows some interesting OECD statistics for average National savings rates (e.g. The US 6%, and India 32%). The aim is to eventually save enough money to invest in a way that you average (at least) 5% return on your investments after infation. If you withdraw from this retirement pool at the rate of 4% and have enough to cover 100% of your expenses – you become financially independent – the retirement pool keeps on giving!

Automate your savings

One of the best financial habits that I formed was to take the thinking out of saving and set up automatic recurring transfers from my work money to my savings or investment accounts – Pay Yourself First. I also took full advantage of “concessional contributions” to my super account which were taxed at 15% rather than my then marginal rate of 37%.

So, automate your savings. Investment returns are important and we hope that we can exceed the 5% after inflation returns that the above table and 4% rule are based on. However, the number you have most control over is your savings rate – and that is most important.