My last post on “Salary Sacrifice” got me thinking on the other things that I did to help myself on the journey towards financial independence. I have before stressed the importance of your savings rate as the primary tool in the box – and, more than anything, this is the number that will affect when you become financially independent.

This figure can be calculated a few ways, but for simplicity, let’s define it as your retirement savings as a percentage of your take-home pay (disposable income after taxes and deductions) – this can be calculated using fortnightly, monthly, or yearly data.You can work out your own savings rate or, if you are in a stable relationship with a combined goal, include your partner’s savings and take-home pay.

SAVINGS RATE (%) = 100 x (Total amount of Savings put aside for Retirement/Take-home Pay)

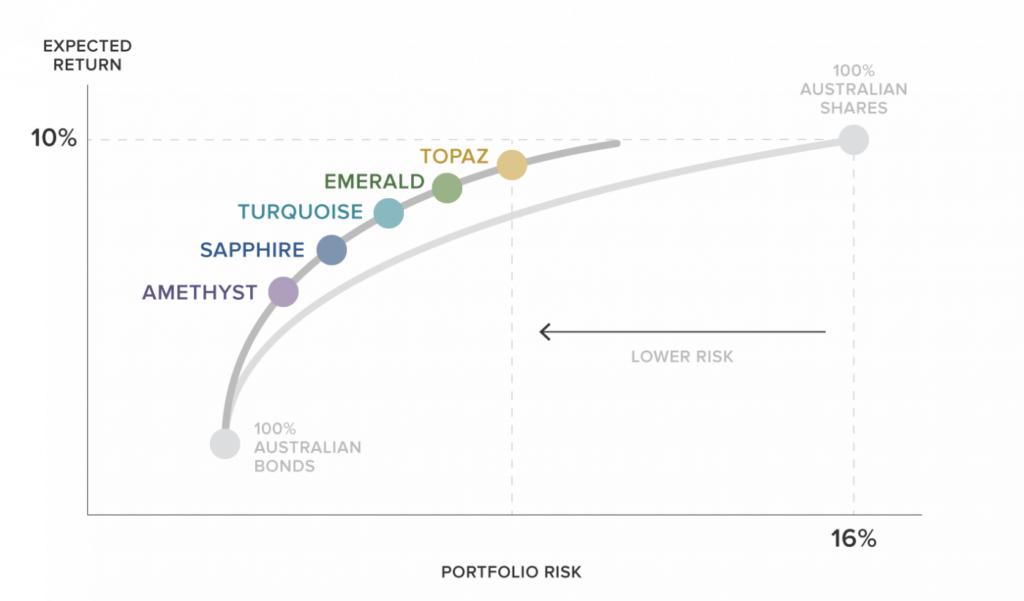

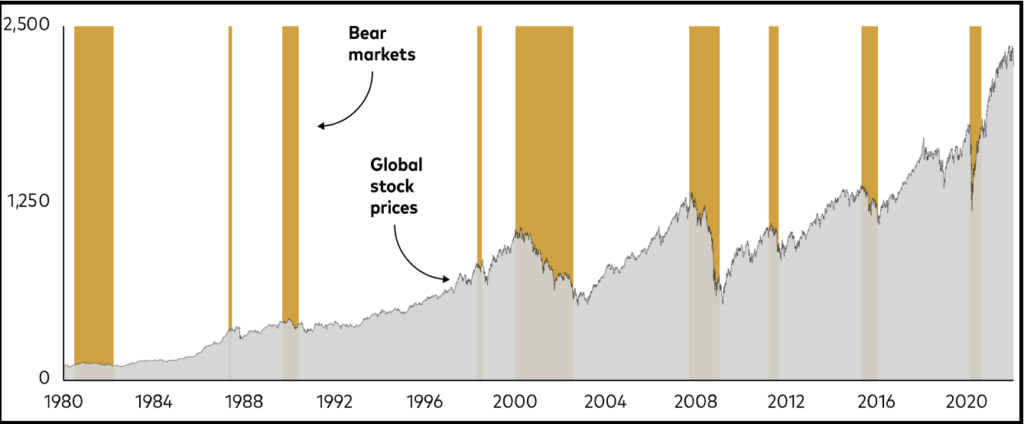

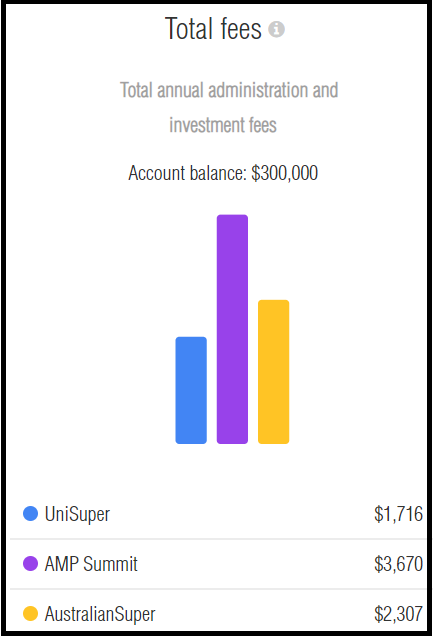

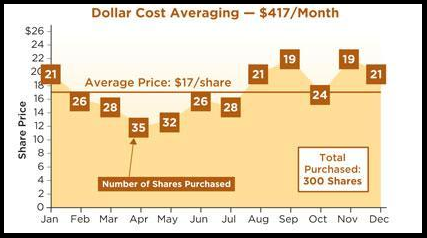

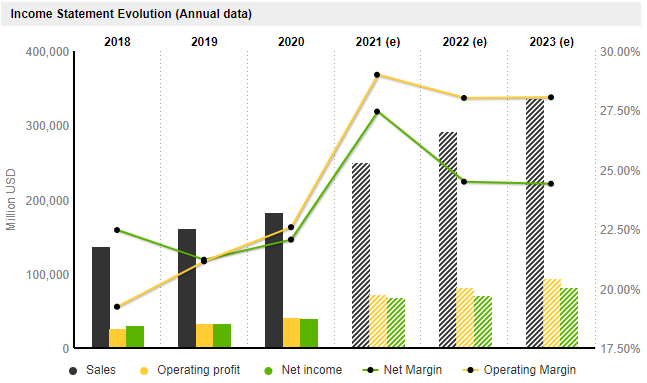

This savings rate is the percentage of your after tax income that you must be putting towards retirement – and it defines the number of years that you have to work until you can sustainably generate your expenses from your investments. There are some assumptions for the following chart:

- Your investments earn 5% after inflation

- You can live from the “4% safe withdrawal rate” after retirement.

This magical curve is presented below to bring a bit of clarity to your goal. The object is to get to the stage when your annual return on investments (Passive income) cover 100% of your expenses. This represents the beautiful state of financial independence.

In Australia, with compulsory superannuation, 10% of your gross salary is deducted from your wages. Taxation rates will vary, but lets just say that 10% of your gross salary is the equivalent of about 15% of your net salary (disposable income). You add your superannuation to any other retirement saving that you are doing to get your total amount of savings put aside for retirement.

Starting from scratch, from the above graph, if you worked continuously, and only relied on compulsory superannuation you enter the full-time work force and you are 42.8 years away from a retirement – where your living expenses are covered by the passive income from your retirement savings. In other words, if working continuously, a 22-year old starting full-time work will have enough passive income to cover expenses when reaching the age of 64.8 – relying solely on compulsory super.

In Australia, there is also the aged pension to kick things along after age 67. Obviously, if you want to retire sooner and have a bit extra for holidays, and to allow a bit of a safety margin, and be financially independent – You will have to do some extra savings towards retirement yourself.

How are people going with their savings rate?

For Australians, the compulsory superannuation system provides a sound base for retirement savings (with a working life of 42.8 years). This doesn’t factor in the government funded aged pension – subject to a means test. Currently the pension (September 2023) is $28,514 per year for a single person – But who knows if this will still be available at present levels in the future. It is best to plan for your future without it – and then accept it as a bonus if you qualify.

Although this sounds OK, any disruption to your working life (ill health, family, education, retrenchment, etc) will be a real setback to your retirement plans – Any work breaks will require additional savings for your retirement. In the US, the “average” savings rate was between 5-10% for many years. Despite some impressive savings rates during COVID-19, in July 2023, the personal saving rate in the United States amounted to 4.1 percent.

From Statista

You would have to say … this does not bode well for a satisfying retirement for the “average” US Citizen.

What was the Slack Investor Savings Rate?

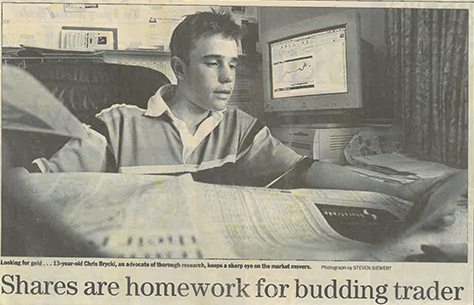

Rusted on followers of this blog will recall that I had a bit of a delayed start to thinking about retirement. I had just arrived back in Australia after a 6-year working holiday overseas. I was aged 30, broke, and the only thing I knew was that I didn’t want to continue working in the field that I was trained in – high school teaching.

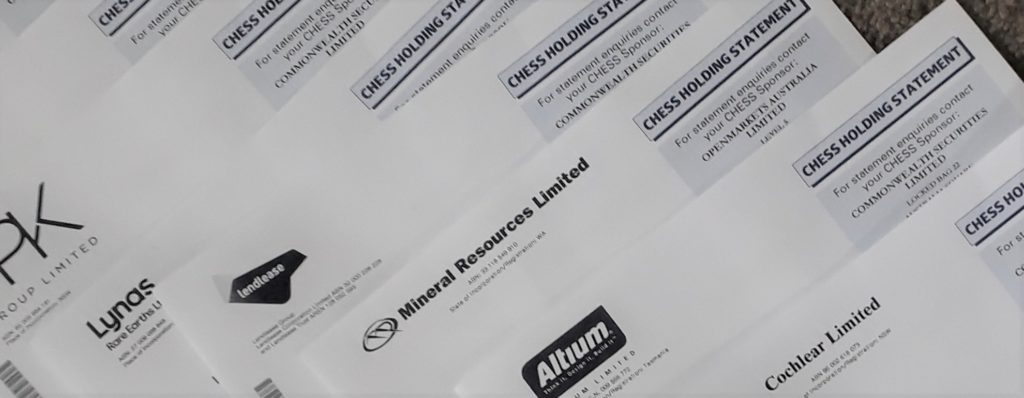

Clearly Slack Investor had a bit of work to do. Once I was in regular employment again, I set about getting the financial building blocks in order. Emergency fund, house deposit … and then savings for my retirement. I did this mostly using salary sacrificing into superannuation and building up my own private share portfolio.

There is nothing Slack Investor likes more than burrowing into my financial history using the excellent and free “Sunset” international release of Microsoft Money. I use the Australian Version. I have been using this software to track my finances since 1990 (33 years!)

Including superannuation contributions, my savings rate for retirement fluctuated between 20% and 45%. From the top graph, this represents a shifting rate that was equivalent to an overall retirement goal that required between 36.7 years and 19 years of working. Since “ground zero” at aged 30 and some extra education, I ended up working mostly full time for 28 years. Luckily, I had found a job as meteorologist that I really enjoyed.

This is not the “hard core” road to financial independence (i.e retire at 35, etc) – but Slack Investor thinks a reasonable compromise with the competing priorities of raising a family and buying a house.

Savings Rate is so important. Determine what your own savings rate needs to be to achieve your retirement goals – and automate your savings deductions as much as possible – and get cracking!.

December 2023 – End of Month Update

Happy Days. The year closes and, Slack Investor was definitely not naughty … a big December “Santa Rally” this month. All followed markets rose. The ASX 200 up a mighty 7.1%, the FTSE 100 up 4.0%, and the S&P 500 up 4.4%,

Slack Investor remains IN for the FTSE 100, the ASX 200, and the US Index S&P 500.

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index). The quarterly updates to the Slack Portfolio have also been completed.