The Vulcan salutation that Spock would give his fellow Vulcans is a catchphrase of the Star Trek series and a reminder that “living long” in a state of good health, would be a nice thing to achieve.

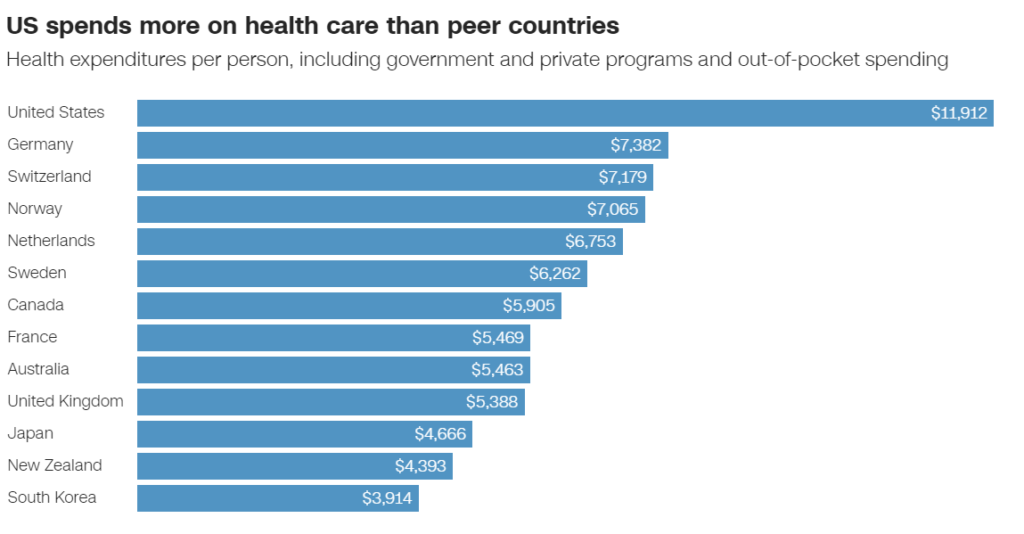

Slack Investor has been thinking about health lately and his research tells him that good health outcomes are not always just a matter of spending more money. The US is a good demonstration of this point. In an analysis of health data for the 38 OECD countries, though spending nearly twice as much as the average OECD country on health care, the US has the highest rate of people with multiple chronic health conditions.

Money and Healthcare – What’s gone wrong in the US?

“16% of all officially recorded COVID-19 deaths (worldwide) occurred in the US, despite having only 4% of the world’s population”

The Commonwealth Fund

In most countries, using the broad indicator of life expectancy, as health expenditure increases, so does life expectancy. However, the US is an outlier. The populations of countries with much lower health spending than the US enjoy considerably longer lives and better health outcomes with other measures. The interactive chart from ourworldindata.org demonstrates this.

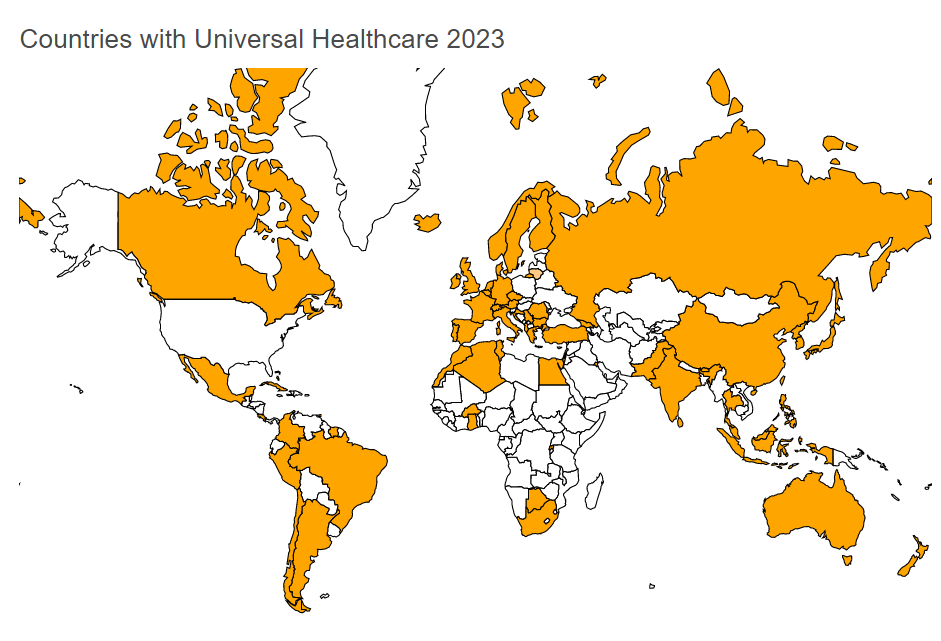

” … the U.S. is the only country we studied that does not have universal health coverage, but its health system can seem designed to discourage people from using services,”

The Commonwealth Fund

Universal Health Coverage (UHC) is defined as everyone having access to good quality health services without suffering financial hardship but this is a complex area and each country does it differently. UHC is usually funded by taxes or access to insurance schemes.

There are many reasons for this disparity with the US and other countries. The American Public Health Association say that improvements could be made by improving access to a UHC system, increasing primary care prevention, and more money spent on social services to support their citizens, rather than “sick care”.

The US has two streams of healthcare, those with insurance (usually tied to employment) and those without. In 2021, 70 million Americans are either not insured, or underinsured. Those without insurance usually get a much poorer health service and yet, in the other stream, the top 5% of spenders are incredibly well serviced and account for almost half of the health spending.

There are lessons to be learned here for all governments – it might mean an increase in taxation, but I would rather have the top ranked Norwegian style of healthcare rather than a US style.

Dying is expensive

Medical spending in the last twelve months of life accounted for approximately 8–11 percent of aggregate medical spending in most countries

2009-2011 Health Affairs study – using data sets from 9 OECD countries

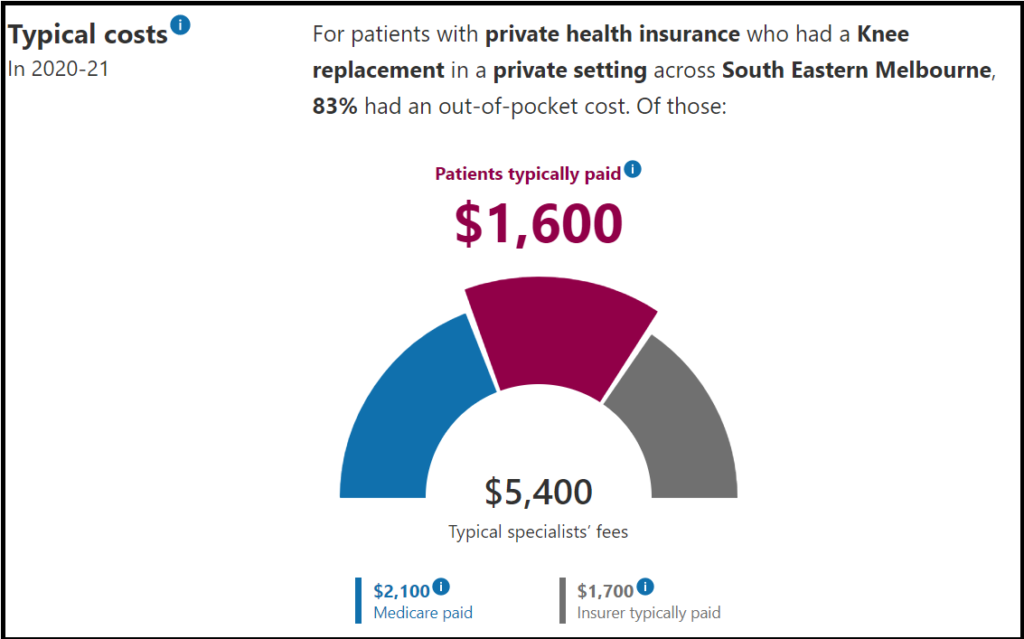

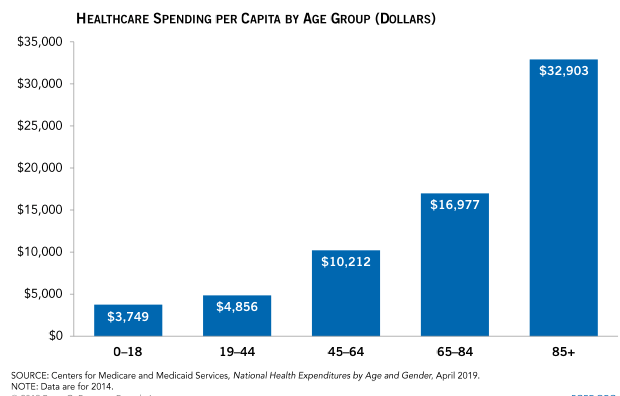

As we get older, we get more expensive to run – more things going wrong! There are high costs associated with dying, as this is often in association with hospital care.

Overall, the average annual health service cost per person for people in their last year of life was 14 times as high as for those not in the last year of life ($24,000 and $1,700 respectively).

Australian Institute of Health and Welfare

It seems that it is not just our last year that is expensive to the health system, One 1993 U.S. study found that 30 to 40 per cent of costs incurred in the last year of life were incurred in the last month of life! Slack Investor calculates this as meaning 3-4% of lifetime aggregate medical spending is spent in our last month!

Cripes … Slack Investor is worried that he might turn up to hospital and some bureaucrat with a clipboard (or AI Bot!) will tell me that they have crunched the numbers …. and it’s just not worth it to admit me.

This deep dive into healthcare has made me determined to take a bit of control. I will try to stay as healthy as possible for as long as possible … better stop here and go for a jog – and have a healthy meal tonight!