Dali’s painting “The Persistence of Memory” has been described as a “surrealist meditation on the collapse of our notions of a fixed cosmic order“. Slack Investor is not gifted in the interpretation of artworks but would “have a crack” and say the work was indicating a lack of permanence, or persistency, that we often associate with everyday things. What Dali called “the camembert of time”.

“The sole difference between myself and a madman … is the fact that I am not mad!”

Salvador Dali

Persistence : (Noun) the act of persisting or persevering; continuing or repeating behaviour – vocabulary.com

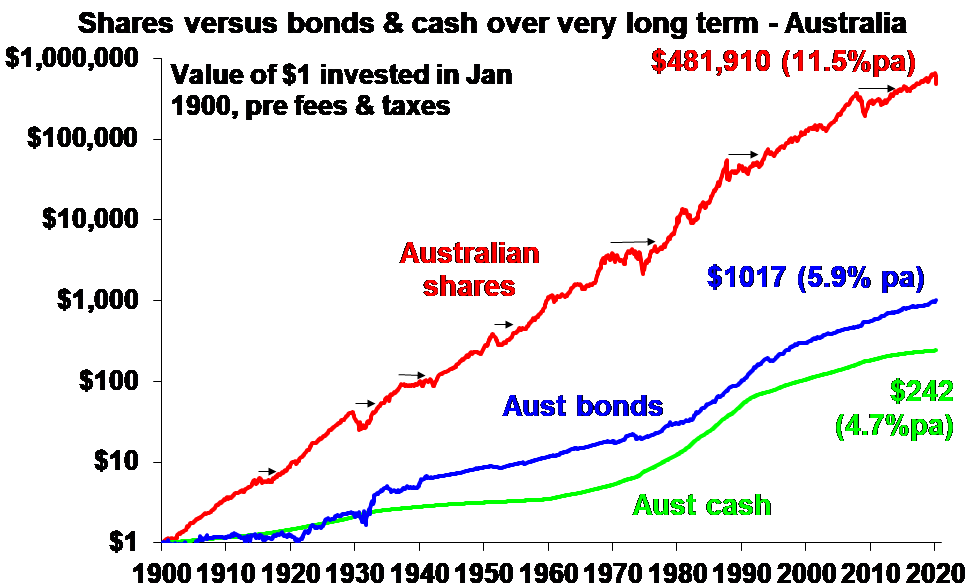

Persistency is a great investing quality that impresses Slack Investor – but I acknowledge the difficulty. Standard & Poor’s collect data from the US market on how consistently recent top performing share funds are able to keep producing winning records in subsequent years. The following graphic tracks the funds that were in the top 25% of performers in 2018 – and who stayed in the top quartile in successive years.

Over a five-year horizon “it was statistically near impossible to find consistent outperformance.”

S&P Research – Ifa.com

Just because a fund, or portfolio, did well in one year does not mean it will continue to perform well the next year. Slack Investor has found this himself with his best performing stocks often becoming the worst performing in the next year – such is the nature of stocks. The stock market often moves between being overvalued and undervalued – and it is the same for individual companies.

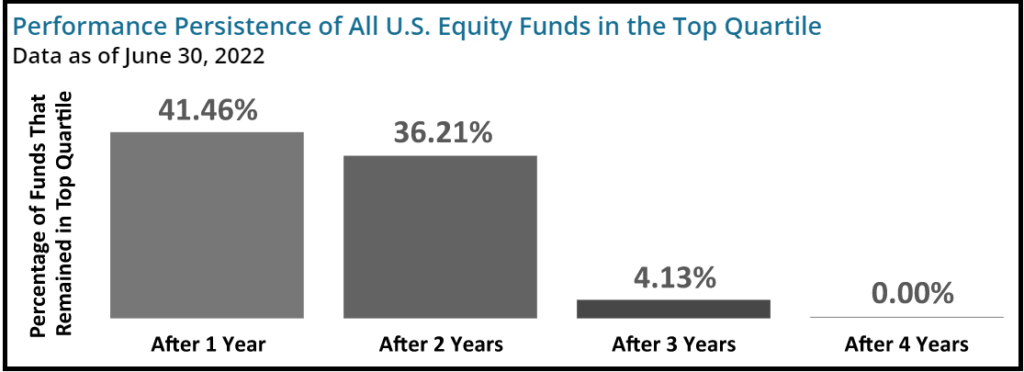

Most active (stock picking) funds do not exceed their long-term benchmarks

Not only do active managed funds struggle to maintain consistency, most of them underperform index funds. We are lucky that there are a group of economic boffins that keep an eye on things in the funds department. They are the known as SPIVA (S&P Indices Versus Active). Since 2002, they have been collecting world financial data and comparing actively managed funds to passive (Index) Funds. The 2022 data is now in and the disappointing theme continues. For Australian Equity (Share) funds, for the 5 and 10-yr horizons, respectively, 81.2% and 78.2% of funds underperformed the S&P/ASX 200.

For International equities, the performance of active funds was worse – Over the 5 and 10-year periods, more than 86% and 95% of funds underperformed, respectively.

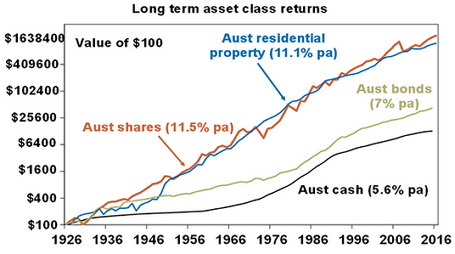

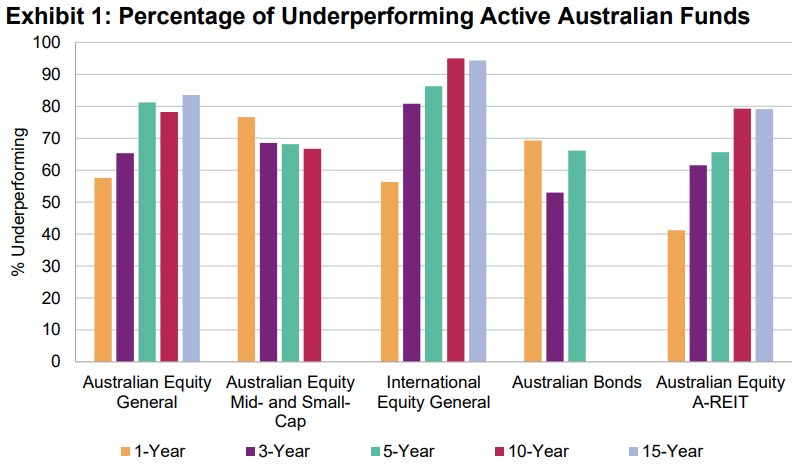

How to cope with inflation

To keep pace with inflation you must be invested somewhere – so that your investments can grow faster than inflation (cpi) over time (at least 5 years). I will explain in a future article why I prefer shares and ETF’s as the vehicle to do this over other appreciating assets. So, on this path, to be exposed to equities (or stocks) you can either buy

- Active managed funds – Roll the dice here as most of these underperform Index funds after fees, but the minority showed some skill over benchmarks over a 5-yr period – but there is no guarantee that they will keep ahead of their benchmarks.

- Individual stocks – this is what Slack Investor does – but some experience is helpful here!

- Low-Cost Index Exchange Traded Funds (ETF’s) – this is the easiest path, and Stockspot have made the process even simpler by researching the best Index ETF’s in each class.

Exchange Traded Index Funds (ETF’s) for a Portfolio

Stockspot diligently analysed 640 of the largest managed funds available in Australia.

Australian Shares Index ETF

For Australian share exposure, Stockspot recommends the ETF ASX:VAS – as it has outperformed 74.3% of large cap Australian shares managed funds over 5 years with an Indirect Cost Ratio (Management Fee) of 0.1% and an annual return (over 5 years) 0f 9.0%.

Australian Small Companies Index ETF

Here, Stockspot recommends the ETF ASX: VSO – as it has outperformed 63.5% of small cap Australian shares managed funds over 5 years with an Indirect Cost Ratio (Management Fee) of 0.3% and an annual return (over 5 years) 0f 11.7%

International Shares Index ETF

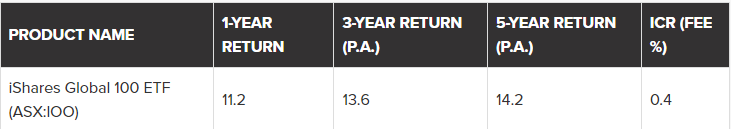

For a swing at the world markets, Stockspot recommends the ETF ASX: IOO – as it has outperformed 97.5% of the large cap global managed funds, available in Australia, over 5 years with an Indirect Cost Ratio (Management Fee) of 0.4% and an annual return (over 5 years) 0f 14.2%.

March 2023 – End of Month Update

After a sparkling January, the calendar year has crawled along in share market gains. But, it’s “dividend season” now – and this cheers Slack Investor up greatly.

Declines this month for the Australian and UK markets (ASX 200 – 1.1%, FTSE 100 -3.1%). Those irrepressible optimists in the US keep powering on, with the S&P 500 up 3.5% – even though this is the most overvalued of Slack-followed markets.

Slack Investor remains IN for the FTSE 100, the ASX 200, and the US Index S&P 500.

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index). The quarterly updates to the Slack Portfolio have also been completed