Every quarter, the economic boffins at ASFA (Association of Superannuation Funds of Australia go to the trouble of crunching the numbers on what yearly income they think is required for a “comfortable retirement”. They assume that the retirees own their own home outright and are relatively healthy. In one year, due to inflation, the comfortable retirement amount has increased by 7.6% , or $4920, to $69,691 for a couple (Dec 2022 ).

| Comfortable lifestyle (p. a.) | Modest lifestyle (p. a.) |

|---|---|

| Couple $69,691 | Couple $45,106 |

| Single $49,462 | Single $31,323 |

ASFA’s calculations are very detailed, but notably these annual incomes do not include any overseas travel – depending on your accommodation standards and length of journey, this could easily require another $20K.

Their latest December 2022 report notes that price rises have occurred for most spending categories. In the last four quarters,

- Food rose by 9.2%

- Bread 13.4%

- Meat and seafoods 8.2%

- Milk 17.9%

- Oils and fats 20.8%

- Gas 17.4%

- Electricity 11.7%

- Household appliances 10.2%

- Automotive fuel 13.2%

- Domestic travel and accommodation 19.8%

- International travel and accommodation 15.9%

ASFA also helpfully calculate a lump sum that you will need to supply this income – with the assumptions that the lump sum is invested (earning more than the cpi) and will be fully spent by age 92. Let’s aim high and just concentrate on the comfortable retirement – the “modest” retirement lump sum amounts are much lower (around $100K) as they assume supplementation from the aged pension.

| Savings required for a comfortable retirement at age 67 |

|---|

| Couple $690,000 |

| Single $595,000 |

How to Cope with Inflation

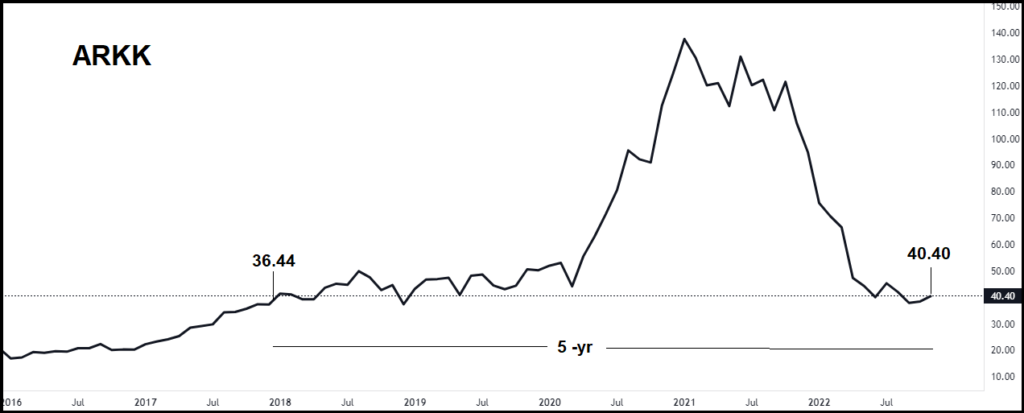

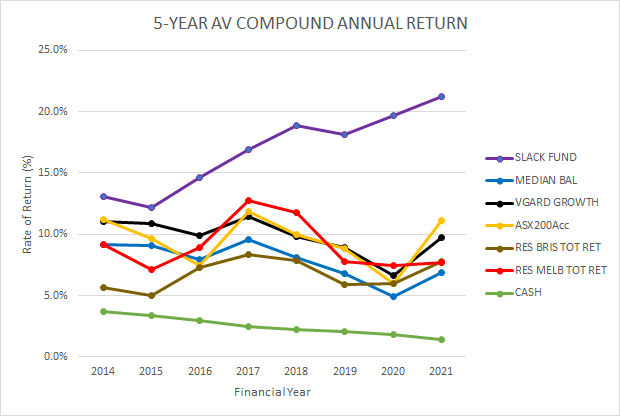

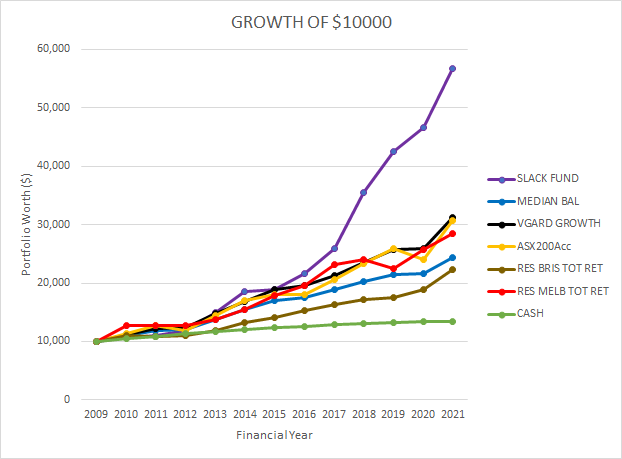

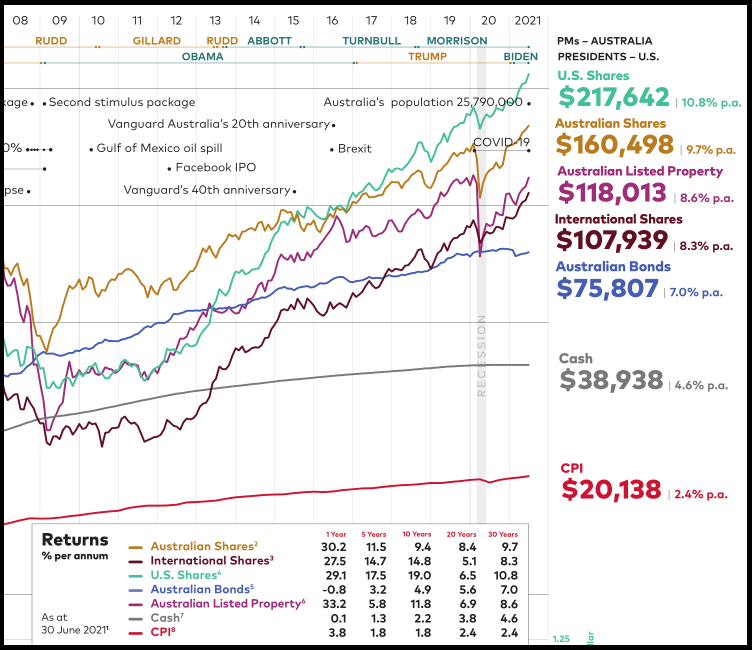

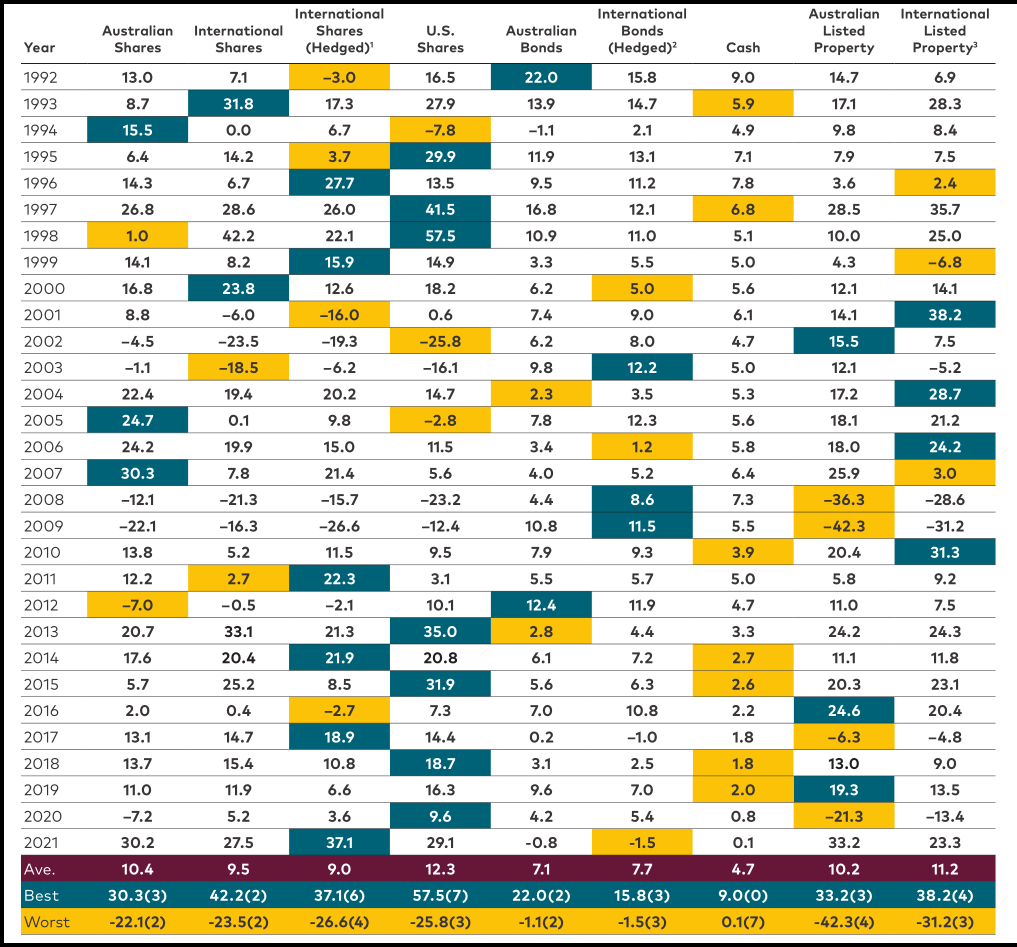

There is just one simple way – you must be invested in appreciating assets that keep pace (or exceed inflation). Appreciating assets tend to go up in value over time. This is pretty vague, but if you are unsure about an asset, try and find a price chart over a 10-yr to 20-yr period. If it is going up, it is probably an appreciating asset.

You will always need some amount in cash for day to day requirements and to ride out any investment cycles without the need to cash in your investments at a low point in the cycle.

Knowing the difference between an appreciating and a depreciating asset (e,g cars, furniture, technology equipment, boats, etc) was an important step in Slack Investor’s investing life. I can still remember the day my father gave me “the talk”, that it was OK to borrow money for appreciating assets – I think he was pushing me in the direction of real estate at the time. However, I was not to borrow for a depreciation one i.e. a car, or consumer goods – assets that lose value when you walk out of the shop!

Appreciating Assets

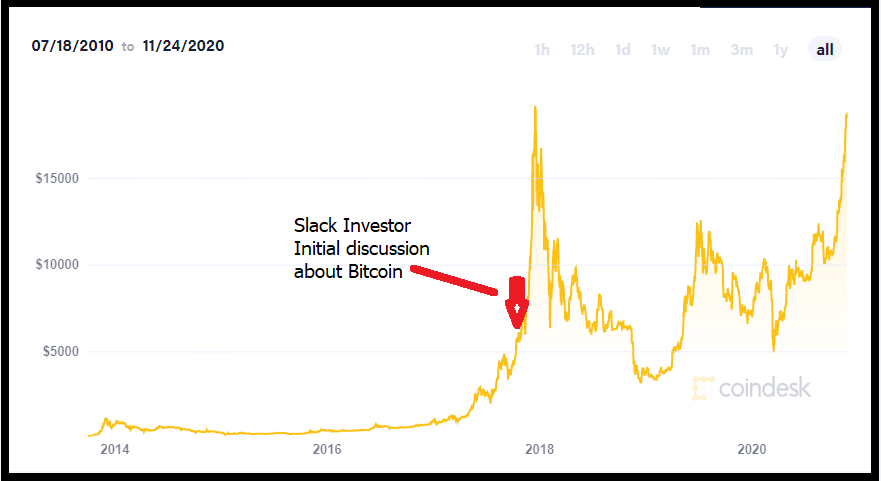

Below is a (not exhaustive) list of appreciating assets. I have left out cryptocurrency deliberately as it has only been traded since 2010, and it is not established yet that it is a long-term appreciating asset.

List of appreciating assets:

- Real estate

- Real estate investment trust (REIT)

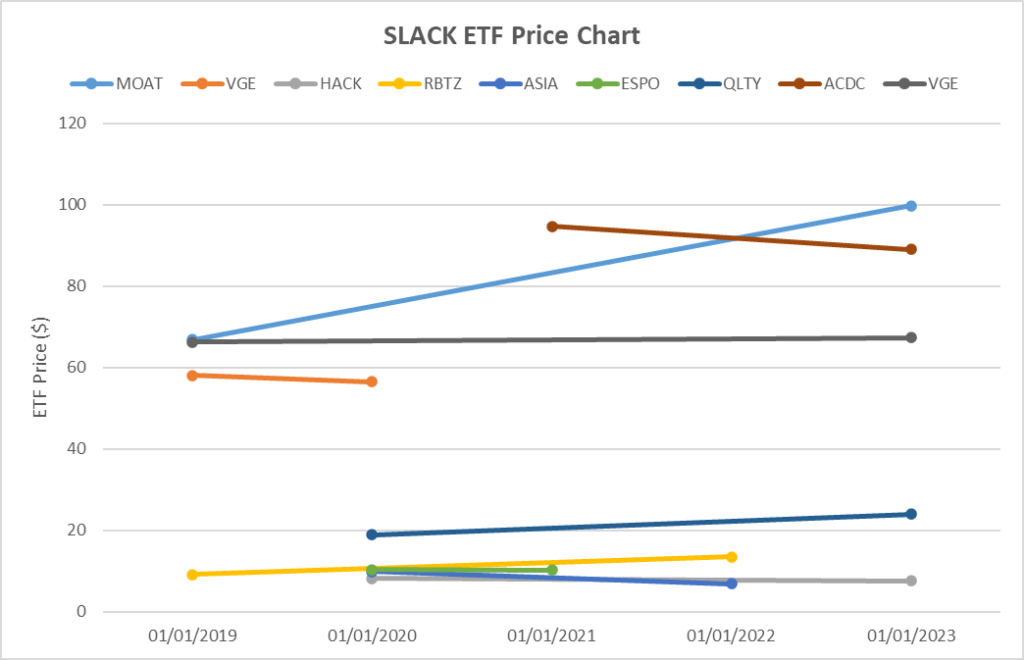

- Stocks (Shares) and ETF’s

- Bonds

- Commodities and Precious Metals

- Private Equity

- Term Deposits and Savings Accounts

- Collectibles e.g. Art

Term deposits and savings accounts might keep pace with inflation (if your lucky!) – but generally do not grow faster than inflation. Slack investor will write about why owning your own home and investing in Stocks (Shares) and ETF’s are his favourite appreciating assets in a later post.