And you better start swimmin’

Or you’ll sink like a stone

For the times they are a-changin’

The Times They Are A-Changin’ – Bob Dylan

That old troubadour Bob Dylan released this back in 1964 …on vinyl … I might add! Bob’s lyrics were written almost 60 years ago about the cultural and political divide that existed way back in the early 1960’s. His message to “start swimmin’ or you’ll sink like a stone” continues to have relevance – even to investors.

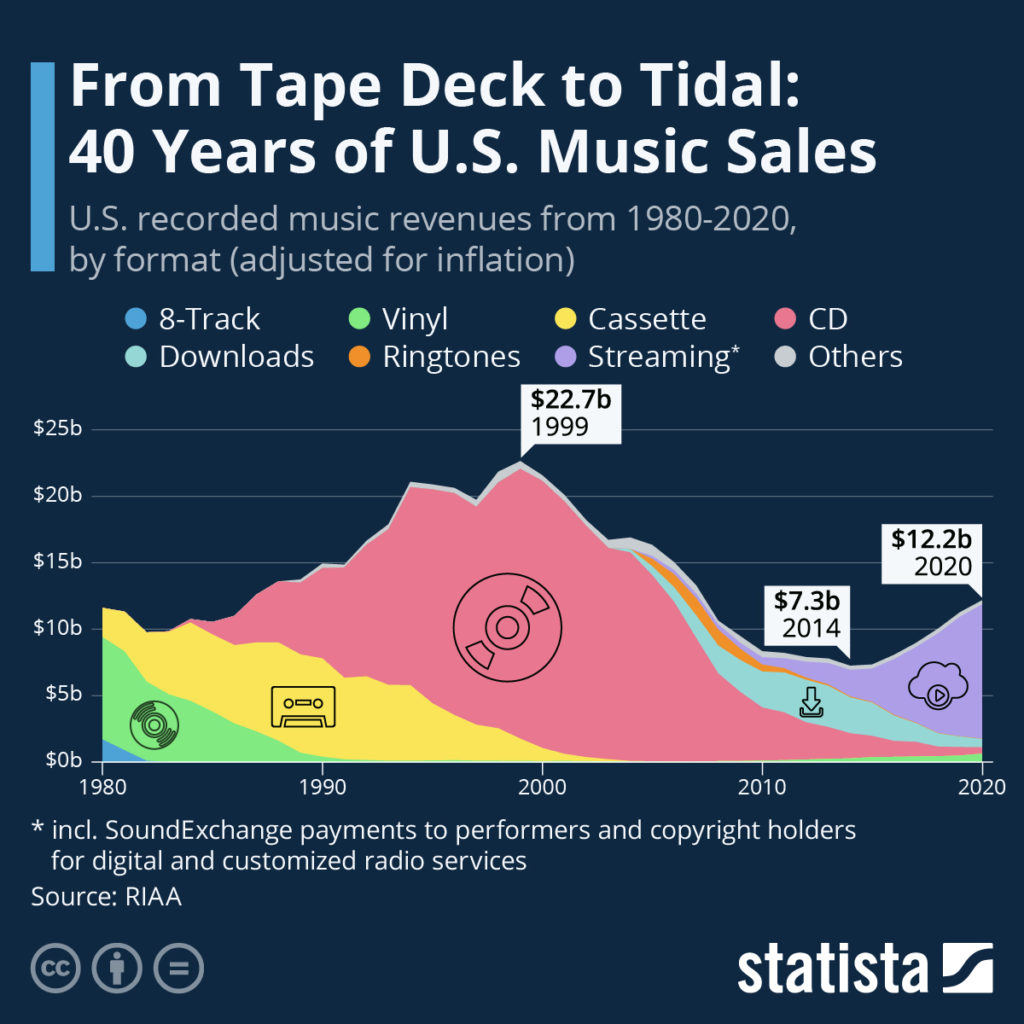

Music has been an important part of Slack Investor’s life and starting with my first “record” vinyl purchase in high school, I then went through the cassette phase. Cassettes were always a bit dodgy, but they did have their moments – who can forget the sublime “mix tape” given to you by a friend. The gradual degradation of cassette musical quality as they lost their magnetism and, the ultimate tragedy when your precious “mix tape” starts unravelling in the car. All this made me glad when CD’s were introduced in 1982. Aaahh … the beautiful world of the CD – Digital quality and a format that I thought would live forever. Only in hindsight do we see that “Peak CD” was in 1999 and this was also the peak of recorded music revenue for artists. I could look at the below chart for hours.

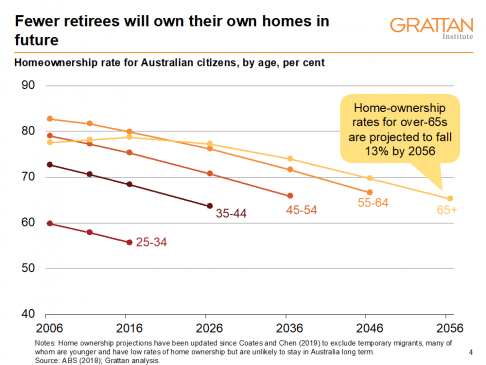

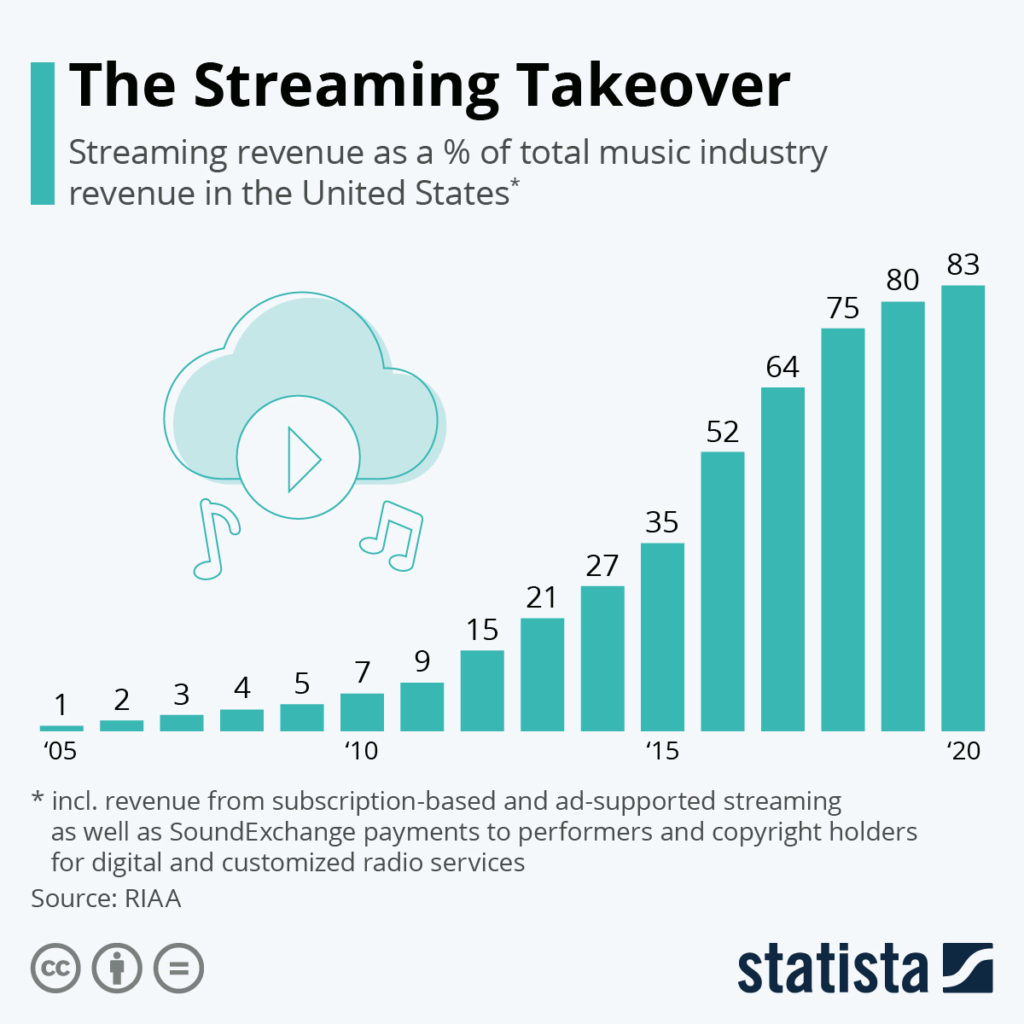

Despite the recent uptick in vinyl sales, it seems obvious that the days of owning music are numbered. It is also sad to note that revenues from recorded music in 2014 sank to a third of those in 1999. Revenues are on the increase but royalties from streaming remain pitifully low and artists can be paid as little as 13% of the streaming income generated. The recording artists must resort to touring and merchandising to provide the bulk of their income. The highest grossing act of 2017 was U2. According to Billboard – their streaming income was only just over 1% of their total revenue of 54.4 million USD.

Spotify generally pays between $US.003 and $US.005 per stream, meaning you’ll need about 250 streams to make a dollar.

Business Insider Australia

In an unbelievable turn of events for all “Boomers”, streaming is now the way to access recorded music and now accounts for 83 percent of music industry revenues in the U.S. Physical CD’s and even music downloads are in major decline.

Music Delivery Change … and Investing

All of that music stuff was just to provide an example about how unexpected change can happen in just a few decades. Slack Investor had built up an impressive CD collection over the past 30 years and, he thought he was set up for life. This collection is now in a box as I now tend to now use digital versions for my musical pleasures. To the great dismay of my children, I am still hanging on to ownership of my music – they tell me this is typical “boomer” behaviour and are urging me to get on board the streaming train.

We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten. Don’t let yourself be lulled into inaction.

Bill Gates

Bill has pointed to a bit of a weakness in the vision of investors … and Slack Investor obviously cherishes his moments of inaction – but will act if he has to. He has already made a few tweaks in his portfolio

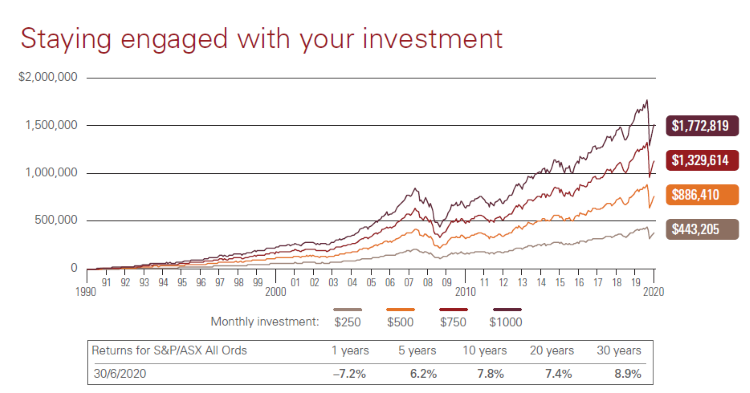

I have been thinking of relatively safe investments lately … and this is tricky in these weird times as, besides precious metals, it is difficult to name a sector that would be unaffected by an inevitable downturn in the markets. Will bricks and mortar retail be the same? Will CBD office real estate be the same? Will banks be the same with the new competition from Neobanks?

With the exception of consumer staples, safety may not be found in traditional industries. Technology is such a large part of our lives now – and this is where growth will happen. I keep returning to the utility of an Index like the NASDAQ 100. It has the beautiful self correcting mechanism where dud technologies get shuffled out of the bottom of the index and the companies that are still making money tend to stay in.

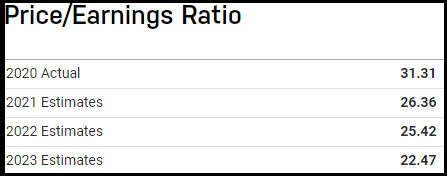

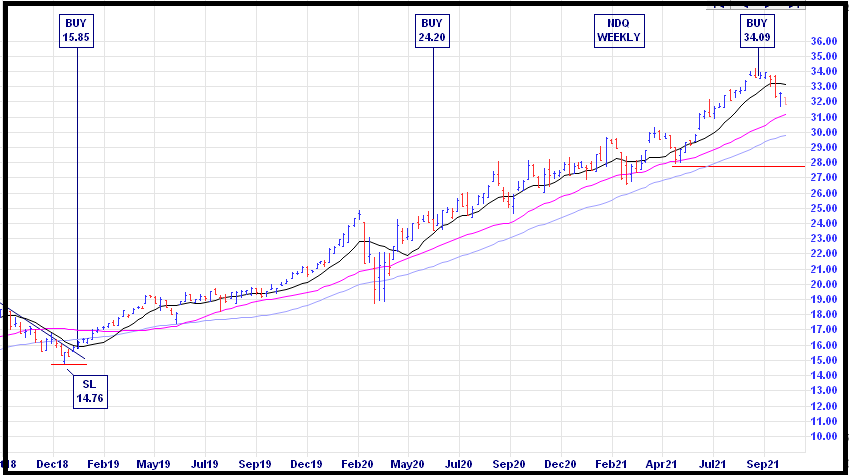

I have been a buyer of this ETF along the way and a recent dip in price (perhaps due to the recent Facebook revelations) point to an increasing mood for more regulation in some of the tech stocks. Barrons have the current PE at 34.5 which does not make it cheap but the PE based upon the forward 12-mth earnings forecast is a bit more reasonable for the growth sector at 28.0. In this changing world, the one thing that you can bank on is that the technology industry will be an important part of it. Not advice … but I think I will buy some more.

Don’t stand in the doorway

Don’t block up the hall

For he that gets hurt

Will be he who has stalled

The Times They Are A-Changin’ – Bob Dylan