The Beatles at Tittenhurst Park, 1969 – From Rolling Stone

It has been 53 years since the Beatles) recorded “Here Comes the Sun” from their landmark Abbey Road Album. It has been 18 months since Slack Investor installed Solar Panels on his roof and is in complete agreement with George Harrison … This Sun, “It’s alright”.

Here comes the sun

Here comes the sun,

And I say, It’s all right

From “Here Comes the Sun” – Songwriter: George Harrison

Always looking for distractions during the declining months of the stock market … and I can always rely on my solar panels for good news. Solar Choice evaluate solar panels in Melbourne (where I live) to have a 22% – 36% internal rate of return on your investment (that’s good!) – and then there is the mantra of “doing the least harm” by minimising fossil fuel use.

The road to Solar Panels

Firstly, great apologies to planet Earth that it has taken me 6 decades to harness some of the sun’s energy for my personal power use. But what is done is done .. and I am moving forward with the zeal of a reformer.

Like all big financial decisions, Slack Investor was not immune to procrastination. There is always an excuse not to act … ” I’ll wait till I pay off my mortgage”, ” I’ll wait till I get to my dream home”, etc. What I wished that I knew during these periods of hesitation was that solar panels on your roof does not only make environmental sense … but it makes great financial sense.

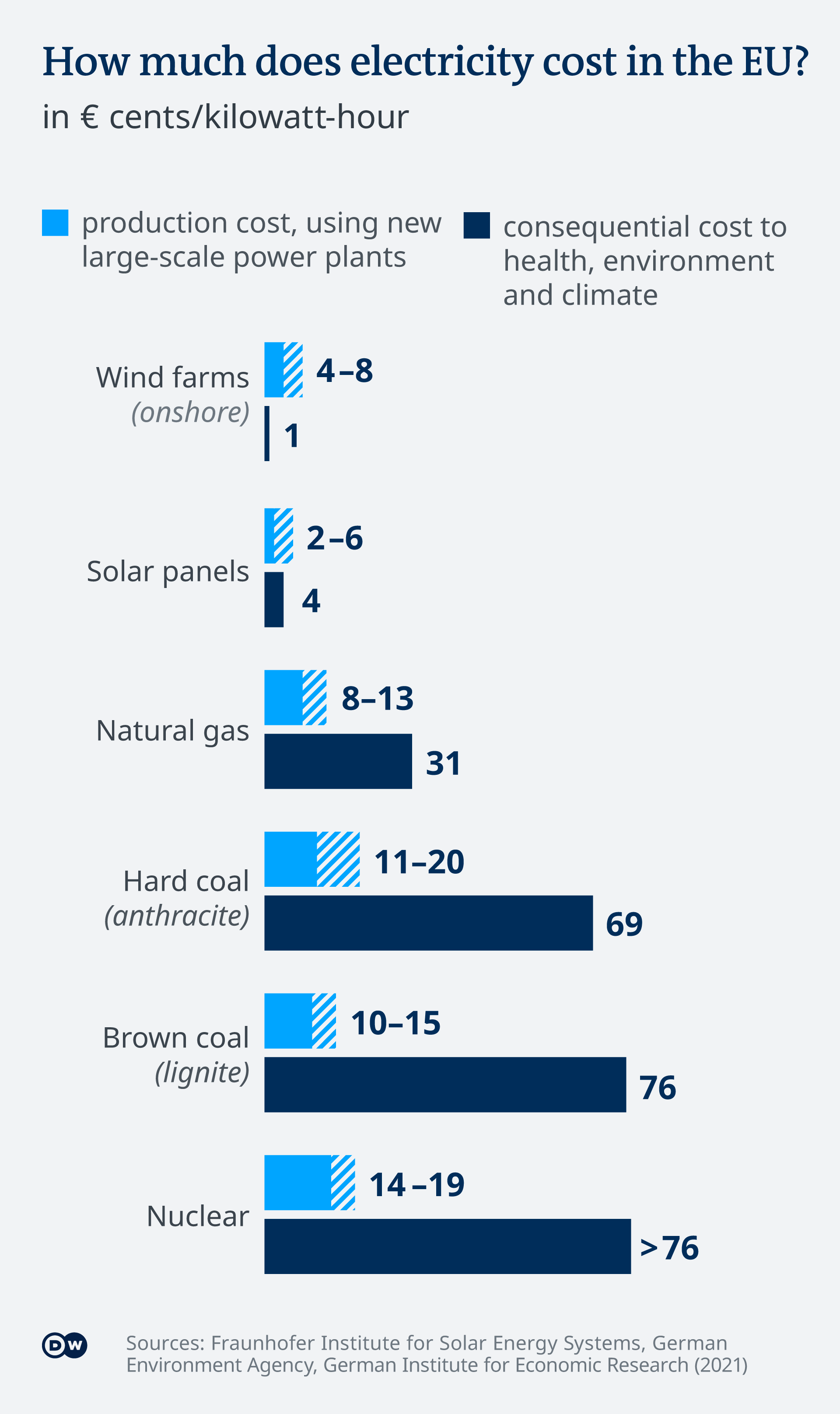

What is sadly missing in energy debates is an analysis of the “total environmental cost” of each way of producing energy. A 2021 report on production and environmental costs of various means of electricity generation in Europe revealed a compelling case to move to wind farms and solar panels to make electricity. This report does not seem to include the vital battery storage costs in its analysis, but another study found the use of solar panels with utility-scale battery storage will have at least 10 times less emissions and air quality impact compared with natural gas or coal for power generation.

Slack Investor tries to do his homework before dipping into his wallet and, during his solar research, I came across a very informative website solarquotes.com.au. Not only can you find great information on solar energy, but they can arrange quotes from 3 local installers. The system is free to the homeowner – I have no affiliation except for the great satisfaction of using their service. Where I live in Victoria, Australia, the governments are encouraging of Solar Panels and offer incentives to install a solar panel system.

Solar Panels now on Roof

The hard part is always deciding on the detail and, after 3 quotes, only one installer actually climbed on our roof and assessed the shading of surrounding obstructions. I decided to reward this initiative and ended up with a

- 7.7 kW system

- 6 kW Inverter

- 22 x 350W panels

- Solar Analytics Smart Monitor and lifetime subscription (Well worth it!)

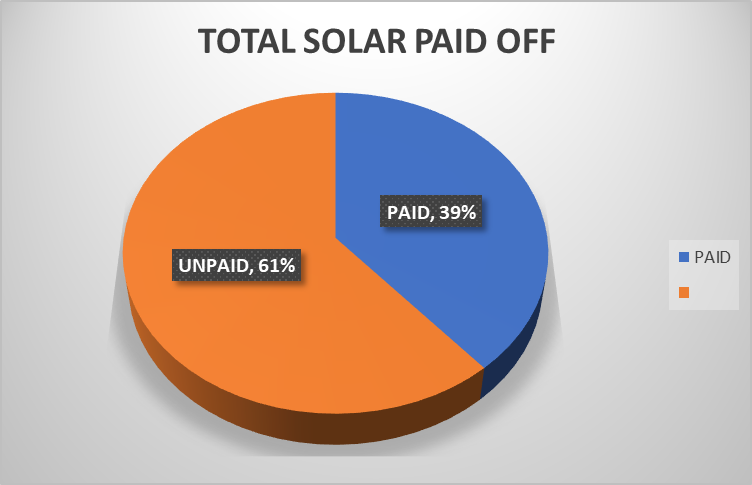

The total cost was $10 906, but with the Australian government $3750 solar credits and the Victorian state government rebate of $1850, out of pocket costs were reduced to $5306

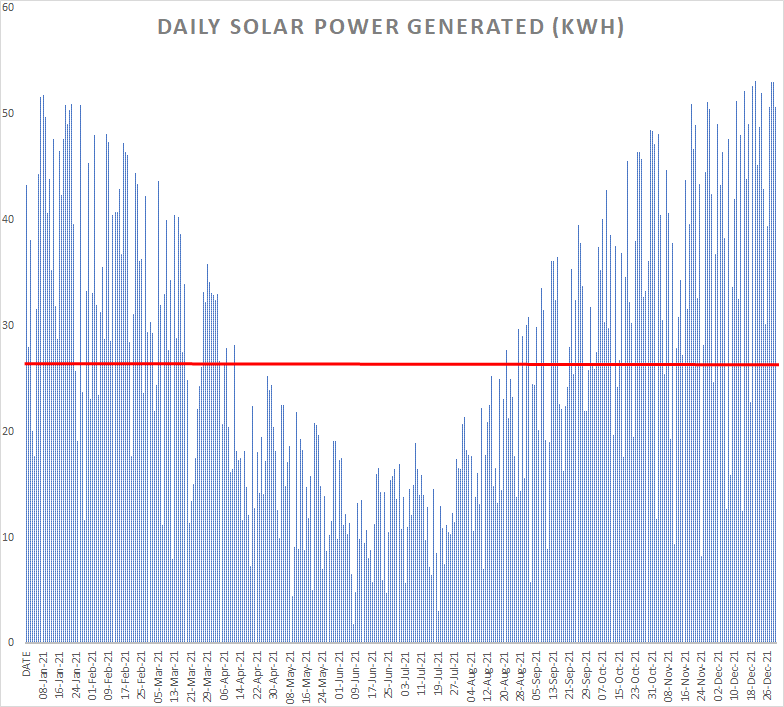

After 18 months, the first revelation to me was the daily variability of solar output of my system due to cloud and rain. The next revelation was the seasonal variability of the output. During winter, the sun is low and relatively weak – Summer is the time of peak production. The third revelation is the economies of using your own power rather than exporting to the grid due to a lower feed in tariff – but that analysis is worthy of a future blog.

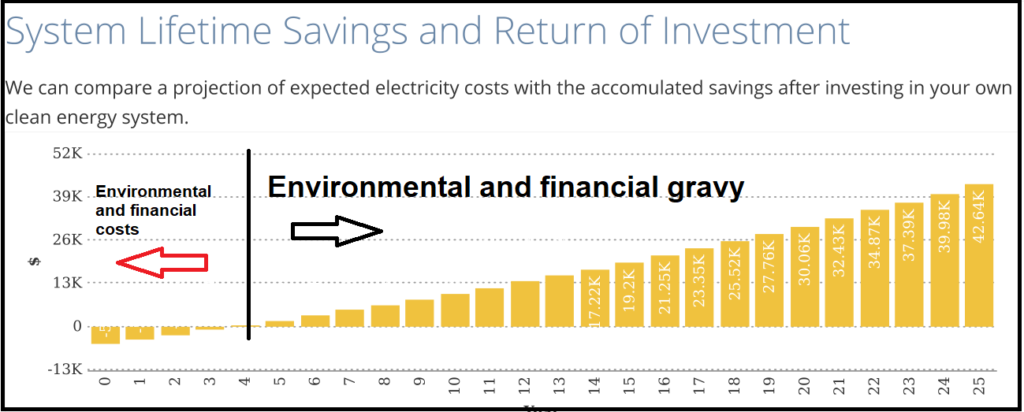

The projections from my installer suggested a return on my investment after 4 years. The first hurdle is to recover the environmental cost of producing the raw metal, silicon and glass of these panels. With the increasing efficiency of solar panels, the environmental pay back period is between 1-2 years. The next hurdle is the financial costs including installer’s fees. My installer projected a break even point after 4 years.

Pleased to report that, after 18 months, everything is going according to expectations. Go Solar … good for planet … good for pocket … Slack Investor happy!