I am hoping that your retirement does not upset as many people as in this James Gillray (1756-1815) painting of “Integrity Retiring From Office”. You can hopefully avoid this by leading a good life and providing yourself with income for this wonderful stage of your life.

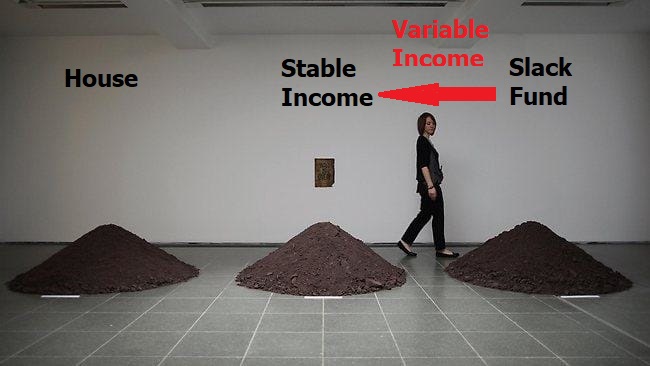

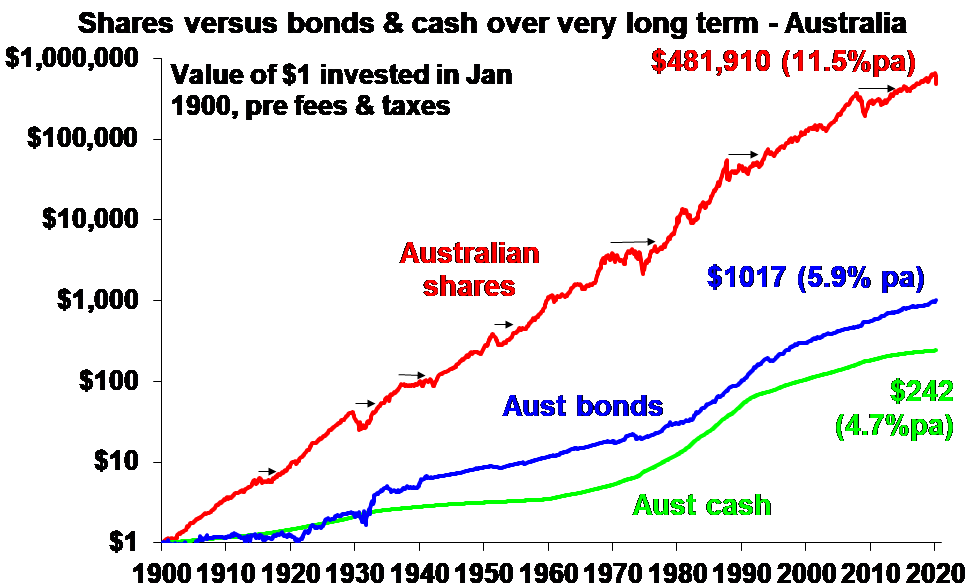

There are lots of ways to do this – Slack Investor likes to separate his non-house assets into a Stable Pile and an Investment Pile in his Self Managed Super Fund (SMSF). Most of the commentary on this website has been about the Investment pile as this is the most exciting – and produces the most gains – and lately, the most losses. My Investment pile is volatile as there is greater risk (and opportunity for growth) in this part of the portfolio.

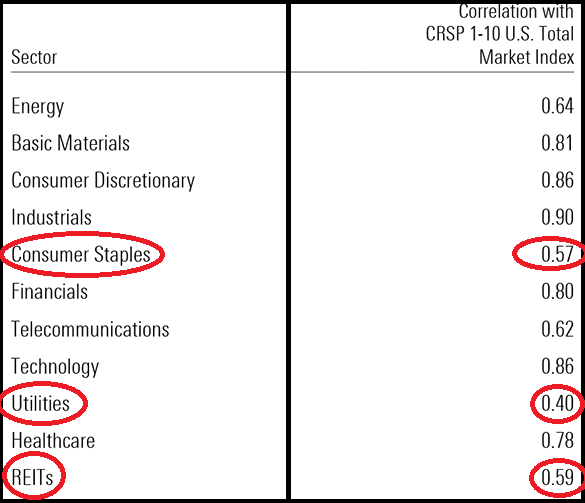

The Stable Pile is mostly to supply me with guaranteed income during the market downturns. Slack Investor’s Stable pile consists of Cash, Term Deposits, An Annuity, Fixed Interest, Real Estate and Bond ETF’s, and some dividend-producing consumer-staple shares.

If the previous financial year has been a good year for investments, my next years annual income requirements can be withdrawn from the investments pile. If you get a bad year for investments, then, I dip into the stable income pile. I try to keep my ratio of Investment Pile to Stable Pile at about 70%:30% and I roughly rebalance at about this time of year (July/August/September).

Using this method, you are always selling from your investments pile when the market is high and buying when the market is low

Slack Investor – A Further look at three pile theory

This method suits Slack Investor, but there are other ways to provide yourself with income in retirement.

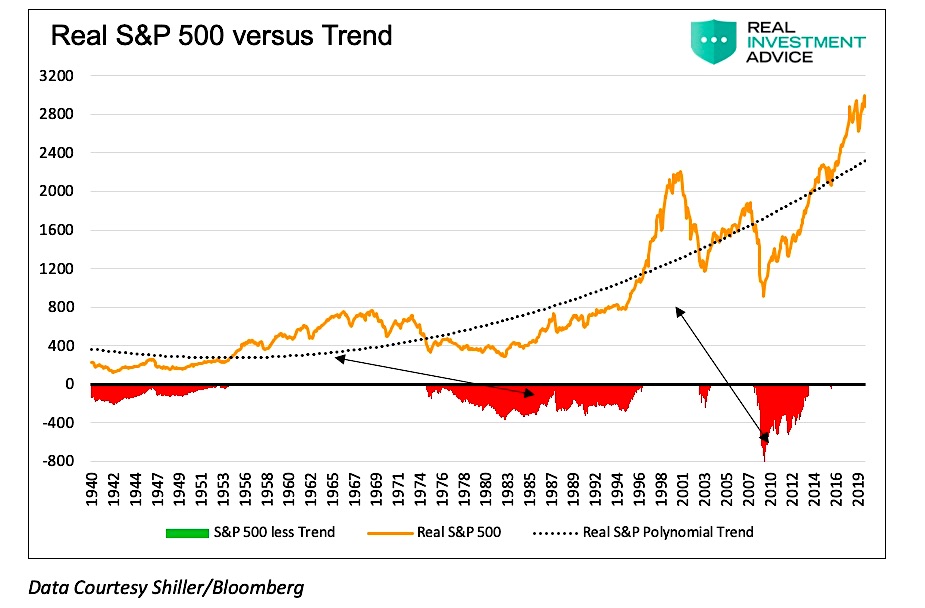

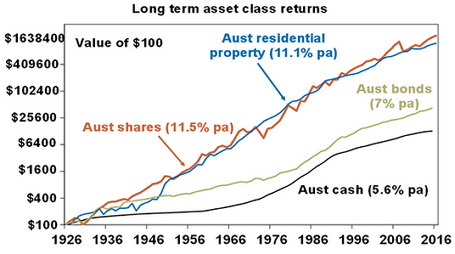

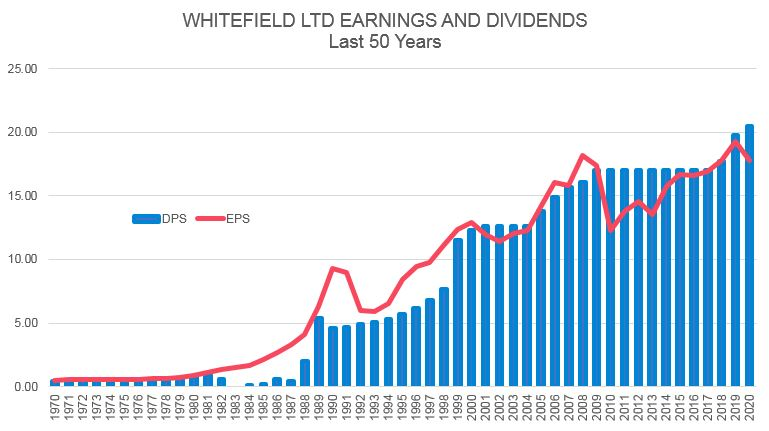

Dividends

The well known Australian investor Peter Thornhill, is a great proponent of using dividends to provide retirement income. His MySay articles are well worth a read. Peter maintains that dividends supply an inflation-protected, income that doesn’t vary as much as stock prices do. He supports this strategy by keeping sufficient cash in his superannuation account to fund the next 3 years minimum pension withdrawals (For the Australian superannuation system) – this helps avoid forced selling. The rest of his fund is in Industrials and Listed Investment Companies (e.g. Argo (ARG), Whitefield (WHF)). He has tested his strategy through market cycles and his strategy has been vindicated through the Covid-19 downturn with even some LIC’s using maintained profits to keep dividends going.

Lifetime Annuity Payments

There are many different types of annuity. Annuities have not been very popular in Australia due to their pricing, relative complexity and inflexibility. Challenger has a few of these products available in Australia with rates at September 2022 for a lifetime inflation-protected annuity of $5104 for a 65-yr-old male for every $100000 invested. There are other options for payments that can be either deferred or market linked. Although you can access these annuities directly through their website, the current model that Challenger prefers is access through a financial advisor.

Retirement Income Stream products

Way back in the Australian 2016/17 government budget, Treasury proposed a series of reforms that included removing barriers to innovation in retirement income stream products. This tinkering was brought about by the realisation that the Australian Super model was mostly fit for purpose in the “accumulation” stage – but was lacking in retirement income stream products that address Longevity Risk – the risk of outliving your savings.

Hopefully, with the benefit of compulsory superannuation, most people would have a pile of superannuation money when they retire – and a desire to turn that pile into income (after paying off any debts). Everybody wants to maintain their standard of living in retirement and would prefer something to invest in that would give them the peace of mind of having a guaranteed income stream for life.

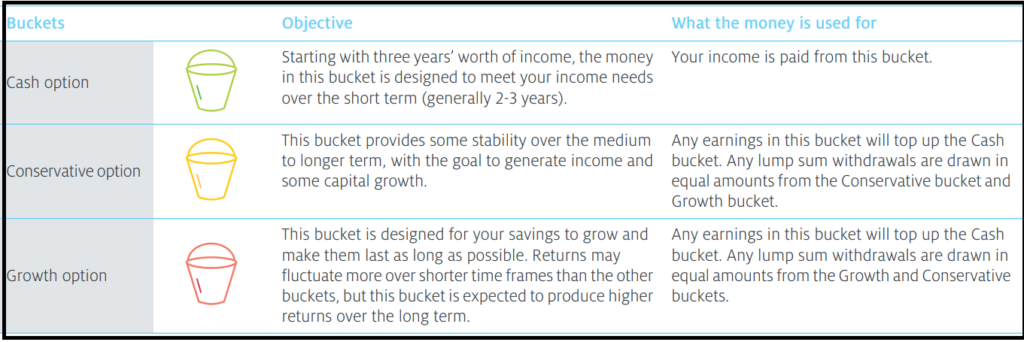

At last some new products are staring to emerge from the super funds. Slack Investor was excited to come across the MyPension income stream from Equipsuper. It is a “set-and-forget” investment strategy that nicely mixes a bit of risk assets (to keep your pension fund growing) with more conservative elements (to maintain a more steady income). This fund uses a similar method to the Slack Investor strategy of using “piles” or “buckets”.

To use the Equip MyPension, you would have to roll your existing super into their fund on retirement. Your super is separated into three distinct investment ‘buckets’. The automatic rebalancing of this product would suit those who want to be a bit more “hands off”.

- Cash – For regular income payments, usually comprised of three years income – about 20% of investment.

- Conservative – Investments in low risk categories including cash and bonds – about 40% of investment.

- Growth – Investments to grow your savings, subject to short term fluctuations – about 40% of investment.

The clever thing is how these buckets work together over time. When investment markets are good, any earnings in the conservative and growth buckets go into the cash bucket, locking in your gains (Automatically). If markets experience a downturn, we’ll leave any buckets that lose value untouched at the end of year, to allow them to recoup losses in future years.

EquipSuper MyPension

Slack investor has just two piles for his retirement – the Stable Income pile (Cash and Conservative) option and an Investments pile- and I do my own annual rebalancing. My investment pile is a bit more aggressive than the EquipSuper offering – more volatile, but Slack Investor likes to meddle and, is developing a “strong stomach”.