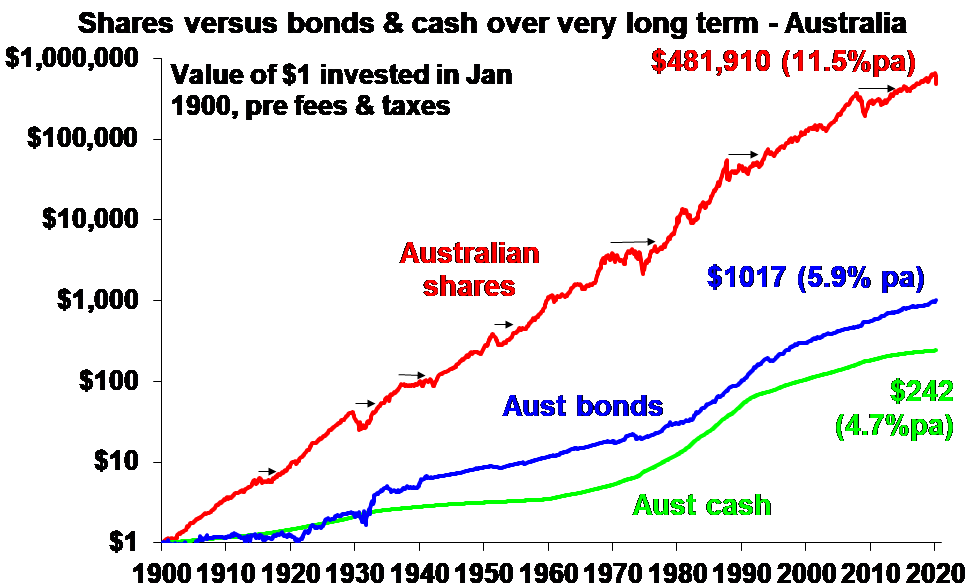

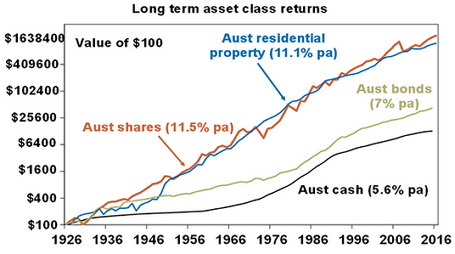

Slack Investor writes a lot about Superannuation because it is a fantastic component to have in your armoury to establish financial independence – in a tax-effective way.

The ultimate aim for Slack Investor is to fund your own retirement, but in reality, according to the Association of Superannuation Funds of Australia (ASFA) estimates, a minority (43% ) of Australians of retirement age would be self-funded by 2023 – this percentage should increase as the compulsory superannuation system matures.

On 31 March 2023, 63% of the population aged 65 and over were receiving the aged pension (full or part), or other government-funded income support.

As so many Australians rely on a mix of both their super and the aged pension for retirement, it is worth revisiting the perverse ways in how superannuation interacts with the pension under the Assets test devised in 2017.

Your own Home

Before we get to this mix, by the time you retire, you do want to have a place to live and be free of landlords. This may sound impossible to some at the moment – but it is a vital part of financial independence. It can be a “tiny home”, an apartment, a place in a regional area …. as long as it is yours!

It is so important to aim to own your own home by the time that you retire – even if it is a 1-br apartment. Admittedly, this is so much harder than it used to be! Looking at the figures below, it is vital to get as large a home deposit as you can to reduce your borrow amount – this should be one of your early financial goals. However, without help, a multi-bedroom home near a capital city now seems near impossible.

If you dont have a deposit, October 2023 data showed that Australians need an income of more than $300,000 a year to buy a median priced home. Household incomes required were considerably less, but still “eye watering”, for outer suburbs and regional cities. e.g. Geelong $243,333, Brisbane $223,333. Apartments are usually less expensive – and require less income to service the home loan.

Things are really bad at the moment for future home owners. It was assessed that for the home market to “affordable” home prices needed to be on average 3.0 times the average median income. Currently, Australia’s housing market has a median multiple of 9.1! I am hoping that future governments will adopt policies that will reduce house prices – But I am not holding my breath.

Super and the Aged Pension

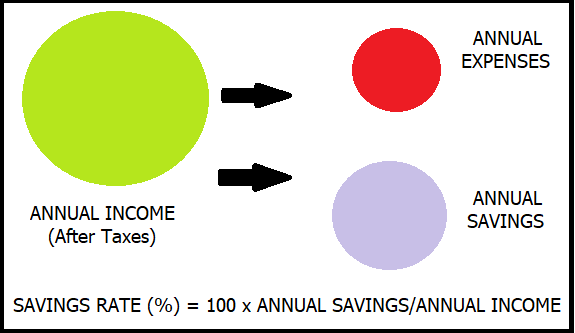

At its most basic level, superannuation is forced retirement savings for all working Australians. A compulsory contribution of 11.5% of your salary (from 1 July 2024) that will compound till your preservation age (between 55 and 60).

According to Treasury projections, about 60% of retirees will have less than $250 000 in super in 2024. This amount of super is not enough to fund a comfortable retirement. $250 000 in pension mode at the official Age 67 drawdown rate of 5% generates only $12 500 income per year. Clearly, many Australians will need to rely on a mix of their super and the aged pension for retirement income. The Aged Pension is available to Australians over 67 – but, it is means tested.

The bare minimum to aim for is the “sweet spot” in the aged pension asset test where your assets are a bit more than the maximum allowed for the full pension. Under current rules (2024), home owning couples can have $451 500 in assets (singles $301 750) and still qualify for the full government aged pension (at age 67).

In 2020, the Alliance for a Fairer Retirement System pointed to a super sweet spot of around $400,000, which can see a pensioner (home-owning) couple “earning $1,000 a month more than a couple with $800,000 in savings.”

Nicola Field (Using data for 2020/21)- Canstar

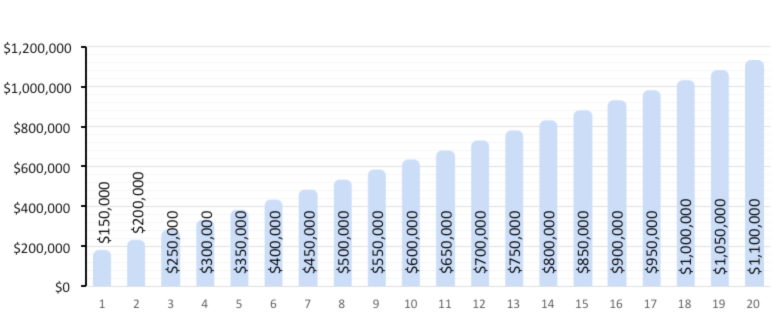

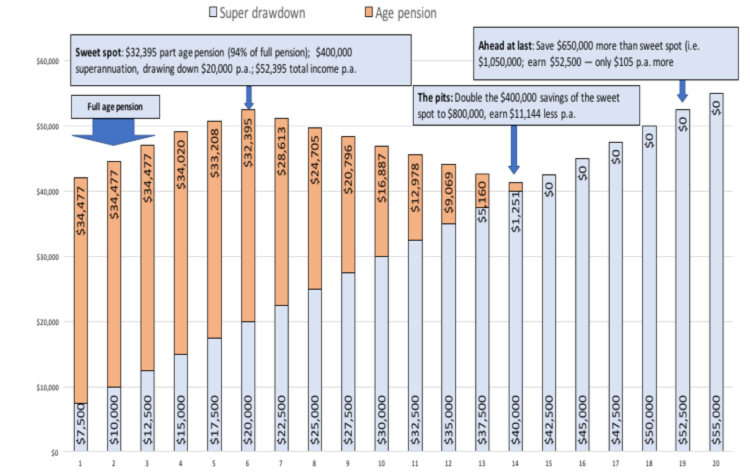

The first chart shows 20 different amounts of superannuation that you might have saved up by the time you are ready to retire – ranging from $150 000 to $1 100 000 above chart – from saveoursuper.org.au.

This next chart is far more interesting, it shows your total income from different amounts of superannuation (shown in the above table) mixed with the aged pension – for a home owning couple. For simplicity, these tables assume your only non-home assets are in super and the aged pension rates were those applicable in 2021 ($34 777 per couple). The essence of the table is still valid.

Bizarrely, there is a point on the total retirement-income (couple) table corresponding to around $400 000 in assets/super where an increased assets/super balance does not lead to an increased total income due to the asset test pension taper rate. Above that point, for those on the part-pension/super mix, the more super you have, your total income actually goes down. This strange anomaly exists for assets/super between $400 000 and $800 000 (2021/2020 data).

Clearly, the current assets test to qualify for the aged pension is unfair and provides a disincentive to save -and should be changed. But, until then, a major retirement goal is to use your super to get your total assets to near the sweet spot before you reach age 67.

(It)is not fair that people who forgo consumption and save more to increase their living standards in retirement and reduce their reliance on an Age Pension should instead get less retirement income. This is the perverse outcome for a large range of savings under the 2017 assets test.

Jack Hammond and Terrence O’Brien – saveoursuper.org.au

How the Assets test works (in real life) for the aged pension (2024 Data)

According to Services Australia, for the aged pension, assets are property or items you or your partner own in full or part – this does not include your home! It does include Financial Investments (Bank accounts, shares, managed funds, annuities, etc), Personal assets (Home contents and vehicles), Superannuation and Real Estate.

I had a recent example of filling in an assets form for a close relative. Her bank statements and investments were easy to quantify. We were advised that personal assets should be valued according to what we could get if we were “keen sellers”. It was suggested to us that, other than vehicles, most peoples personal effects would amount to between $5000 and $10 000. This proved to be near the mark as most furniture and home items end up having to be donated when finalizing a deceased estate.

For the table below, the aged pension and asset limits are current values* and correct at February 2024. Using 2024 data, the “sweet spot” for assets is now near $451 500 for couples ($301 750 for singles). If you had $250 000 in super, and your “other assets” added up $60 000 (Car $13 000, Bank Ac’ts/Shares/Funds $35 000, Home Contents $12 000). Your Total assets would be $310 000.

For a couple with similar “other assets” and a combined super of $400 000, your total assets would be $460 000.

| Situation | Asset Limit | Other Assets* | Super | Drawdown from Super @ 5% | Age Pension | Total Income |

| Single Home-owner | $301 750 | $60 000 | $250 000 | $12 500 | $28 514 | $41 014 |

| Couple Home-owner (Combined) | $451 500 | $60 000 | $400 000 | $20 000 | $42 988 | $62 988 |

Using this mix of super and the pension, when reaching the pension qualifying age , a modest to comfortable retirement is possible under current rules when you own your own home. Also, under the Work Bonus Rules, singles can earn up to $5304 (Couples $9360) in a part-time job without affecting their aged pension.

| Comfortable lifestyle (p. a.) | Modest lifestyle (p. a.) |

|---|---|

| Couple $71,723 | Couple $46,620 |

| Single $50981 | Single $32,417 |

February 2024 – End of Month Update

Slack Investor is IN for Australian index shares, the US Index S&P 500 and the FTSE 100.

Little movement this month for the ASX200 (+0.2%) – but, it is testing new all-time highs. Nothing happening with the FTSE 100 (0.0%) at the moment.

The S&P 500 (+5.2) and the NASDAQ 100 are hitting new record highs and Slack Investor is pleased to go with the momentum but remains nervous for these markets.

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index).