“… the farm had grown richer without making the animals themselves any richer — except, of course, for the pigs and the dogs.”

George Orwell – Animal farm (1945)

There is a bit of an animal theme in this post as Slack Investor pays tribute to George Orwell and his book Animal Farm. The “pigs and the dogs” have all the power in Orwell’s allegorical tale – and, with Australian’s paying $31 billion annually in super fees, there are plenty in the superannuation fund industry that are getting richer like the “pigs and the dogs”.

In common with most of the school essays that I wrote … after an interesting start, things start to fall apart … and I can’t stretch this narrative too much further. In Animal Farm, two of the leading pigs inspired the other animals to revolt against the humans … and, I cant see any of the retail super fund executives (who are benefiting from the status quo) getting us to demand lower fees – So it is up to us … Come on other animals … Let’s break out of our “profound disengagement” with our retirement savings and … Let’s revolt against these fees!

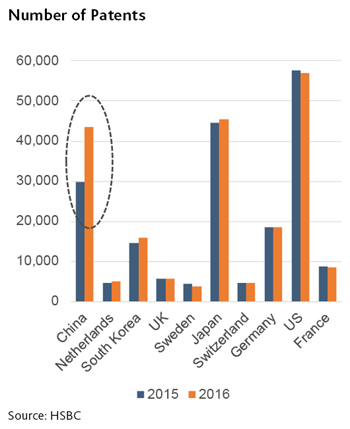

A good start would be to avoid most of the large institution owned retail funds (big banks, Macquarie, AMP) which creamed $12 Billion in super fund fees during 2016. While they were doing this, they delivered returns of 2 per cent less (pa) when compared to Industry super funds over 10 years. This under-performance, if continued, could cost $200,000 in retirement savings over a working lifetime.

So stand tall on your hindquarters all you downtrodden animals and firstly check where your current employer-paid super payments are going.

With few exceptions, you have a legal right to choose where your employer pays your superannuation contributions. If you formally notify your employer of your preferred fund, they must direct their employer contributions into the superannuation account of your choosing.

From Goodsuper.com.au

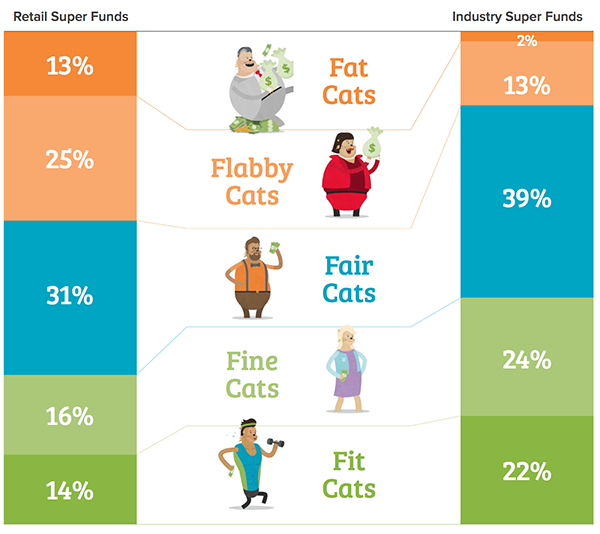

A recent survey by Stockspot “Fat Cats Fund Report 2017” looked at 4,102 Australian funds, sorted them into categories from Conservative to Aggressive then filtered them for relatively poor performance after fees over 1, 3 and 5-years. Stockspot calls these poor performers “Fat Cat” Funds.

At the other end of the scale, there are the “Fit Cats” with relative outperformance – these are the ones that you want! Stockspot found that fees were really important when measuring performance – if you are in a fund charging more than 1.5% per year, it is at high risk of becoming a Fat Cat Fund – to check how your fund rates according to Stockspot, go to this link.

So, as banged on about in a previous post, Industry funds generally have lower fees but Stockspot recommends looking further into the relative performance of each industry fund (after fees) over a period of at least 5 years as there is considerable variation in performance.

To flog a dead horse ( You will have to read Animal Farm to really get this pun … Sorry Boxer, Vale!) … and with apologies to George Orwell again …

Not all industry super funds are equal … some are more equal than others