Everyone has heard about Albert Einstein – The theoretical physicist that came up with the famous relationship between Mass and Energy ( E = Mc2 – where c is the speed of light in metres per second). He also came up with ground breaking work in relativity and quantum mechanics. As a student of physics in my younger days, Slack Investor was in awe of this wild-haired genius but, even understanding the very basic concepts of general and special relativity at university … just made my head hurt.

“There are only two ways to live your life. One is as though nothing is a miracle. The other is as though everything is a miracle.”

Albert Einstein

Einstein had a brilliant mind, the 1921 Nobel prize winner was instrumental in developing new ways of looking at energy, time, space and gravity. He often would construct a “thought experiment” to help him visualise the difficult concepts that he was tackling. I will try to explain one of his many thought experiments

Einstein’s elevator thought experiment

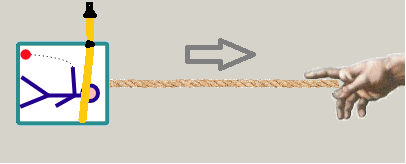

The first part of Einstein’s elevator thought experiment is the “equivalence principle” – where Einstein concludes that there is no difference between gravity and acceleration.

To an observer in an elevator drifting along in space experiencing weightlessness. If some “being” attached a rope to the elevator and then started pulling it along with the same acceleration force that gravity provides (9.8 m/s per second), the experience of someone inside the elevator would be exactly the same as if he was in Earth’s gravitational field — they are the same thing to the elevator man.

Because of this acceleration, if a light beam entered one side while the elevator is moving, the beam would appear to drop or curve down as it crossed the elevator. Einstein postulated that light would behave in the same way if the elevator was in a gravitational field. He concluded that gravity could ‘bend’ light.

This prediction was tested by Arthur Eddington in 1919 who devised a very clever experiment during an eclipse that demonstrated a shift in locations of distant stars when recorded during the day (when light would have to move past the sun’s gravitational field) compared with night time measurements.

Einstein proposed an extension of this concept with the introduction of the idea of “black holes” in 1916. These strange dense objects have a gravity that is so strong, even light cannot escape their clutches. Black holes remained as theoretical objects for decades – the first physical black hole was not discovered until 1971.

Slack Investor volatility thought experiment

In these tough times where Slack Investor is currently getting a bit of a whack in his share portfolio, he has adapted a thought experiment on coping with volatility.

I go to the end of my driveway and construct a big sign for all the passersby. It says “Shout out how much you would pay for my house”

In this thought experiment, I imagine I am also sitting out the front in a chair and listen to the informed offers as people go past. There would be a great variance in the offers and whenever an offer is heard below what I thought it was worth, I would wince a little. After a while I would just get sick of it and tear down the sign and go back inside my house – completely satisfied that most of these people had got it wrong … and I am happy with my house – it represents a value to me that is higher than nearly all of those shouted offers.

This is exactly how I try to think my share portfolio in troubled times. I own mostly good companies with good management that are projected to increase earnings. Earnings are critical. People can shout out whatever they want about what they will pay for my small percentage of these companies. While their earnings story is basically intact, I will hang on to them.

“It is not that I’m so smart. But I stay with the questions much longer.”

Albert Einstein