The ruthless faces of the tax collectors depicted by Marinus Van Reymerswale do not ring true to Slack investor. These days, tax and fee collectors sit smugly behind desks as the fees and taxes roll in. Don’t get me wrong, Slack Investor is pleased to pay his fair share of tax … but excess fees for investing, that’s another story.

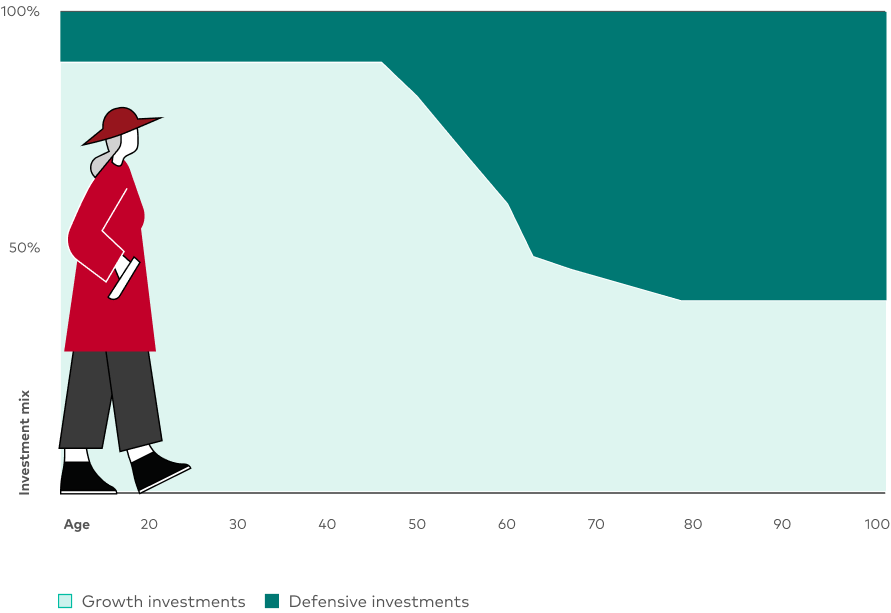

Most people have money in a super fund during their working life – this is normally known as an Accumulation Fund. When they retire, and the money can be released, they rely on this saved money to pay of debt – or fund their retirement. It is usual practice that you ask whoever runs your super fund when it is accumulating to also run your retirement fund – that pays you a pension at regular intervals.

For a fee, the super funds take care of the “back end” of this retirement fund – where your money is invested and all the administration for the fund. The Super provider sets up a new account within your super called an Account Based Pension (ABP). There is a great advantage in doing this as all earnings from from money transferred to this pension part of the fund are tax free if you are over 60. At 60, Slack Investor converted all of his accumulation funds into an Account Based Pension.

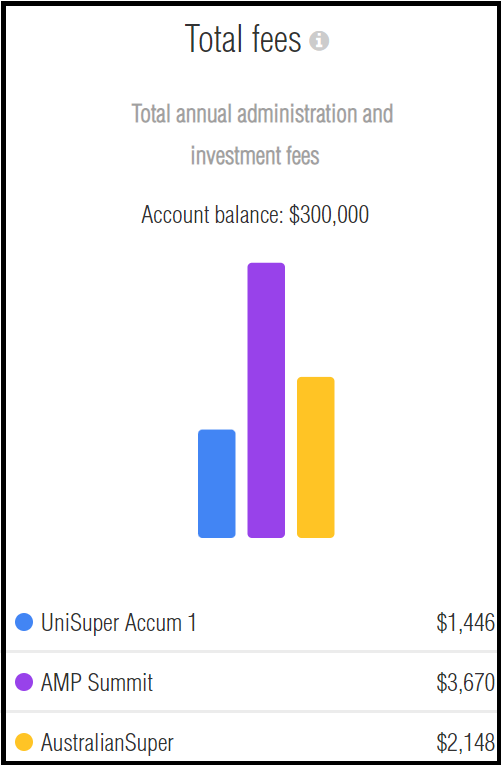

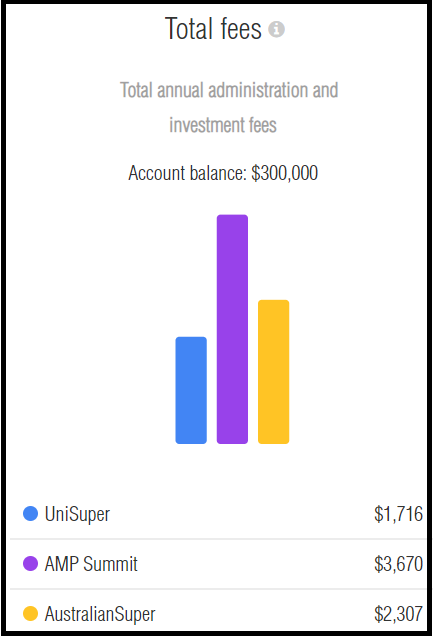

Naturally, Slack Investor is all for minimising these fees. Lets have a look at some of my favourite industry funds (Low cost high/performance) – Australian Super, Hostplus, UniSuper, and HESTA. Using the Chant West AppleCheck online tool available through the Australian Super site we can compare what they charge for running an accounts based pension.

For comparison, I invested our hypothetical ABP in the “conservative growth” option (21-40% shares) on all funds. This is usually the least risky of pre-mixed types of investments – and might be favoured by retirees. There are more other pre-mixed options that have better long-term performance – but these other options have more volatility. I have shown below the fees on a $550K account comprising of a $500 000 Account Based Pension together with a smaller $50 000 Accumulation account that you might have still running for any extra contributions.

| FUND | 10-yr Perf (%) | 5-yr Perf (%) | Fees 500K Pension | Fees 50K Accum. | TOT Fees 550K |

|---|---|---|---|---|---|

| Australian Super | 5.1 | 3.5 | 2602 | 322 | $2924 |

| HostPlus | 4.7 | 2.9 | 3043 | 404 | $3447 |

| UniSuper | 4.8 | 3.5 | 2696 | 356 | $3052 |

| HESTA | 5.4 | 4.3 | 3152 | 362 | $3514 |

The more you have … the more they charge.

Looking at just the cheapest of the above Industry Super providers, Australian Super with a pension account of $500K, $1m, and the current maximum amount for an accounts based pension $1.9m – again using the Chant West AppleCheck online tool.

| Australian Super | Fees – Pension | Fees 50K Accum. | TOT Fees |

|---|---|---|---|

| $500K Pension Fund | 2602 | 322 | $2924 |

| $1m Pension Fund | 4802 | 322 | $5124 |

| $1.9m Pension Fund | 8762 | 322 | $9084 |

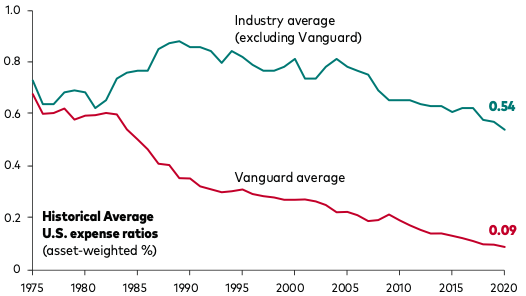

You could argue that these fees are reasonable, at around 0.5% of your invested funds, as there are inherent costs in investing and responsibly administrating these large amounts of money. Take the time to check what fees you are paying on your Super fund – and compare with a low cost/high performance fund using the AppleCheck tool – it might be time to switch funds!

Comparing Retirement fees with SMSF funds

Slack Investor is a great fan of the Self Managed Super Fund (SMSF) but recognizes that it is not for everyone – you must really be prepared to put a lot time and thought into the SMSF for it to be successful. To save on costs, rather than divesting responsibility to an accountant, Slack Investor uses a low-cost (no advice) provider and takes on a lot of the administration duties and investment responsibilities himself.

Unlike the Industry funds sliding scale for fees, a significant advantage in SMSF funds is that the costs are fixed – no matter what amount you have. For the 2023 financial year, Slack Investor’s costs through his provider eSuperfund were.

| Task | Amount |

|---|---|

| Admin and Audit Costs (eSuperfund) | $1,330 |

| Brokerage (10 trades) | $300 |

| ETF Fees | $2,300 |

| Time (50h@$50) | $2,500 |

| TOTAL | $3,930 |

In the above example of annual fees, I have tried to include a charge for my own time at a nominal 50 hours at $50 per hour. On average, a hour per week. Most weeks I wouldn’t spend any time on my SMSF but, around tax time, and when making decisions about buying or selling, pensions, or contributions, I would spend a few hours thinking or researching. Annually, 50 hours is a fair approximation. I would gladly perform these tasks for free as finance is an interest and a hobby, but I’ve included them above to make a proper comparison – as not everyone is a Slack Investor.

Running an SMSF, because of their fixed costs makes more sense with a large super fund (>$500K). However, at the core of any successful self-managed fund (SMSF) is the amount of time and effort that the trustees (you, and other members of the fund) are willing to put into it.

Given the all the above data, it could be better, but the amount of fees that a good industry fund charges to run your pension seem reasonable at around 0.5% of funds under management. Slack Investor hopes that competition and transparency should gradually lower these fees.

September 2023 – End of Month Update

Slack Investor remains IN far all followed markets. The ASX 200 (-3.5%) and the S&P 500 (-4.9%) have had a poor month. However, the FTSE 100 is emerging from the doldrums with a positive month (+2.3%).

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index). The quarterly updates to the Slack Portfolio have also been completed.