Vienna and its art institutions are among the casualties of this new wave of prudishness – with nude statues and famous artworks blacklisted under social media guidelines, and repeat offenders even finding their accounts temporarily suspended. That’s why we decided to put the capital’s world-famous “explicit” artworks on OnlyFans

From the Vienna Board of Tourism

But I digress, the figure (above) representing the Inn River is depicted asking the Danube River for some leniency on her home loan rate – This conversation is something I highly recommend to all with a mortgage.

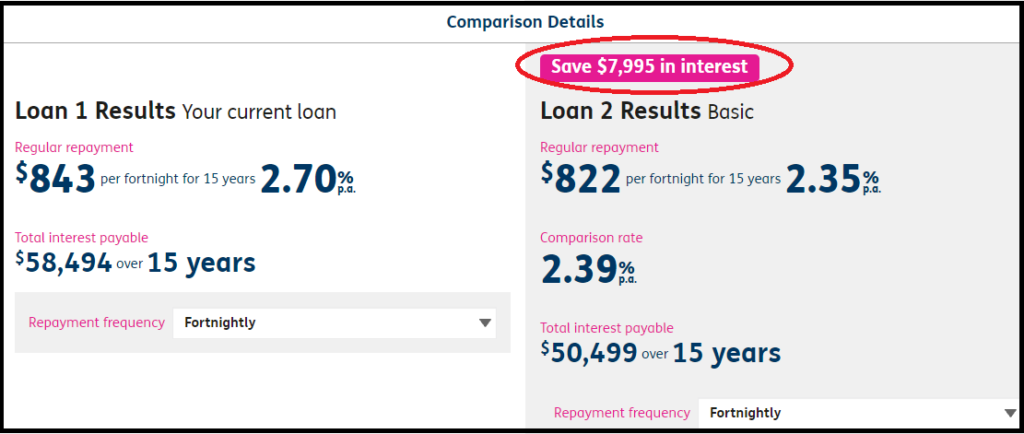

Not for the first time, I did a bit of a review of Slack outgoings this month. Starting with the large fruit first, loans and insurances. We have a small loan remaining on our house because I have used the home equity to buy some shares in the past. We could pay the loan off by selling the investments but, while home loan interest rates are low ( 2-3%), I am happy to keep this money in shares and hopefully gain a return more than my interest costs.

I noticed that the rate my bank charges me on my loan (2.7%) is higher than that offered to new customers (2.35%). A quick internet search revealed a few loan operators offering loans close to the 2% mark. An informed phone call to Bank Australia provided a quick revision of my rates downwards. Confirming that loyalty is only rewarded – when you nag the institution.

Regardless, I am happy with the saving of $8000 for the life of the loan that this phone call achieved. Those with higher loan balances should be rewarded more significantly for a painless phone call to your lender.

New Fintech loans

Beyond the traditional banks there is an emerging FinTech solution to loans. There are too many to mention but they all seem to be willing to lend you money for all sorts of reasons. In a further erosion of “old banks” business, Slack Investor was shocked to count over a hundred of these new enterprises. Each with their own “catchy – but cool” names. I would be very wary about investing any Slack funds in these new businesses as there seems to be a lot of competition in this space.

However, taking money from them … where they are assuming all the risk – and offering very competitive rates – sign me up! Providing, of course, that I know all of the conditions of the loan contract up front.

There are a number of new home loan providers Yard, Athena, Nano , Bluestone, Well, etc. Each are offering products at about the 1.99% rate for home loans with a high amount of equity. In the event of of a loan provider collapse, they offer the assurance that another loan provider will takeover the loan under the same conditions that you originally signed.

Athena Home Loans

There a range of home loan providers that are offering no-fee loans at around the 1.99% comparison rate. I have no affiliation with Athena. The only reason that I am focusing on Athena rather than the other excellent home loan providers is that I like their sustainable philosophy of trying to obtain their funds from super funds who need the stability of a fixed income for a portion of their portfolios. It is also a good marketing link to a lot of people. They also have a reputation of quickly passing on any reserve bank interest rate cuts.

We’re working on providing industry super funds a way to access the Australian mortgage market directly and aim to be the first in Australia to do it!

From Athena

I am happy to go through the loan application process with Athena. They have streamlined applications so that it is mostly online. Their 1.99% rate will give me a further saving of around $8000 in total interest payments on my current loan. However, I note that I will incur discharge fees on my current loan of about $370. This does not trouble me as I would have eventually incurred these discharge fees when I fully pay off my home loan – and the further joy of the Athena loan is – No application fees. No ongoing fees. No discharge fees.

October 2021 – End of Month Update

Slack Investor remains IN for Australian index shares, the US Index S&P 500 and the FTSE 100.

The Australian market remained flat -0.1%. Overseas markets seem on the move with the FTSE 100 up 2.1% and the S&P 500 rising an incredible 6.9%. The optimistic Americans seem impressed with a swathe of good earnings reports and have had the best monthly return this year. Slack Investor remains watchful with stop losses in place.

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index).