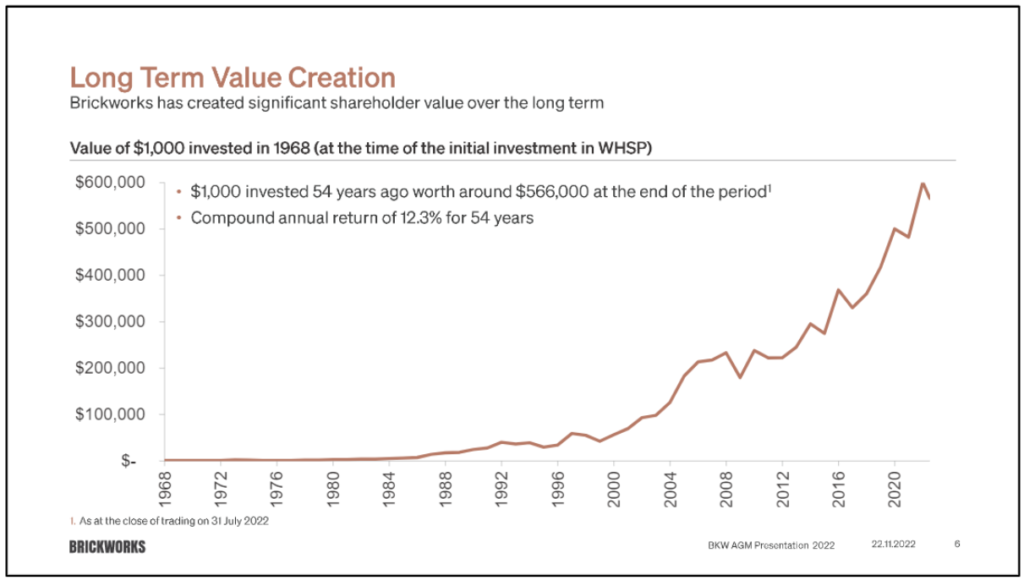

Slack Investor is always on the lookout for new investments … and nothing attracts the jaundiced Slack Eye more quickly than continuous long term results.

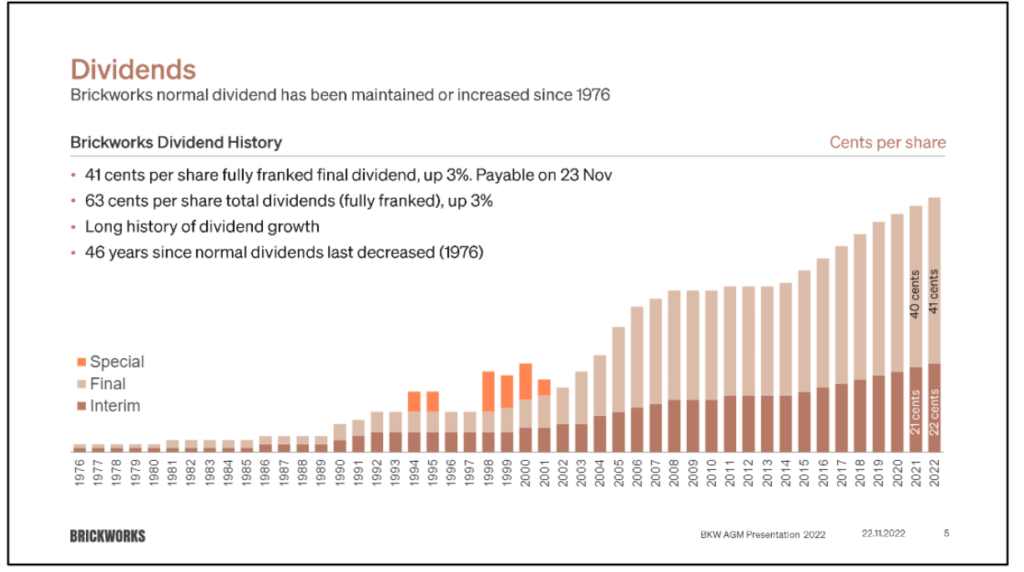

Brickworks Ltd (BKW:ASX) have just had their AGM presentation. I was very impressed by the claim that they have maintained, or increased, normal dividends for the last 46 years!

As well as being a very good maker of bricks, Brickworks operates as an investment company and own a 26.1% stake of the diversified investing house Washington H. Soul Pattinson (SOL:ASX). SOL, in turn have holdings in

- TPG Telecom – Australian telecommunications provider

- Brickworks Limited – Clay and concrete production for the construction industry

- New Hope Group – Coal and oil mining and energy generation

- Tuas Limited – Telecommunications provider

- Apex Healthcare Berhard – Malaysia-based pharmaceutical production

- Pengana Capital Group Limited – Fund management

- Aeris Resources – Mining and exploration activities

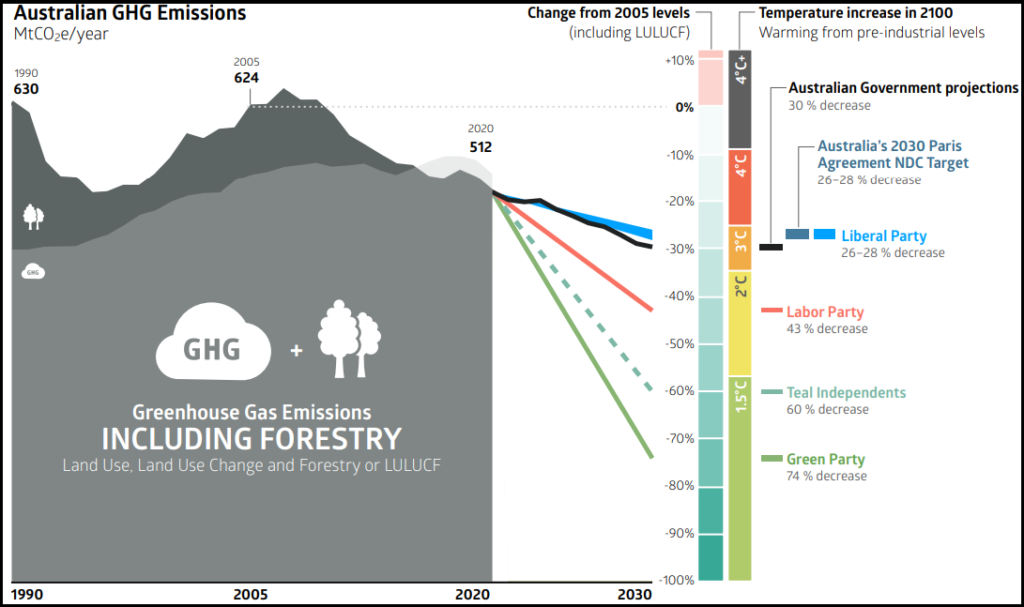

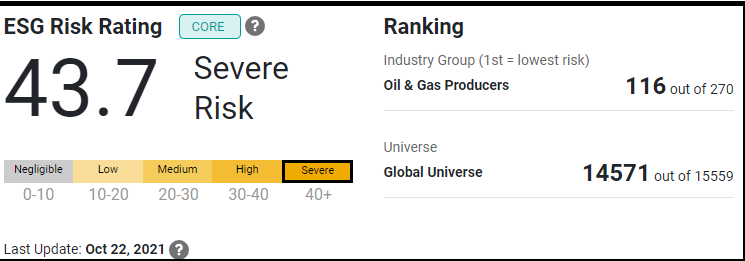

Now Slack Investor does not want to get all preachy here, as as everyone has to draw their own line in the sand – These things are very subjective. I looked up New Hope Mining on the excellent Morningstar Sustainalytics site to get an idea on how well the company is ranked in terms of Environment Sustainability and Governance (ESG).

New Hope Group ranked 14571 out of 15559 in terms of ESG risk rating – on a worldwide basis. I personally would feel uncomfortable being a part owner of a thermal coal miner given the current state of the planet.

So despite the most excellent management and performance of BWK, while they still own an interest in the New Hope Group, I will look elsewhere for investments.

Puff Puff MOAT

On the subject of digging deep, I have been a long term holder of the VanEck Morningstar Wide Moat ETF (MOAT:ASX). Slack investor has many vices – Wine and beer just being just two of them … so again, I won’t lecture – as these things are very personal. However, some of the sins that my mother rubbed into me as being “particularly evil” are smoking and gambling. I will do my best to avoid ownership of these type of stocks in deference to my dear Mum.

I noticed back in 2021 that this MOAT ETF had Phillip Morris International as one of its top 10 holdings. According to the Yahoo Finance site – Phillip Morris is 2.5% of the MOAT holdings! Owning a part of a multinational tobacco company that is a leading part of Big Tobacco didn’t really sit well with Slack Investor.

According to the Global Burden of Disease Study, in 2015 alone, smoking caused more than one in ten deaths worldwide and killed more than 6 million people, resulting in a global loss of nearly 150 million disability-adjusted life-years

The Lancet

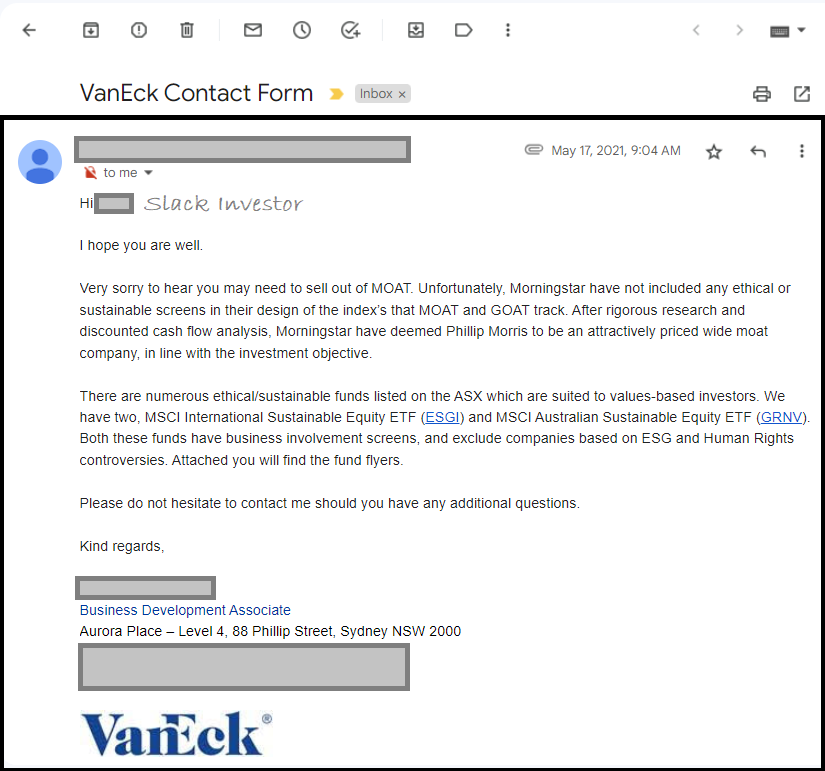

Slack Investor marked MOAT as an ETF to get rid of, despite liking the concept of its construction – “companies with sustainable competitive advantages”. I had a feeble attempt at shareholder activism and emailed VanEck about this … and enquired whether thy might screen the MOAT ETF with an ethical filter … to get rid of tobacco and gambling stocks – they replied with a polite “no”.

I finally got around to attempt to sell MOAT this month and I thought I should just check the VanEck holdings MOAT site and look at their complete holdings list. Lo and behold … at 29/12/2022, Phillip Morris has now gone from their holdings list! So, for now, MOAT is a keeper!

If at a loose end during the holidays and need a distraction, Slack Investor highly recommends the free exhibition “Streets of Your Town” at the Ballarat Art Gallery, VIC. Bren Luke is an amazing artist, his exhibition runs till 5th Feb 2023.

December 2022 – End of Month Update

The year closes and, I’m not sure if Slack Investor was naughty (probably?)… but, there was no “Santa Rally” this month. All followed markets took a dive in December. The ASX 200 down 3.4%, the FTSE 100 down 1.6%, and the S&P 500 down 5.9%,

Due to the return of all followed share markets to more normal valuations, I have returned my stop-loss upper-limits to 15%. This means that when I work out my stop loss value, I add another 15% to it, this is my upper limit. If the stock price exceeds the upper limit, I will adjust my stop loss upwards. This method helps to lock in some gains if they occur.

Slack Investor remains IN for the FTSE 100, the ASX 200, and the US Index S&P 500.

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index). The quarterly updates to the Slack Portfolio have also been completed.