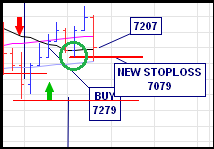

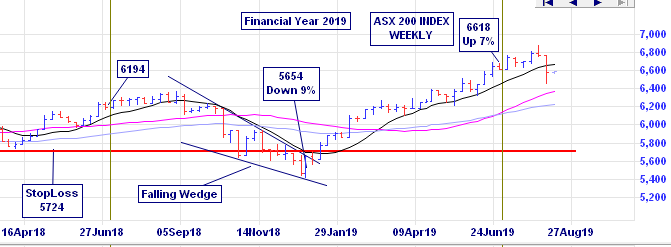

Slack Investor remains IN for Australian index shares, the US Index S&P 500 and the FTSE 100. The Slack Investor followed overseas markets have had a bit of a recovery this month ( ASX 200 +1.3%; FTSE100 +2.8%; S&P500 +1.7%).

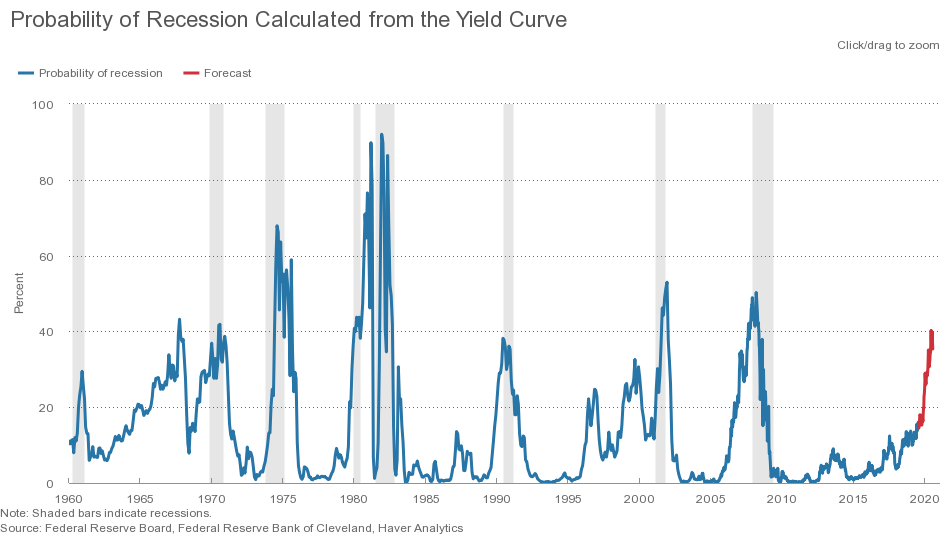

The Federal Reserve bank of Cleveland have the probability of recession within the next year at 37.9%. This exceeds the Slack Investor threshold of 20% and my monthly stop losses for Index funds are definitely “switched ON”

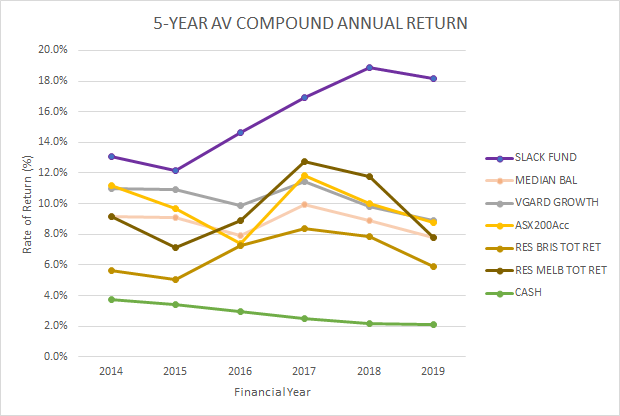

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index). As it is the end of the quarter, the Slack Portfolio has been updated with some readjustment of the portfolio and a solid whack of cash (5.1%).

Trim the Sails … things might get rough

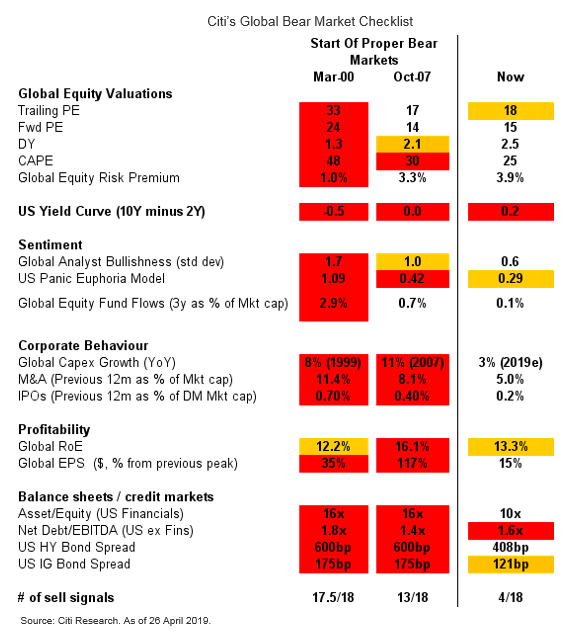

The economists at the Cleveland Fed are rating the chances of recession as significant. This is enough for Slack Investor to do a little portfolio trimming and try to dampen the effect on my capital if a recession does happen. I am a long way from going “all the way” and converting my entire share portfolio to cash-like products – though some pundits already have. There are a few reasons for this Slack approach

- I am not a very good predictor of exactly when things might go bad

- The returns for the safety of cash are not good at the moment, under 2%

- I have a buffer of cash income that will help me weather through any economic downturn without having to sell any stocks at downtrodden prices – Those without a cash buffer or subject to sequencing risk should take a more prudent approach than Slack Investor.

- Most of my stocks are producing reasonable dividends

Sequencing risk peaks in the seven or so years before and after retirement. Investors at this stage have a higher retirement balance and typically more of it invested in shares, meaning they have more to lose if sharemarkets tumble …

From an AFR article by Tony Featherstone

Sequencing risk refers to the possibility that a retiree that depends on his savings for income may have his capital (and future income) greatly reduced by a sequence of poor returning years (such as a recession!). The retiree would be in danger of having to draw down on capital at depressed prices.

A solution for retirees to the problem of sequencing risk is to set aside 2-3 years of income in cash assets that can be used for income while the underlying assets are waiting to recover. This strategy avoids a “fire sale of assets” during a recession.

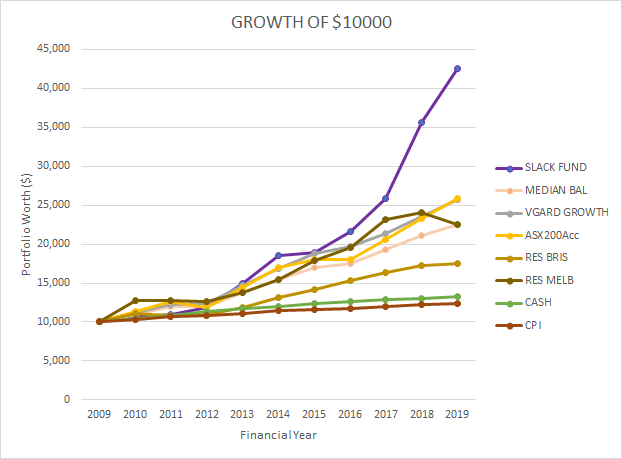

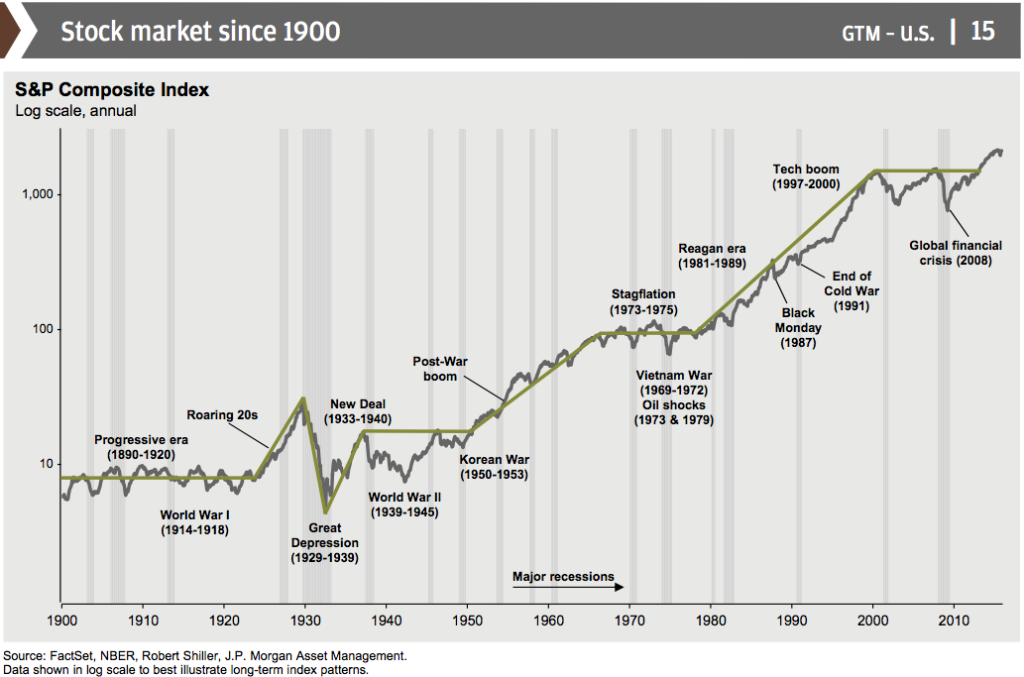

Those younger folk still in the accumulation stage can hope that any future economic downturn does not affect the employment market too much – Jobs and income are a key to survival in tough times. As far as investments are concerned, the effects of a recession are only temporary and things will recover (see chart below). Downturns are a good time to start buying if you have any spare funds.

I am happy with my minimal trim approach as I generally invest in solid money earning companies that may suffer in earnings during a recession … but wont go broke and disappear.

For stock owners, recessions and economic downturns are only bad if you have to sell your stock before the inevitable recovery. In these trying times I am often comforted by long term share charts. Please note that any downturn is always followed by a recovery- though in some cases, it may take a few years.

My Slack trimming strategy has several components

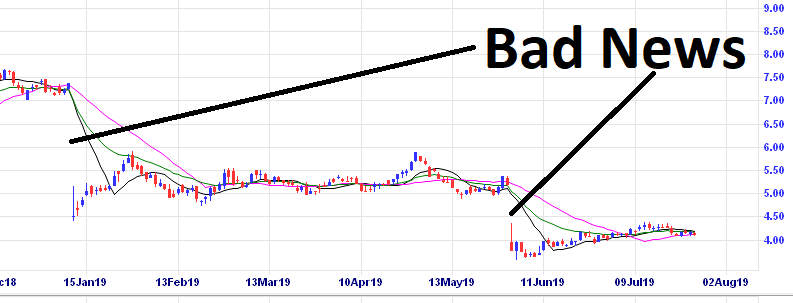

- Sell some of my stocks that have increased in price and now have extremely high PE Ratios – Although some, like Altium, are hard to let go. They are “old friends” and I am very sentimental to consistent company performance over many years.

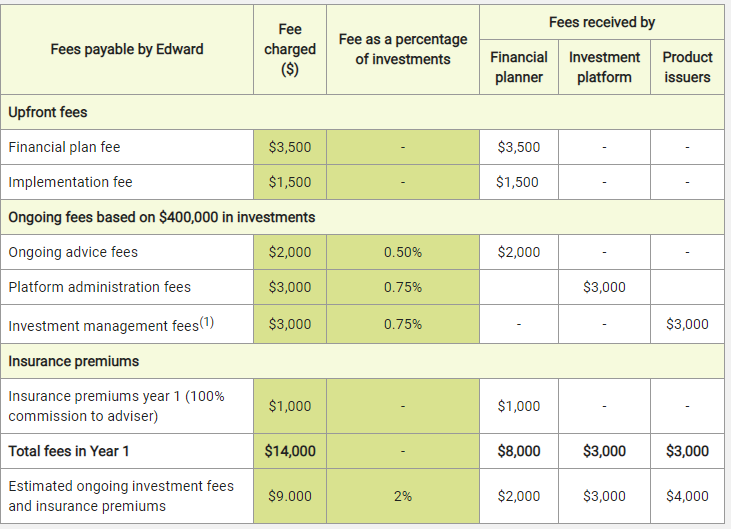

- Increase the weighting of my portfolio towards cash or bonds or fixed interest.

- Try to be invested in companies may not suffer too much during an economic downturn i.e. Healthcare, Essential products.

- Re-focus on dividends – the dividends might reduce a little in a downturn but the income is important. Dividends have in the past been much less volatile than share prices.

I have not changed the core of my portfolio, just fiddled around with 20% of it. Some more detail on the portfolio trimming in the next post.