Slack Investor remains IN for Australian index shares, the US Index S&P 500 and the FTSE 100. The Slack Investor followed overseas markets are all in positive territory this month ( ASX 200 +2.9%; FTSE100 +2.2%; S&P500 +1.3%). All markets are still “exuberent”. However, checking out the US Yield Curve indicator at GuruFocus , the indicator again shows a weak positive result (Near zero, Just … +0.09%) so my monthly stop losses for Index funds are temporarily “switched off”.

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index).

Slack Investor Stinkers – FY 2019

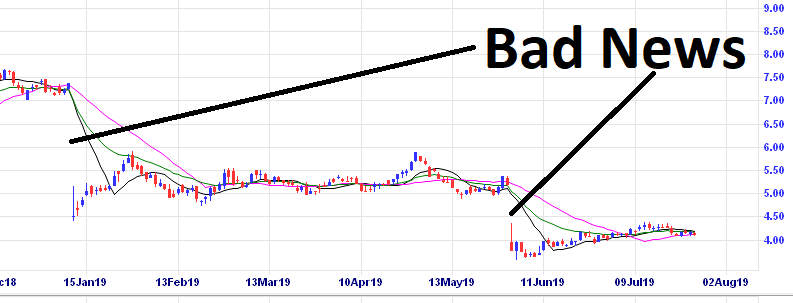

Stinkers are part of investing in growth stocks. Growth stocks usually have a high Return on Equity (ROE>15%). By their nature, they have a relatively high PE ratio and are usually punished in the markets during reporting season if there is any bad news – and I am not too worried when this occurs – It is the total performance of the portfolio that counts. If they breach their monthly stop loss – I will review the stocks and ask myself the question – Factoring in what I know now about this company, would I still buy this stock at its current price? – If not, out it goes!

The percentage yearly returns quoted in this post include costs (brokerage) but are before tax. This raw figure can then be compared with other investment returns.

Costa Group (CGC) -34%

This should be a lesson to Slack Investor … try to avoid growth companies that do not set the price of its products i.e. are “price takers”. This agricultural company had some earnings revisions during January and May due to weather and some difficulties in their Morocco operations. I have hung in and still own the company as it looks cheap on projected price earnings … but another downgrade would test my good humour.

Challenger (CGF) -30%

I have been listening to the story of this company for ages. Its income products (annuities) should really appeal to the retiring baby boomers. However, there has been a long slide in price of its shares. In a bit of “hands on” research, I had a look at their CarePlus product for a relative moving into Aged Care – Their package was difficult to sign up to, and the web examples used were underwhelming. Perhaps they market more to financial advisors than for retail investors. The good thing about reviewing the chart of a stock every week is that eventually you “wake up”. I sold the shares in March.

Dishonourable mentions to Corporate Travel (CTD), Platinum Capital (PMC) and Worley Parsons (WOR), which all lost more than 10% this financial year.

Slack Investor Gold Nuggets – FY 2019

By investing in companies with high return on Equity with a track record of increasing earnings, you can expose yourself to some pleasant surprises. The Return on Equity (ROE) and forward Price Earnings (PE) ratio values for each stock are found on the excellent Market Screener site.

ProMedicus (PME) +148%

Pro Medicus is an Australian company that produces medical imaging software for hospitals and medical specialists. Their products are used worldwide and there are e projected increasing sales. Their ROE 2020 is an excellent 41%,however, their projected PE ratio for 2020 is over 100. This is dangerous over value territory – and I am watching this stock closely for any price declines. But until then, I am riding this horse home.

Appen (APX) +101%

Appen supplies data services to global tech companies and their language division provides machine-learning technologies for devices. Perhaps because I don’t really understand what they do and because of their high estimated 2020 PE ratio of 61. I said thanks very much and then I got out of this stock last month. However, the price of this stock is still climbing! Ouch!

Rhipe (RHP) +79%

Rhipe is another tech company that I had a speculative interest in. It provides software licences that help their clients transition into a “cloud” environment. Rhipe has a working relationship with Microsoft in Australia but their high 2020 projected PE of 39 makes it another stock that may be overvalued and I am watching it closely.

Altium (ALU) +53%

Another fantastic year for ALU The designing of integrated circuit boards for technology products is proving to be a lucrative business. A high 2020 projected PE of 39 is a concern -but I really am smitten with this company – as they have been great growers of their business.

Service Stream (SSM) +52%

Service stream provides network services to Utility companies. This is the sort of company that Slack Investor loves. A high ROE of 20% and a reasonable 2020 projected PE of 19 with anticipated earnings growth.

Honourable mentions for Slack Investor portfolio stocks AMC and RHC that increased more than 20% in this financial year.

Slack Investor Total SMSF performance – FY 2019

In another good year for shares where Chant West reports median growth super funds made 7%, the FY 19 Slack Investor preliminary Total SMSF performance looks like coming in around 20%. Anyone can fluke one good year so 5-yr performance is a more useful benchmark to me and the Slack Portfolio now has a compounding annual 5-yr return of over 18%.

Not bad Slack Investor … now get back on the couch … with full FY 2019 results and benchmarks next post.

Looks like your nuggets more than offset your stinkers by far! I’m not sure my ratio of nuggets to stinkers is as positive so far…

Such a difficult thing to know if and when to buy more of a stock like Costa’s when it looks cheaper and cheaper. I’m constantly astounded at how much cheaper a stock can get when I think it’s impossible it can’t go lower…

Cheers, Frankie

Hi Frankie … yes currently taking a bath with Costa Group (CGC). I have got a bit relaxed with my stockslately (thinking that they are all great companies – delusional!). It was due for a sell and move on but I am getting soft in my old age and as CGC is due to be reporting later this month … will give it one Last chance! PS love the graphics, ethics and great content of your site https://fullyfrankedfinance.com/

High Regards, Slack Investor