The Class M-3 Model B9 – From Source

The Class M-3 Model B9 (Pictured) was one of the first examples of Robo-advice and would always issue Will Robinson, of the 1960’s TV show, Lost in Space with sage guidance. Can we expect the same from this new generation of Robo Advisors? My Star Trek knowledge tells me one thing for sure, the Disruptors are on!

Slack Investor has already had a bit of a rant on the layers of fees that you can expect from seeing a Financial advisor. But many would benefit from financial advice – Can we get it from the Robots? There are quite a few Financial Robo-advice companies emerging. Lets begin with a couple that have caught Slack Investor’s eye – Plenty and Stockspot.

Plenty – A Good place to start

Plenty is a new service that, after a 15-minute online questionnaire, develops tailored (up to a point) financial advice for no cost. Plenty offer more than most robo advisors. In addition to an automated platform for investing, they offer a whole advice product similar to more conventional financial advisors. Their basic service is free and, if you need it, they charge fees to help you implement the plan. Their Blog is pretty good too. Due to high demand, unfortunately, Plenty are not taking on new clients at present. But this doesn’t stop us using their structure to develop your own financial roadmap. An example of the financial plan that it robo-generates is here.

When Plenty takes on clients again, to get their online plan you must divulge your financial details (bank accounts, super, etc) – this is a bit scary and is usually the point where Slack Investor … Says NO!

However, the way that Plenty provides a free robo-way towards your financial goals is fully Slack Investor approved. They claim to be “product agnostic” and will only recommend the lowest fee (best!) products that aim to get you in a good financial state. The Plenty example financial plan contains plenty of good ideas!

- Lower Fees – Oh Yeah!

- Smarter Investments – Through ETF’s and Listed Investment Companies (LIC’s) – Sounds easy doesn’t it!

- Lower Interest on Debt – Making sure you get the lowest interest rates on your debts

- Save Tax – Thanks Kerry Packer!

- Spend appropriately – Budget … and measure what you spend

- Protect your financial position with insurance – Very important for those with dependants or a big mortgage. Slack Investor does not have financial insurances now that he is in retirement mode with little debt. However, when I did need insurance, I would get my income, death & disability insurance through my super fund – as this was the cheapest way.

Stockspot

“I started Stockspot five years ago because I saw too many people getting poor investment advice from stockbrokers and financial advisers”

Chris Brycki – From article in Business Insider

“The evidence shows that simple, low-cost ETFs [exchange traded funds] beat picking stocks or paying expensive fund managers over the long run.”

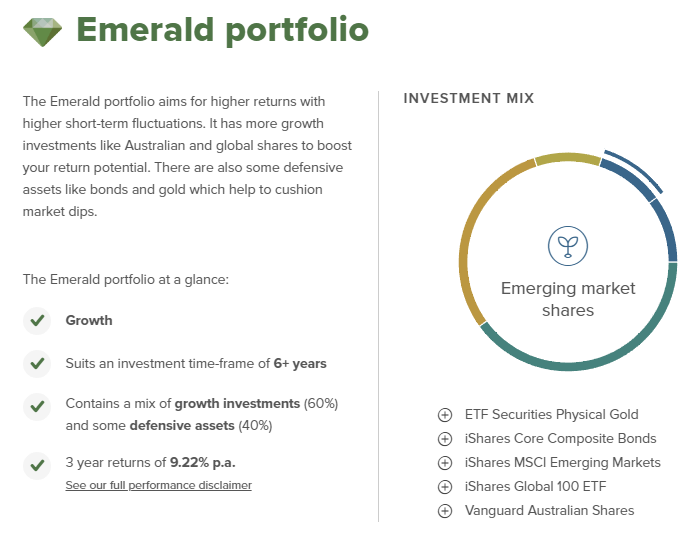

Stockspot was started by Chris Brycki, is Australian owned, and has excellent intentions. Their investment vehicles are low-cost ETF’s and through a quick online questionnaire you can determine your risk profile and suggested pre-determined mix of investments. For example, the Emerald growth portfolio is shown below

There are no entrance and exit fees, the fee structure is based upon the amount invested. For a $30 000 account, the fees are .055% (or $16.50 per month). This works out as a yearly fee of 0.66% (or $198). The fees are a bit annoying on first glance – However, Stockspot do not charge for brokerage and rebalancing your portfolio – this is a good deal for the more hands off investor.

You could save $100 per year to set up a similar bunch of ETF’s as those shown above and do the rebalancing yourself. Let us say, your target portfolio had 5 ETF’s and you rebalance them once per year, using the rock bottom brokerage of SelfWealth at $9.50 per trade – 10 trades per year would cost $95.

However, the whole idea about Robo Advice is to make things simpler and combat the inertia to action that gets in the way of our accumulating wealth. If embracing the full robo, then the extra hassle of doing everything by yourself is probably not worth the money saved.

Lets Robo On, there are plenty of other players in this exciting new area. Six park, Raiz, Clover, QuietGrowth and FirstStep will get a bit of a look next month.