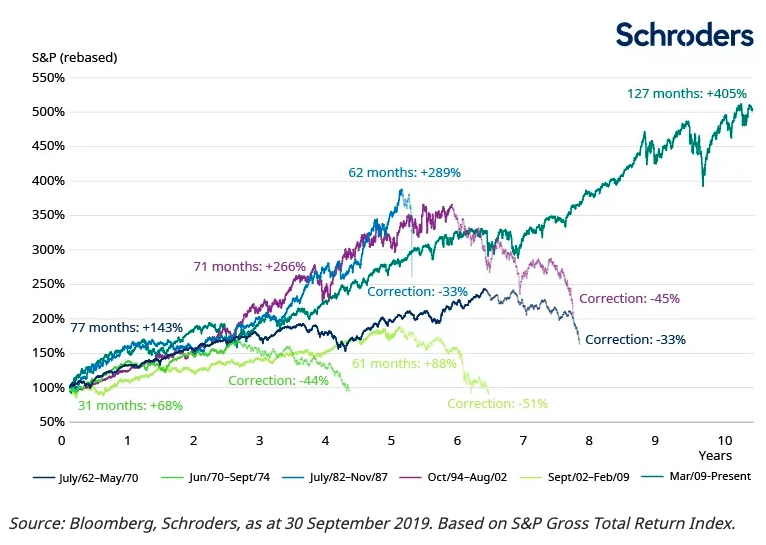

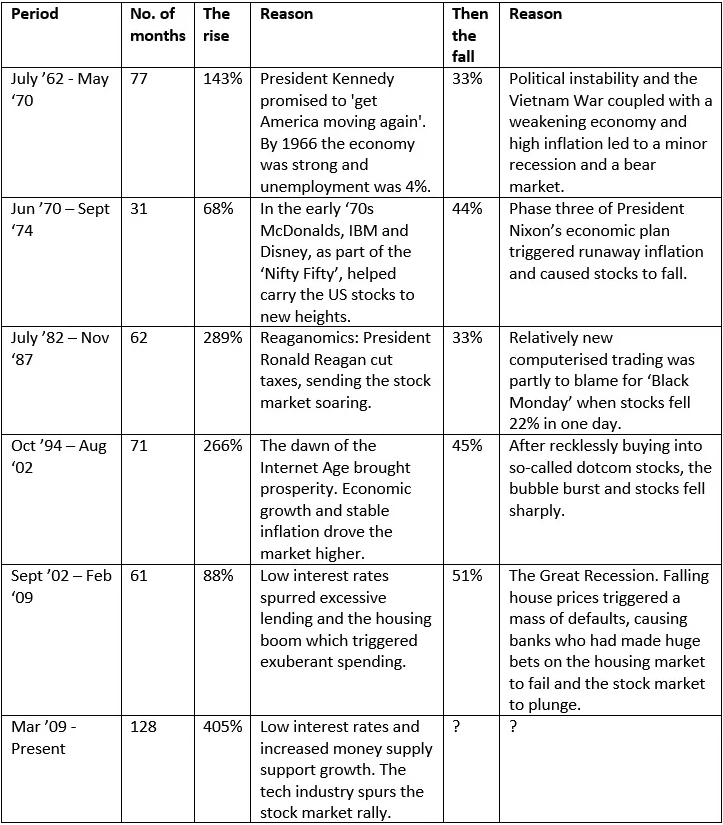

A wild month in all stock markets with increasing concerns of the punters about virus COVID-19 and its effect on the world population and economy. There is a selling fever at the moment. Slack Investor is no predictor of the future, but he reminds himself that stock prices are set by the market and there are often times when prices exceed the “value” of each individual company – and times when prices fall due to panic selling. Stock markets are volatile and while we frail humans (and a few robots!) are in charge of setting the price – this will always be the case. Some markets have had an official correction (10% fall from their peak). This is quite normal and usually happens after a period of strong rises. Marcus Padley points out that

“Normal” risk is the stock market having a 20 per cent correction every three years and bouncing rapidly afterwards.

Marcus Padley in article from The Age

Slack investor has two systems going with his shares. With his funds that track whole Indexes, he attempts to time the market a little with the use of stop losses. However, for individual companies, I deal with them on a “case by case” basis and think about how this current Coronavirus crisis will affect them. If I owned companies in tourism, international education, airlines, or those who source most of their goods in China – I would be cutting my losses and getting out. If the crisis worsens, and COVID-19 is declared Pandemic, then I would have to have a closer look at my share holdings as health epidemics are a risk to all businesses.

The Federal Reserve bank of Cleveland have the probability of a US recession within the next year at 32.9%. This probability is starting to creep up again. The current value exceeds the Slack Investor threshold of 20% and my monthly stop losses for Index funds are “switched ON”

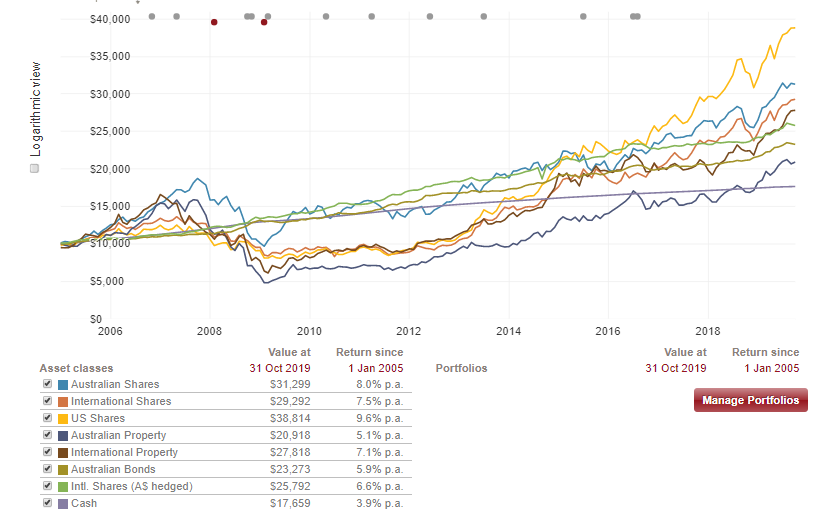

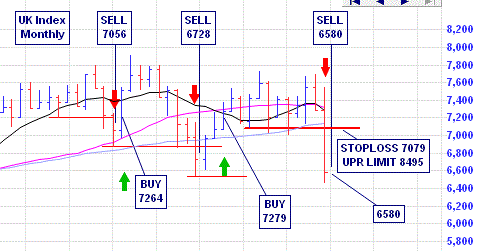

Slack Investor remains IN for Australian index shares (ASX200 down 8.2% this month) and the US Index S&P 500 (down 8.4%). I have not had much luck with the fluctuating FTSE100 and it has breached its monthly stop loss (down 9.7%). So I’m OUT. The latest trading cycle showed a loss of 9.6%. But since 2004, the Slack Investor timing method for indexes has beaten the FTSE “buy and hold” strategy by 17%.

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index).

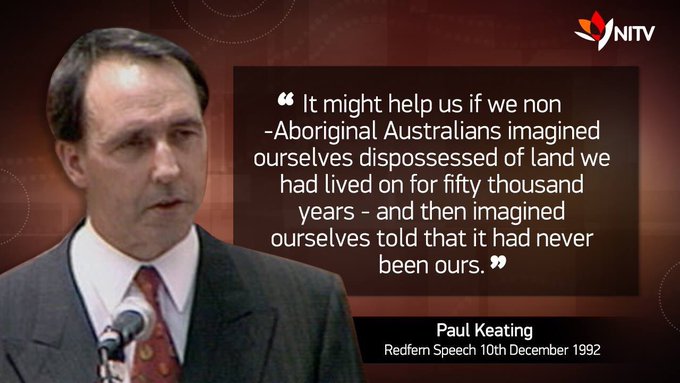

When “the Buff” talks … Slack Investor Listens

It is not unusual for Warren Buffet to expand on his thoughts on investing. Every year his investment company Berkshire Hathaway reviews the last 12 months and gives a fair chunk of investment thinking according to Warren Buffet and his distinguished offsider Charlie Munger. The full 2019 year letter is here.

Year after year the advice is remarkably constant.

“What we can say is that if something close to current rates should prevail over the coming decades and if corporate tax rates also remain near the low level businesses now enjoy, it is almost certain that equities will over time perform far better than long-term, fixed-rate debt instruments.”

Warren Buffet from the Berkshire Hathaway annual letter for 2019

In other words, despite the world-wide Corona virus inspired rout on stock prices, “the Buff” feels quite comfortable with his exposure to shares “over time” and feels confident that his portfolio will outperform bonds and cash.

Warren Buffet tries to tune out the daily fluctuations in share price and he has always said that investors should see themselves as long-term part owners of corporations. “The Buff” looks for companies with low debt, good management and a high return on equity. Mr Buffet does not anticipate selling any of his top 15 stock holdings.

Corrections aren’t much fun, and Slack Investor has as much investing prowess as Mr Buffet’s toenail, but, Like “the Buff”, I would rather have the bulk of my investments in good companies than anywhere else.