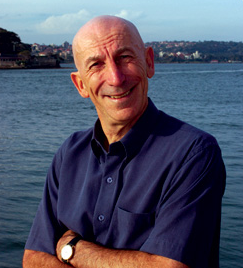

I have a few people that have greatly influenced my investing life – One such figure is Colin Nicholson. I have never met him, but he has taught me a vast amount through his long running website “Building Wealth Through Shares” (bwts.com.au).

This great Australian investor Colin Nicholson, has been investing for over 50 years and documenting his adventures with shares since 2001 on his site. Colin has only stopped actively contributing at the end of 2019. Fortunately, this website is still running and his knowledge and experience keeps on giving. As well as education material on technical and fundamental analysis, he often discusses the psychology necessary to be a successful investor.

We tend to have an impulse to snatch profits quickly and to let losses run, hoping things will come good if we hold on. This natural impulse is the exact opposite to what a successful investor must do.

Colin Nicholson

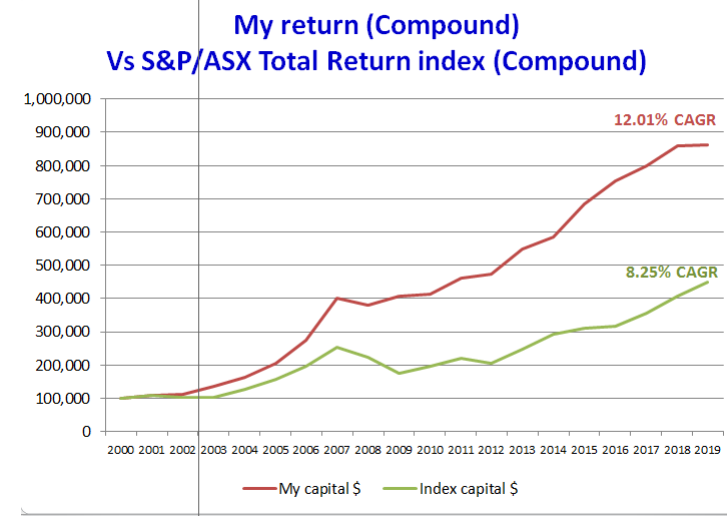

Colin started bwts.com.au when financial blogs were in their infancy and Australian contributors were rare. Colin is a private investor, an author, and educator. He has been contributing to his site for over 20 years and answered hundreds of questions from other investors. His site is an incredibly detailed knowledge base covering all aspects of owning a share portfolio. His Investing – Twelve Key Lessons is essential reading to anyone thinking of entering this fascinating world. His results over a 20-yr period are very impressive. Colin has retired from active contributions to his website but has hinted that he would maintain his website for the education of future investors.

There are countless bits of wisdom as Colin relentlessly tackles investment according to a defined, well-tested, and logical plan. No matter what the investing subject, search his site, and Colin Nicholson will offer some useful and reasoned discussion.

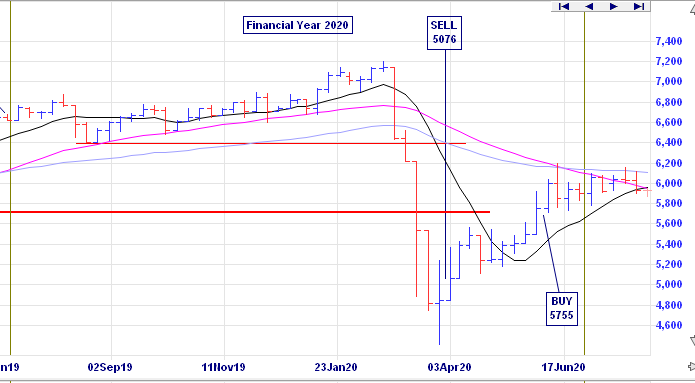

The source of most frustration in investors is that they are expecting the impossible. They want to sell at the top. I repeat that it simply cannot be done except by sheer luck.

Colin Nicholson – Take Profits or Wait for the Stop-Loss?

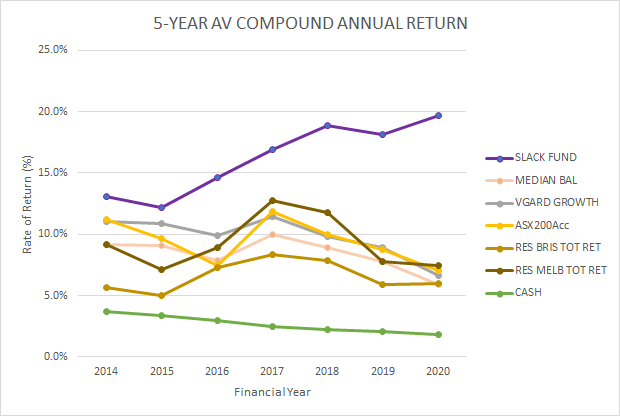

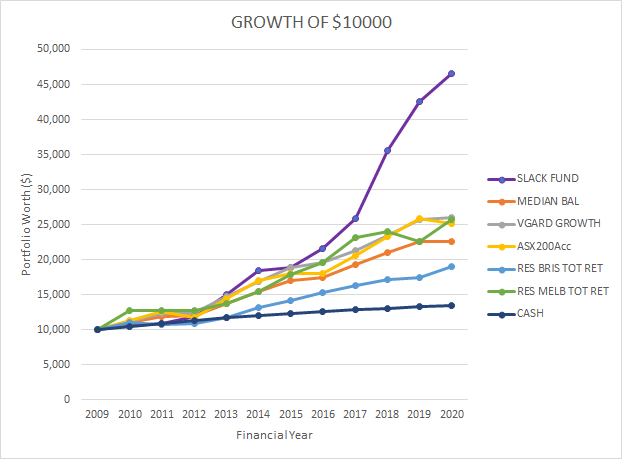

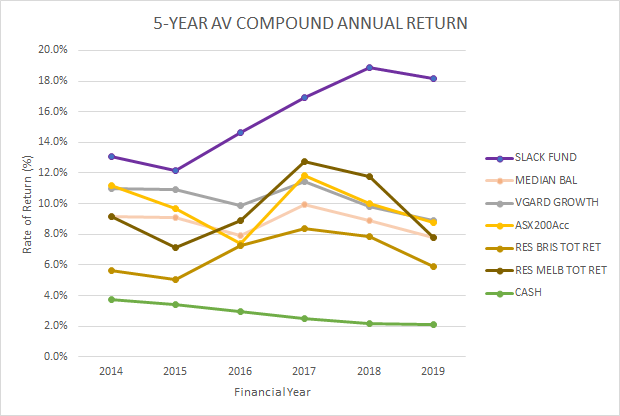

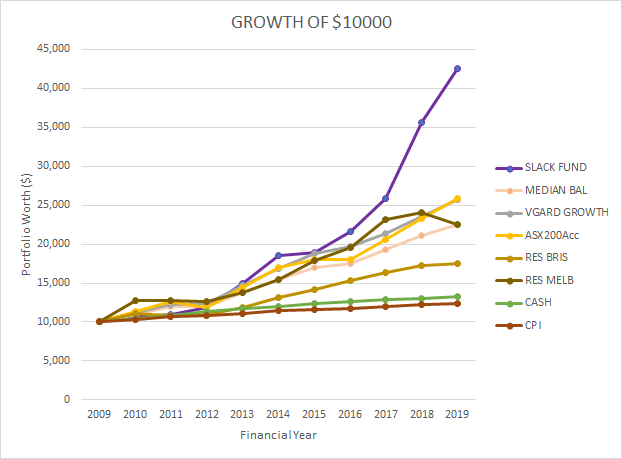

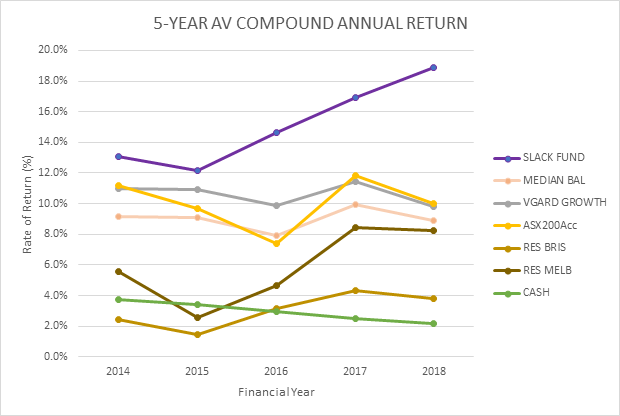

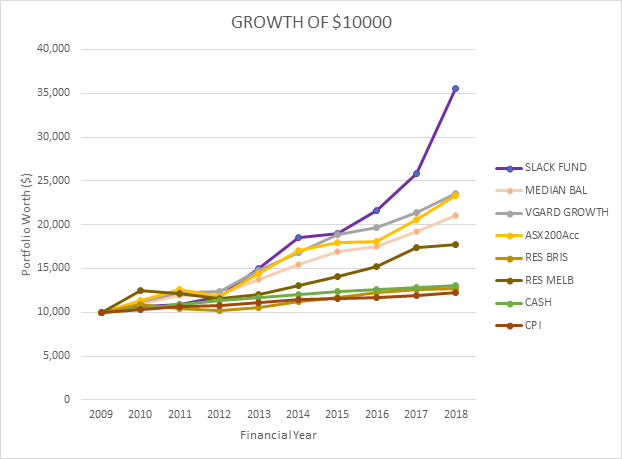

My first introduction to his site was through his meticulous documentation on how he calculated his end of financial year performance returns. Year after year he would list his portfolio and investment returns.

… I do not wish to advise people or to manage their money. Rather, my focus is on my own investments and passing on what I have learned to others.

Colin Nicholson

In addition to his website and public speaking, Colin has also authored Building Wealth in the Stock Market and Think Like the Great Investors. Like another of Slack Investor heroes, Warren Buffet, Colin has a plan for “retirement mode” and intends to become more passive with his investments and half of his portfolio is now in LICs and index funds.

I am not retired – I am a full-time investor

Colin Nicholson

Colin Nicholson, Slack Investor salutes you for your enormous contribution to my investment life and for helping countless others with your education materials and your disciplined and methodical approach to investing in shares. Dive deep and long into bwts.com.au and you will be a better investor.

February 2021 – End of Month Update

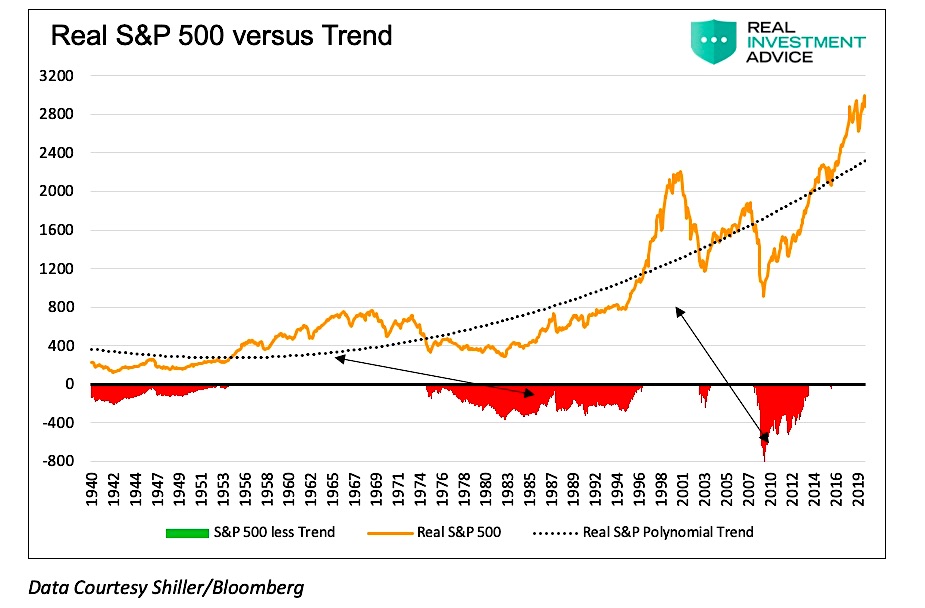

Slack Investor remains IN for Australian index shares, the US Index S&P 500 and the FTSE 100.

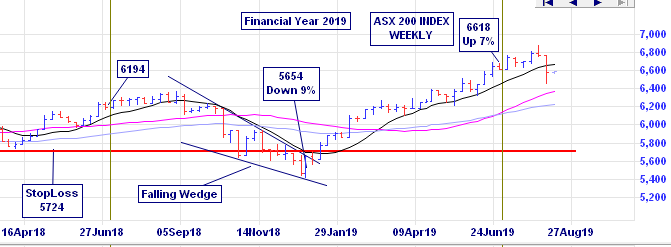

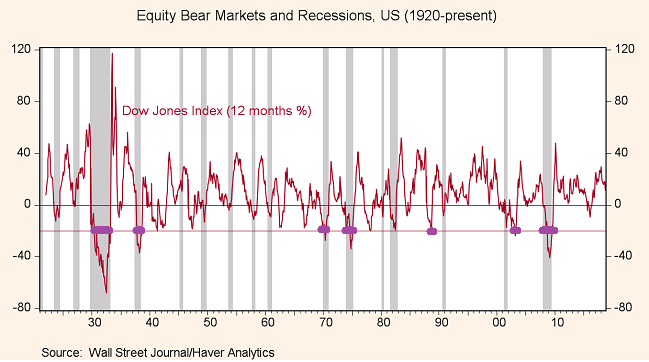

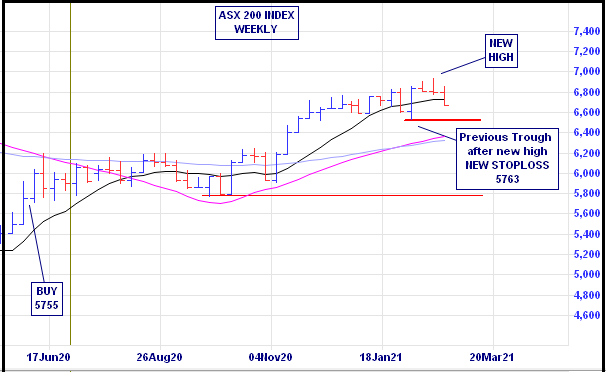

When having a look at the end of month charts, I noticed that all index trackers were well above their stop losses (>16%). My Mum (and Kath and Kim) would say that she could “feel it in her waters” when she had a premonition about something. My index rules allow the end of month stock price to be up to 20% above the stop loss. However, in a tip of the hat to Mr Nicholson, who is far more disciplined than Slack Investor in the investing arts, some action this month. As “new highs” have been established, I decided that now wouldn’t be a bad time to adjust the stop loss levels upwards.

I place my stops below the low of the last trough in the uptrend and move it up to just under the next trough every time a new high is made for the trend.

Colin Nicholson

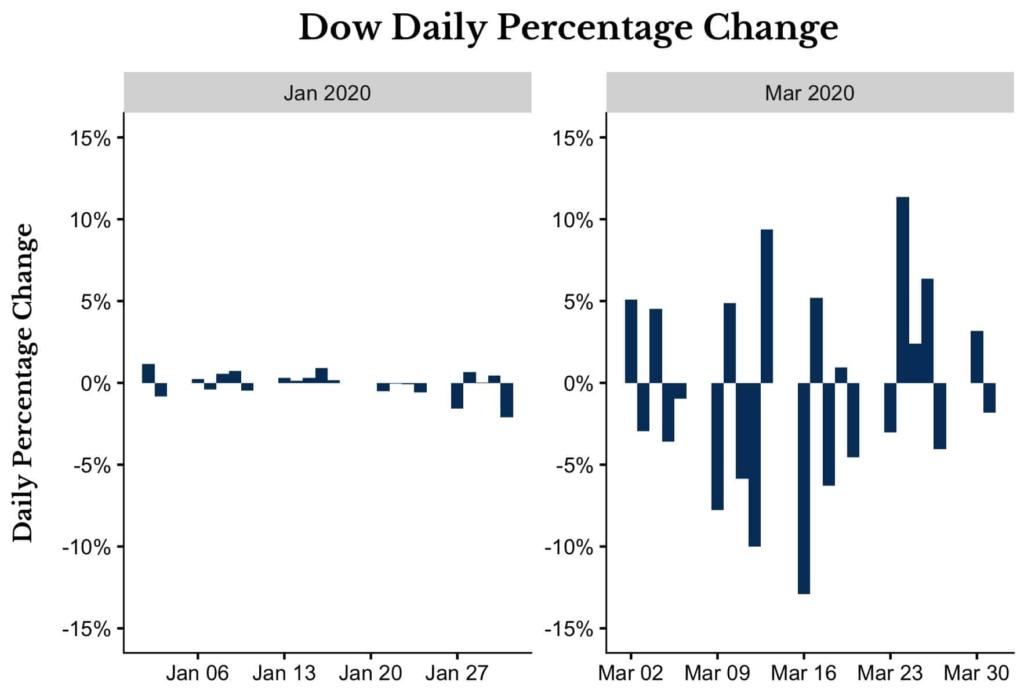

For February 2021, there were falls in the growth oriented Slack Portfolio due to rising long-term bond yields. But stock prices have always fluctuated above or below a “fair price” – for one reason or another. Slack Investor is still on the couch.

Tech stocks are susceptible to rising yields because their value rests most heavily on future earnings, which get discounted more negatively when bond yields go up.

From The Bull

Despite the end of month sell off, there were modest rises in all followed index funds (ASX 200 +1. 0%, S&P 500 +2.6%, and the FTSE 100 +1.2%). All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index).