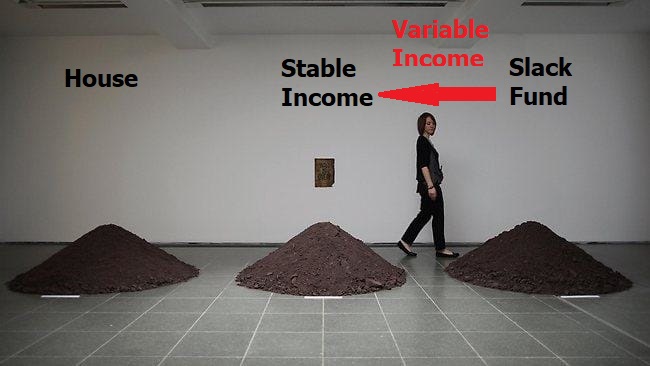

With apologies to Yoko for interfering with her art, but Slack Investor first thought of his own “Three Pile Theory” back in 1989 when I had got myself a “Proper Job” and enough stability in my life to make the big plunge into Real Estate. At that time, I owned a few grains of dirt in my House pile (the Bank owned the rest), My income was OK, and my investments (which would later morph into the Slack Fund) contained a few thousand dollars in shares.

Now, 32 years later, Slack Investor still has these three financial pillars to keep himself steady.

- House – Home ownership gives me great security and pleasure. The bank owned most of this 30 years ago – but now I have the upper hand! (~30% of Net Worth)

- Stable Income – This used to be my job, but in retirement I have some stable income annuity style investment (~20% of Net Worth) that would pay my bills and maintain a basic Slack Lifestyle should Armageddon befall the stock markets for a few years. This income is supplemented by income from the Slack Portfolio.

- Slack Portfolio Investments – (~50% of Net Worth) – Now currently in my Self Managed Super fund (SMSF) which is almost exclusively invested in growth companies. These are great businesses to be invested in if you have a long term horizon – however, stock prices can be volatile in these high Return on Equity (ROE) companies. I am currently retired and do not rely on the Slack Portfolio for stable income. Because of the stability of my other two pillars, I can be quite aggressive in the allocation of my investments in the Slack Portfolio – as I know I will not have to panic sell (for income) during any downturn.

Slack Investor didn’t really invent “Pile theory” – it has been around for a while in various guises – Three Buckets is a tried and true way to manage your retirement expenses by dividing your retirement stash into buckets of cash, conservative investments and more risky, growth investments.

House

My home may not feel like a palace to you, but to me, it is a whole Kingdom.

Prerona Chatterjee

There are some who argue that you are financially better off by renting over a 10-year period rather than buying. But for Slack Investor, the tax advantages – no capital gains tax on your own home in Australia; the leverage – banks are usually willing to lend at least 80% of the house value; the forced saving – your mortgage payment is a big monthly portion of your income which you set aside for a long period; and, the stability provided by home ownership make this a clear winner for me. “The Serenity” is just a bonus.

Stable Income

To cover living expenses and to give yourself “peace of mind” it is so important to have a slab of money that is not subject to the vagaries of the sharemarket. In Australia, if you haven’t enough super to go independently, you might qualify for a full or part pension.

If going the fully self-funded route, many advisors recommend your stable income should be in two parts. You should work out your living expenses for a year and then keep between 2 and 5 years worth of expenses in stable cash deposits – Let’s start with 3 years of expenses in accessible cash. The rest of you stable income pile can be in longer term cash deposits, bonds or REITS. Because the investments pile (Slack Portfolio) is in growth shares that can be very volatile, my stable income must be something that is not highly correlated to to the sharemarket.

Term Deposits– although interest rates are woefully low now on bank term deposits, it is still possible to get ~1% p.a. from some of the minor banks that still have the Government Guarantee for the first $250 000.

Vanguard Australian Fixed Interest Index ETF (VAF)

MER (0.20%) – Annual performance over 1/5 years – (3.81%/4.41%)

Vanguard Australian Government Bond Index ETF (VGB)

MER (0.20%) – Annual performance over 1/5 years – (4.08%/4.49%)

Challenger Fixed Term Annuity – Rates are pretty low at the moment, locking away a deposit for 5 years will earn a measly 1.65%.

Real Estate or Real Estate Investment Trusts (REIT) – these are a bit higher up the risk curve but as they produce income (rent) and can be associated with longer term leases – are usually less volatile than the share market. For example, Vanguard Australian Property Securities Index ETF (VAP) – MER (0.23%) – Annual performance over 1/5 years – (-13.3%/6.23%)

Investments – The Slack Fund

Because the Slack Portfolio is mostly in growth shares, I have steeled myself that this particular pile is volatile and changes value every day. I am prepared for a few low performing (or even negative) years in a row for this pile. Even great investors that have much more knowledge than Slack Investor have the occasional bad year – during some periods, share investments just perform poorly. I am accepting of this truth.

Because this Investment pile is mostly in my Self Managed Super Fund (SMSF), I am usually obliged to withdraw 4% of its total value each year – this percentage increases with age – but this payment is currently tax free for those over 60. I can use this income in a discretionary way. My living expenses should be covered by income from the Stable Income pile – and any other income is gravy.

Pile Rebalancing

Once you are in a house that you are happy in and hopefully will be near paying off any outstanding loans as you get into retirement – other than maintenance, you can leave this pile alone.

The Stable Income cash pile might occasionally need a bit of topping up from the longer term stable Income or Investments fund. Any dividend or interest income from your investments is fair game. The investment Slack Fund usually produces 2 -3% income.

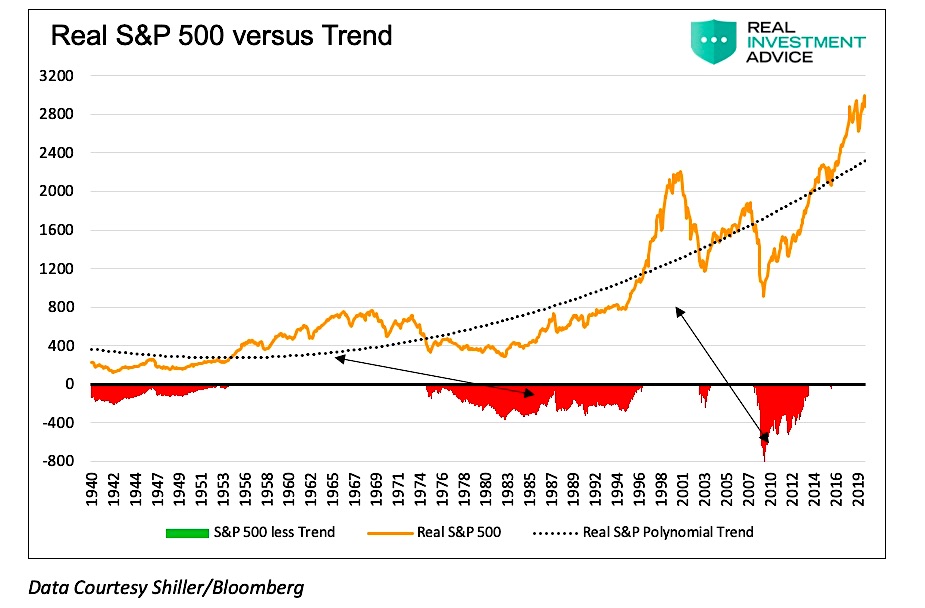

Hopefully, with 3-years worth of living expenses in the stable income pile, you can ride out a few bad years in the share market and only sell shares to top up the stable income pile when the share market has had a good run. Ideally, you would only sell share assets out of this pile when the share market is above the long term trend line. However, realistically, from the chart below (in red) there are long periods when the market is below trend. Have no fear, your basic expenses are always covered by a mixture of stable income, interest and dividends.

There are other piles worthy of attention such as Health and Relationships but the finance stuff is necessary too. So get the shovel out … and start working on those piles!

This is how I’ve organised my retirement income as well.

I’ve just started on my retirement; good to see my plans appear to work!

Hi Frogdancer … congratulations on your retirement! May it be long and hearty! – Just had a quick peek at your blog – Very entertaining – You write with great wit Madam.