Slack Investor hasn’t written much about Self Managed Super Funds (SMSF’s) despite his love affair with his own fund. SMSF’s are only found in Australia and represent a “hands on” way to accumulate, nurture, and eventually release your super funds as a pension or lump sum. They have the same status as a normal retail or industry super fund (e.g. Australian Super) but they are “self managed” and give the trustees (members of the fund) power over where the fund is invested. This control is a double edged sword, as it is also possible to destroy your super wealth with a SMSF by making unwise investments.

SMSF’s offer

- Control

- Flexibility in investments – But this can be dangerous!

- Estate Planning and Taxation advantages

There are nearly 600,000 SMSFs in Australia with over a million member (March 2020). Although this represents less than 5% of Australia’s population, about 25% of the $2.7 trillion invested in superannuation is invested in SMSF’s. The average member balance for an SMSF was a whopping $678,621 (ATO Data 2018).

It is possible to structure an SMSF so that the investment fees are very low. A surprising finding from a SuperConcepts study was that the average annual expense ratio for SMSF’s was 2.8% for the over 20000 funds surveyed. This seems particularly high when compared to the Slack Investor SMSF portfolio expense ratio of 0.12% through a “no advice” online SMSF services provider like e-superfund. This suggests that most of the funds surveyed used the relatively high cost route of engaging an accountant to administer the fund. There are many SMSF providers – Slack Investor uses e-superfund which provides the legal structure and web-based audits and education. The yearly operating expenses are an amazingly low $999. The SMSF is so integral to Slack Investor’s strategy that I have set aside an SMSF page on the Slack Investor site – Alas, there is not much on there yet … but it will come!

Rainmaker are producing monthly comparisons of SMSF’s with the larger low cost My Super products offered by Industry and Retail Super Funds. The analysis can be found on their Superguard360 site.

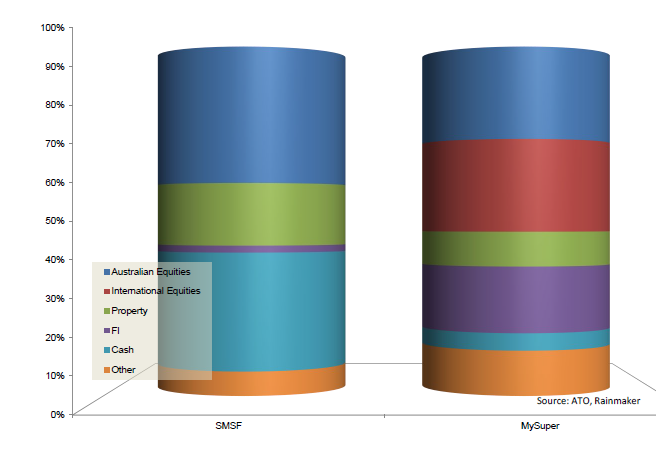

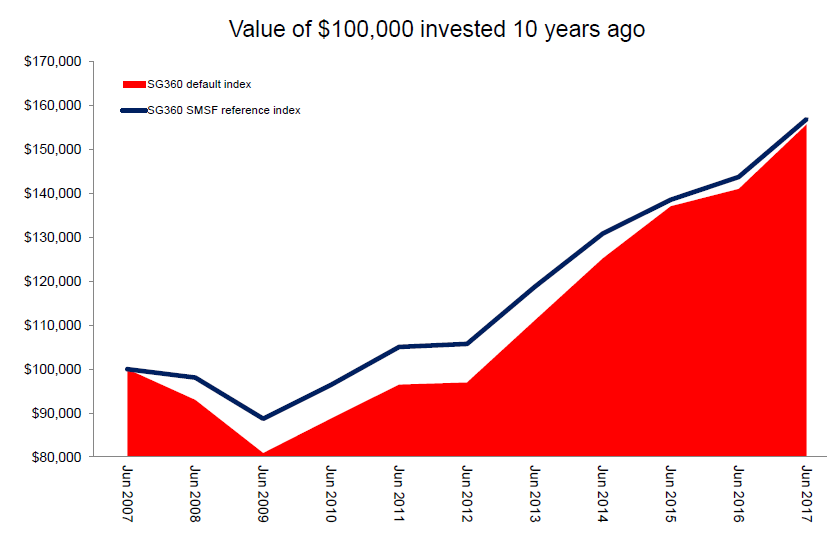

SMSF funds (above left) traditionally hold more cash, property and less international shares than the larger Industry/Retail funds (My Super – above right). SMSF’s have outperformed MySuper since the GFC (see below, SMSF’s Blue line, My Super Red block). However, with the recovery of equities, the MySuper funds have been catching up and as at June 2017, 10-year returns from both types of funds are near identical at 4.2%. Under current asset allocations, the more diversified Industry and retail funds should overtake SMSF performance – on average.

Self Managed Super is NOT for Everyone

“… That a little knowledge is apt to puff up, and make men giddy, but a greater share of it will set them right, and bring them to low and humble thoughts of themselves.”

From an anonymous author, published in 1698 as “The Mystery of Phanaticism”

Running a SMSF takes time and I wouldn’t recommend it to anyone that doesn’t want to be fully engaged with their financial future. Luckily, Slack Investor finds the whole finance and ATO compliance scene most interesting. Trustees of SMSF’s are held responsible for compliance with super and tax laws and there are many other risks in running a SMSF fund. A long term study of SMSF data by SuperConcepts, “When Size Matters” found that that SMSF’s below $200000 in total funds generally underperformed. However, the larger SMSF’s were comparable in performance with industry funds.

Over 10 years, there’s hardly any difference between the performance of not-for-profit funds, such as industry funds, and DIY (SMSF) funds.

SMH article (2017) summarising Rainmaker data from the ATO

Despite how well an SMSF style really suits Slack Investor – The large majority of people should not get into an SMSF – but stick with a good performing Industry Fund. Unless you are justifiably confident in your investing abilities, most people will be better of with a well diversified industry fund for long-term Super performance. It is always better to “have low and humble thoughts of ourselves” – it is too easy to destroy the value of your hard earned super.

January 2021 – End of Month Update

Slack Investor remains IN for Australian index shares, the US Index S&P 500 and the FTSE 100.

Some tested COVID-19 vaccinations have started to be rolled out internationally – but uncertainty prevails. Slack Investor followed markets all fluctuated but, overall, remained pretty flat this month. For January 2021, the Australian ASX 200 rose 0.3%, the S&P 500 fell 1.1%, and the FTSE 100 down 0.8%.

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index).