This striking image of Leningrad children in their gasmasks has left a haunting impression on Slack Investor. The 900-day siege of the Russian city during WW2 claimed the lives of 800000 civilians – Many of the photographed children would have been involved.

Not trying to draw any parallels, but it is true to say that we are all a bit apprehensive about how to deal with this new post-lockdown world in Australia.

The number of fatalities for COVID-19 is still shocking and it is causing great hardship in many lives. In perspective though, the “big Daddy” virus is the 1918 Influenza where nearly a 1/3 of the world’s population was infected and global deaths amounted to almost 50 million people.

Given sufficient leadership (are you listening Donald and Boris!) the world will eventually see this COVID-19 off – like it has with all previous past viral outbreaks.

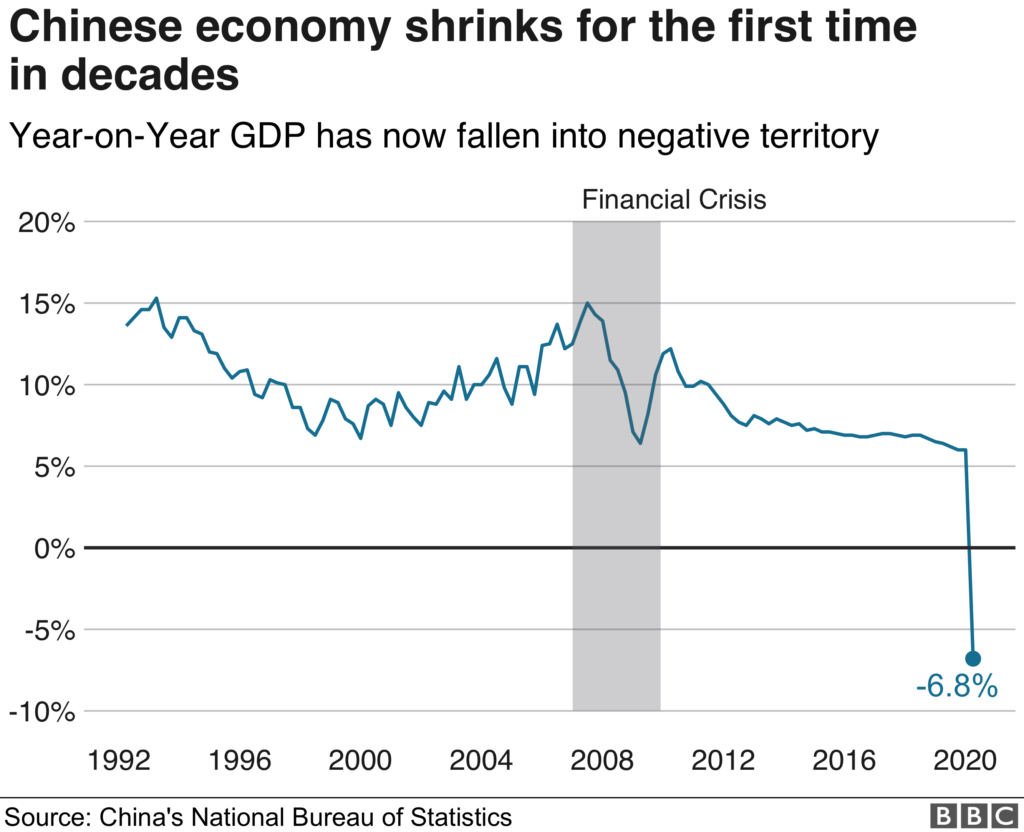

Slack Investor does have a furrowed brow about the whole world economy thing. Even bevore COVID-19, China’s economy was shrinking – and has now tanked.

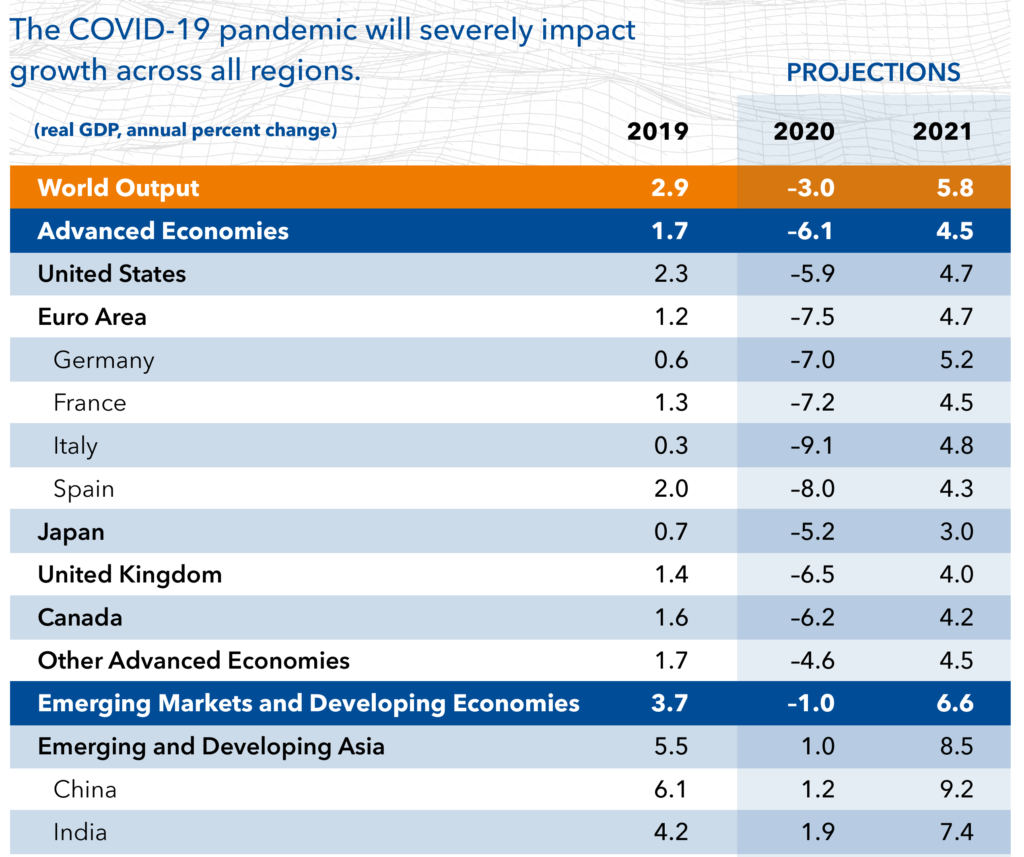

Although China is expected to recover later this year, things don’t seem so good for the moment. The International Monetary Fund (IMF) are describing it as the worst economic downturn since the Great Depression. It is tough to provide forecasts for this event and, as a retired meteorologist, I feel for my economy forecasting brothers and sisters. They predict both advanced and developing economies are expected to show signs of life in 2021.

No country is spared in this global crisis, in particular, nations with weak health systems, and more limited funds to provide support will struggle.

Slack Investor will leave the big world predictions to others and continue tinkering in a small way with his portfolio. What is obvious is that companies reliant on tourism, travel, hospitality, and entertainment for their growth are in big trouble. Emerging market and developing economies face additional challenges as they will find it harder to find investors to fund their projects in this climate.

This is not advice, but I will sell off my shares in emerging market ETF VGE and the Malaysian property trust UOS and buy some ETF’s such as NDQ or QLTY. I have had second thoughts about selling down my overweight position on CSL . This company continues to grow – and I just love owning it. – I would have topped up my holding this week as it is currently slipping in price to below $280 – but it is already a big chunk of my Portfolio.

May 2020 – End of Month Update

Governments around the world have been mostly doing their job responsibly and adding stimulus to the world economies in these troubled times. In response to this, the Federal Reserve bank of Cleveland have stabilized the probability of a US recession within the next year at 19.4% (below Slack Investors threshold of 20% – so stop losses on index stocks are in hibernation). There has been some real optimism in the markets with further big monthly rises in all followed markets ASX200 +4.2%, FTSE100 +5.4% and S&P500 +7.6%.

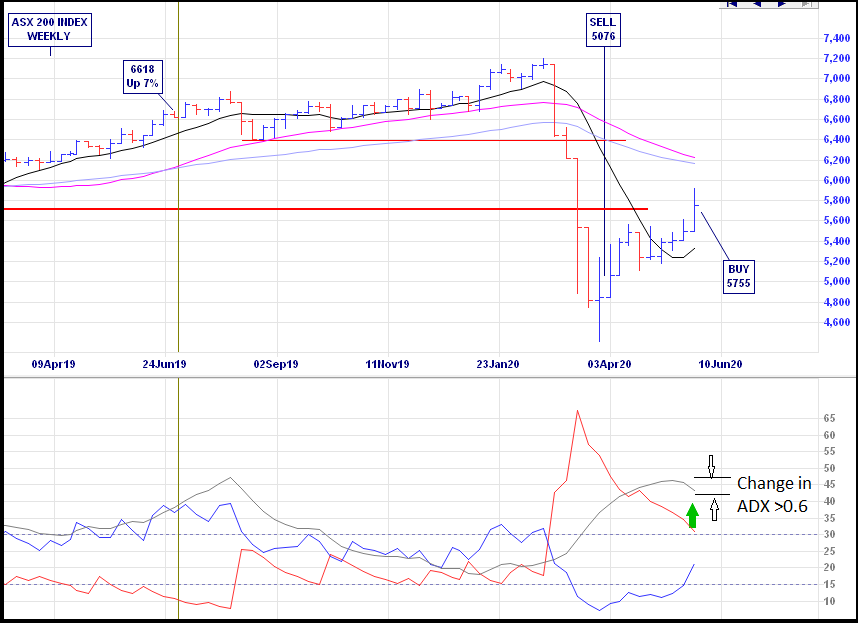

The rise in the ASX200 has Slack Investor back into the market with a weekly change in momentum of the weekly charts signaling a BUY. It’s all a little bit crazy … but I am back to all IN! The 11-Period Directional Movement Index (ADX) change of greater than 0.6 is used as the momentum indicator for entry with the complexities of this process explained on the Resources page.

All Index pages and charts have been updated to reflect the monthly changes – ASX Index, UK Index, US Index.