I did a north to south crossing of Africa 36 years ago, mostly in a 4-wheel drive truck and, if we stopped in a village, my routine would be to grab the water containers and find a well. This was always a pleasant task as it involved a line-up, sign language and usually a few giggles at the strange visitor’s expense. Overwhelmingly, the well would be attended by women and there was usually an air of joy and strong comradery in the queue.

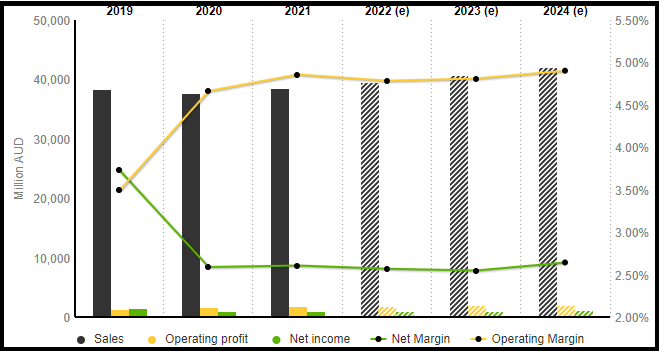

CSL have just gone to the “well” – with a Share Purchase Plan (SPP). They have purchased a Swiss company, Vifor Pharma (VIFN:SWX), which specialises in iron deficiency and renal disease. The acquisition cost US$11.7 billion and they have already covered most of this with an institutional placement and some new debt. CSL is trying to raise another $750 million from the “well” of shareholders pockets – and they seem likely to get it – let’s hope they will be welcomed back when they need water next time.

It seems to be the way of things that institutions (Brokers and Super Funds) get the first slice … and when this is done, there is a limited offer to retail investors – just to stop them whinging. Most of the time I participate in any share purchase plans as a convenient way to accumulate shares without the cost of brokerage. The CSL offer is set at $273 (or a 2% discount to the share price if CSL shares fall below this mark). Bids for the stock must be lodged by the 7th February, 2022.

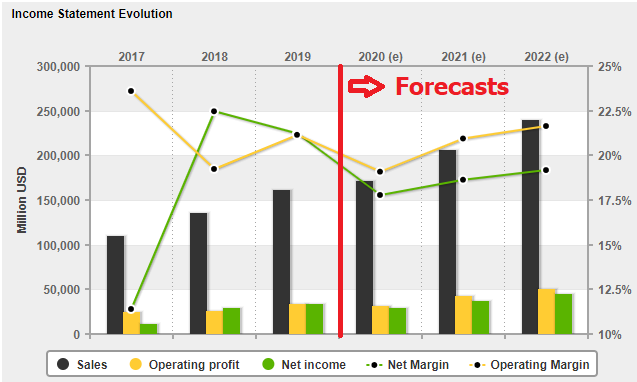

“The combination with Vifor Pharma is expected to be financially compelling for our shareholders while expanding and diversifying our revenue base. It is expected to be immediately earnings accretive in the first full year of CSL ownership …”

Paul Perreault, Chief Executive Officer and Managing Director of CSL

Nice words Mr Perreault … but I have never ever read a share purchase plan that didn’t offer these comforting sentiments – CEO’s usually love to inform us of their astute decisions. “earnings accretive” just means that after all costs and synergies, the earnings per CSL share (EPS) should go up … and, when earnings go up, the share price should go up.

The projections for acquisitions and mergers are always complicated – the only real proof … will be down the track.

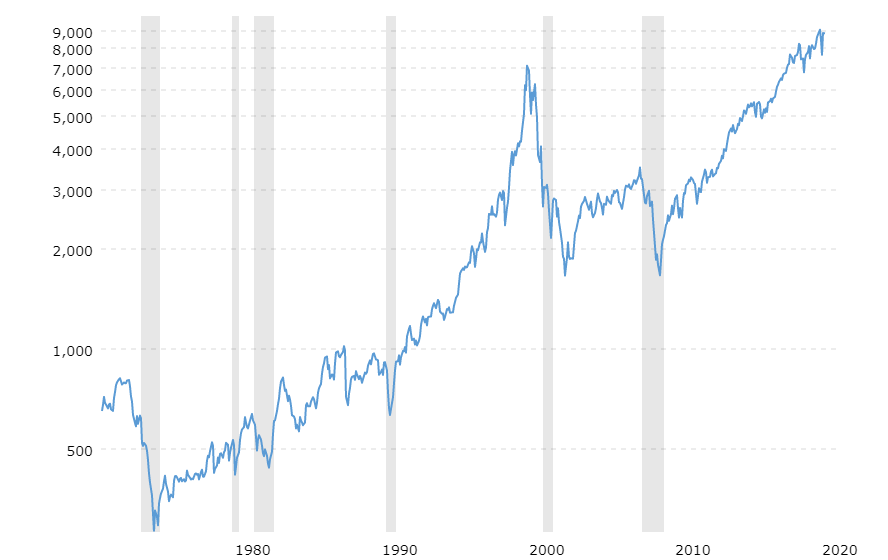

(There is) 30 years of evidence demonstrating that most acquisitions don’t create value for the acquiring company’s shareholders

Harvard Business Review

CSL do have a good track record of acquiring new assets and turning them into future growth engines. However, The CSL offer to acquire Vifor Pharma was generous at 40% above the Vifor list price. But this is where it gets even more complicated, the size of the premium is historically not a good predictor of how the deal will turn out. The most pertinent question is “Has CSL paid more than the acquisition was worth to to CSL.” Slack Investor has no answers yet … We will see how this deal settles.

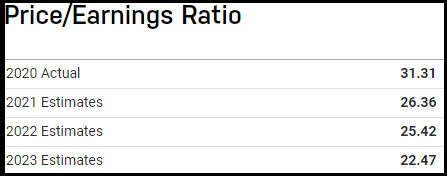

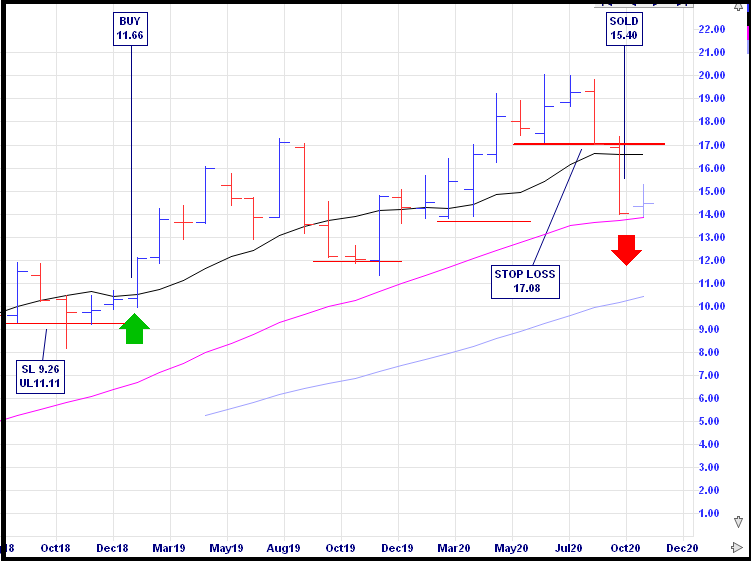

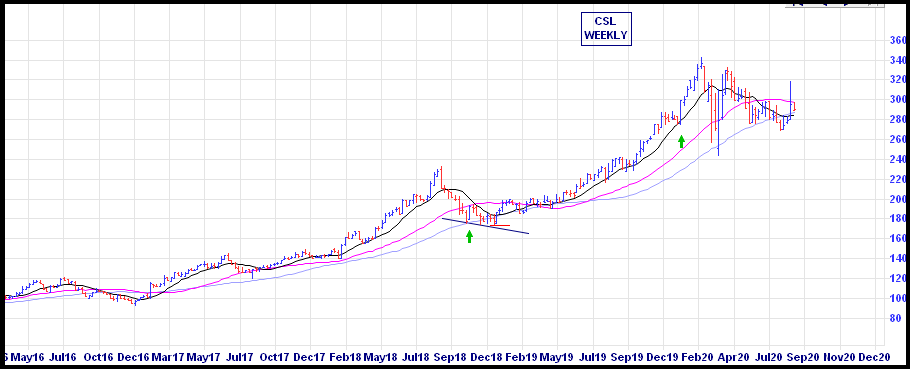

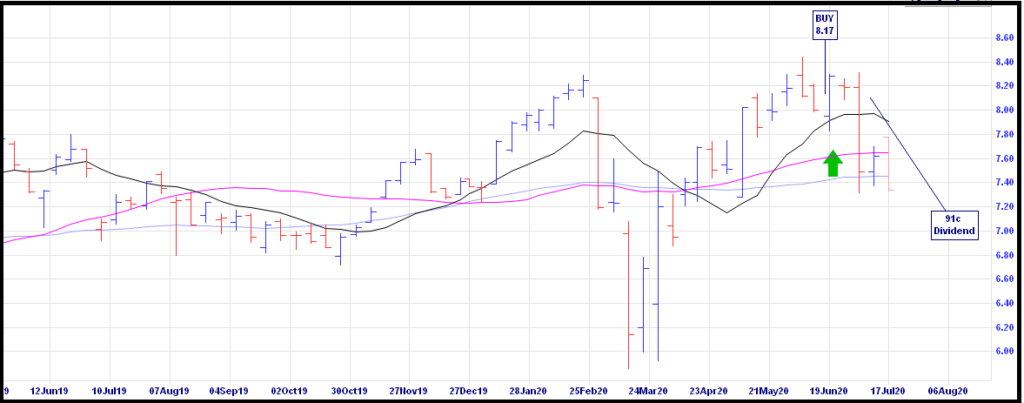

On 14/01/2022, the CSL share price was $276.00 – A premium of $3.00 to the $273 offer price – or about 1% – so the SPP offer price is no real bargain. Despite Slack Investor’s endless devotion for the company, it seems that the market is currently out of love with CSL.

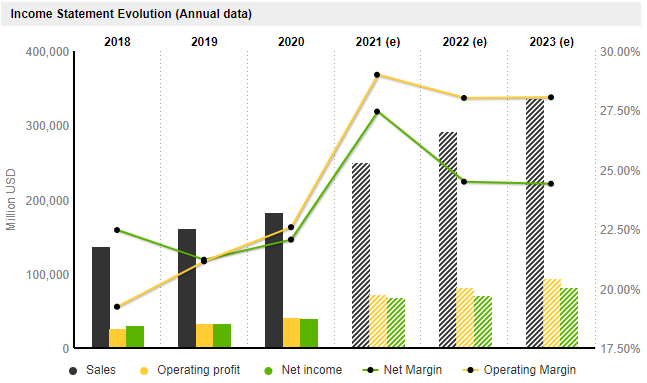

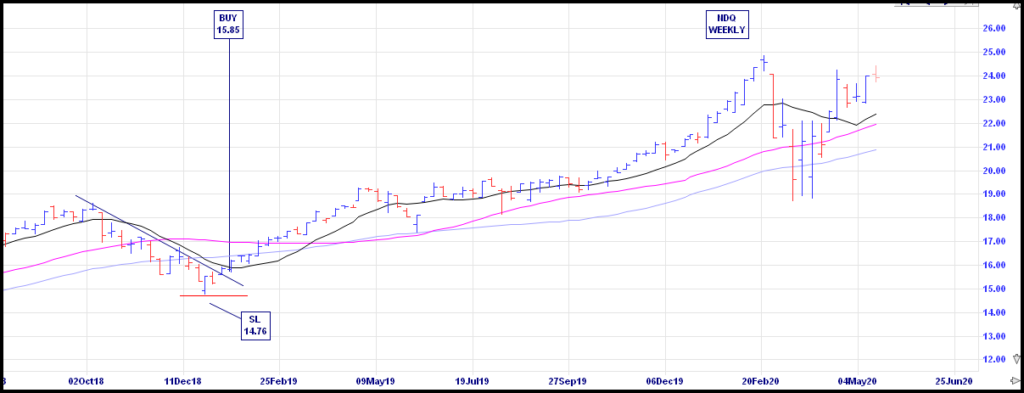

In the background, despite ongoing problems with plasma collection due to COVID-19, CSL has increased its profit for the past two financial years by 20% – but its share price does not really reflect that. After a rapid increase in 2019, the share price has gone nowhere in the last two years. Macquarie analysts have a 12-month price target on CSL of $338.

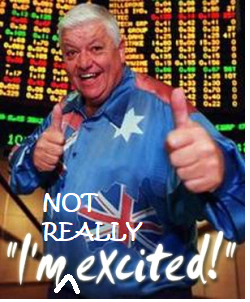

Unlike Big Kev, I’m not super excited … The investor presentation, as always, looks compelling – full of talk about global reach, synergies and “developing a significant renal franchise”. But what really impressed me was the confirmation of CSL FY22 NPAT guidance of US$2,150 million – US$2,250 million. This is not advice, even though Slack Investor already has a big holding in this company, he will be participating in a slice of the CSL 2022 SPP.

Scaling Back

One of the annoying things about share purchase plans is the “scaling back”. If the SPP represents a good deal … they are usually oversubscribed. The 2021 Commonwealth Bank (CBA) SPP was such a good deal for retirees that they stumped up $18 billion more than the amount of shares on offer. Their share bids were scaled back by 79.4%. If you applied for $20 000 of CBA, you would have to send off this amount – and you would have been rewarded with $4120 of shares – and then have to wait for your refund.

The CSL 2022 SPP is not as immediately financially rewarding as the CBA offer and will probably not be scaled back as much. CSL has assured share owners that after the SPP, they will at least retaining their percentage shareholding in the company,

Slack Investor has done some rough calculations. As this new placement and SPP represents approximately 5.1% of current CSL ordinary shares on issue -This means that I should be able to buy at least 5.1% of my current holdings in the SPP without the inconvenience of scaling back.

If I owned $120 000 of CSL shares, I would be guaranteed to get at least $6120 (120K x 0.051) in the new SPP without scaling back. I round this up to the nearest allowable dollar value parcel, which is $10000 – and that’s how much I will apply for. Most people would apply for more (up to $30K) – but my portfolio is heavy with CSL, and this scaling back process just annoys me! CSL will of course refund any scaled back monies as soon as practicable after 14/02/2022 – without interest.