On the theme of a trim … who doesn’t like a bit of topiary. My portfolio has had a little haircut in the past 3 months as I have been thinking about the potential of a recession and the effect it might have on my investments. Lacking the skills of Nostradamus, Slack Investor has chosen the “middle path” for his individual stocks i.e . Between doing nothing and “selling everything”, I have chosen to fiddle with about 20% of the portfolio. Some of the things I have bought are expanded on below, in order of investment commitment. This is not advice, just a random walk through stock selection. To make room for the new purchases I sold a few high PE stocks and a few underperformers. The sold stocks include APX, CGC, PMC, AGL and CTD.

Alphabet -Google ( GOOGL)

This is new ground for Slack Investor as GOOGL is US based company and the investment has the additional complexity that I have to use an international broker (Saxo) to purchase shares on the NASDAQ exchange. But, I feel the extra effort is worth it as I can’t think of a better company to ride with through the next 10 years.

Google search has 92% global market share. Chrome is the world’s most widely used web browser. Android is the world’s most popular mobile operating system with 2 billion-plus active users. YouTube is watched for more than 1 billion hours a day. Alphabet has about US$100 billion in cash which, for a sense of scope, is larger than the combined market values of Telstra, Woolworths, and Macquarie.

Joe Magyer from Motley Fool on the dominance of Google’s Alphabet

I use Google products countless times a day and with a Return on Equity of 21 % and a reasonable Price Earnings ratio (for the growth tech sector!) of 24. I would like to own more of this and will seek to add to my position over time. The international shares thing is a bit of a hassle and has some extra expenses. A far easier, way to get a slice of Google (and other great tech growth companies) is by buying the Australian-listed NASDAQ ETF (NDQ). Alphabet represents 8.6% of the NASDAQ Index.

Vanguard Australian Fixed Interest ETF (VAF)

For ETF’s, I naturally lean towards Vanguard due to their relatively low fees and a commitment to keep them low (Thanks Jack Bogle!) I bought this ETF to try and derisk my shares portfolio by getting some exposure to the Australian Government Bond and Fixed Interest Market. I have also bought some Vanguard Emerging Markets ETF (VGE) and Vanguard Global Infrastructure (VBLD).

Centuria Industrial REIT (CIP)

The lure of property rentals during tough times and a bit of exposure to Industrial Real Estate has brought me to this area. I was tossing up buying Goodman (GMG) or Centuria. Both have a similar Weighted Average Lease Expiry (WALE) and occupancy rate. GMG has a relatively high 2020 PE of 26.1 compared with a CIP 2020 PE of 14.8. CIP also has a more fruity yield of 5.7%. Case Closed.

United Overseas Australia (UOS)

A Malaysian real estate developer … Steady on, this sounds a bit wacky! – UOS is a bit of a speculator for Slack Investor. Real estate is a place where I am underdone and I am alway convinced by good arguments. A respected investor (by me), Tony Hansen, from EGP Capital has this stock as his highest portfolio allocation. UOS has a solid cash position, a decent yield and the discount to net worth got me over the line. What is life without a little bit of risk!

Fitcats – Get your super runnin’

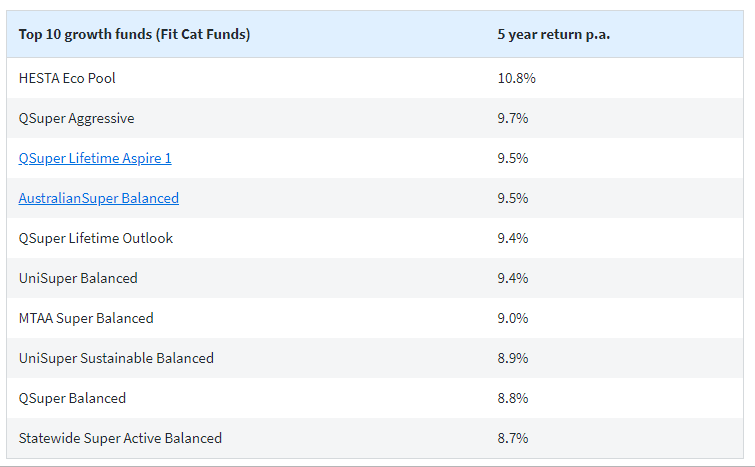

With apologies to the legendary Steppenwolf, Slack Investor has the news from Chris Brycki (the tireless CEO of Stockspot and author of the Fatcat/Fitcat report). He has produced his yearly assessment of the best super funds (Fit Cats) and the worst (Fat Cats). Fat Cat Super Funds on average charge 2% a year in fees, while, in comparison Fit Cat Super Funds charge less than 1% a year in fees.

“One of our golden rules of superannuation is; the less you pay, the more you get. Always pay less than 1% p.a. in fees so your super isn’t eroded by high fees. I know 1% doesn’t sound like a lot, but for the Aussies stuck in these Fat Cat Funds they’ll be worse off by $200,000 or more compared to their friends who are in a low-fee fund,”

Chris Brycki, Stockspot

So, if you haven’t already done so … get financially fit, grab yourself an account number in one of these top performers. Most will allow new customers. Then continue to get some Fit Cat action by asking your employer to make any future contributions to your new account. Then rollover your super to the new fund and your sweet.