In honour of the upcoming International Geek Pride Day to be celebrated on 25 May.

Being a geek is cool (Just ask Bill Gates!). They have rights … the top 5 rights of a Geek are:

1. The right to be even geekier.

2. The right to not leave your house.

3. The right to not like football or any other sport.

4. The right to associate with other nerds.

5. The right to have few friends (or none at all).

During the past month. Slack Investor has certainly lived the geek lifestyle and he has reflected on the magnificent gift that geeks gave to the world – technology!

The NASDAQ (National Association of Securities Dealers Automated Quotations) is a special US based electronic stock exchange that was created in 1971 and now lists over 3500, mostly tech, companies. The top 15 companies in the NASDAQ consist of the household names below.

| Name | Weight (%) |

|---|---|

| MICROSOFT CORP | 12% |

| APPLE INC | 12% |

| AMAZON.COM INC | 10% |

| FACEBOOK INC | 4% |

| ALPHABET INC | 4% |

| ALPHABET INC | 4% |

| INTEL CORP | 3% |

| NETFLIX INC | 2% |

| NVIDIA CORP | 2% |

| PEPSICO INC | 2% |

| CISCO SYSTEMS INC | 2% |

| ADOBE INC | 2% |

| PAYPAL HOLDINGS INC | 2% |

| COMCAST CORP | 2% |

| TESLA INC | 2% |

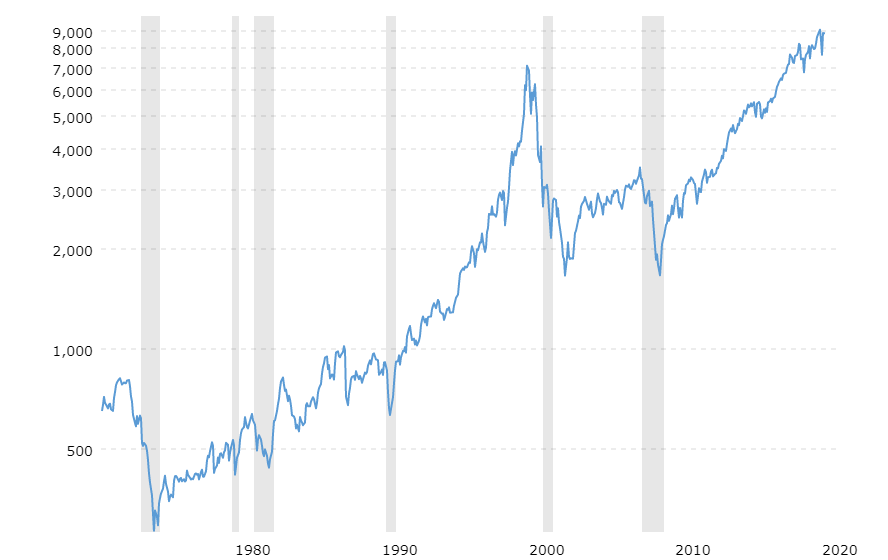

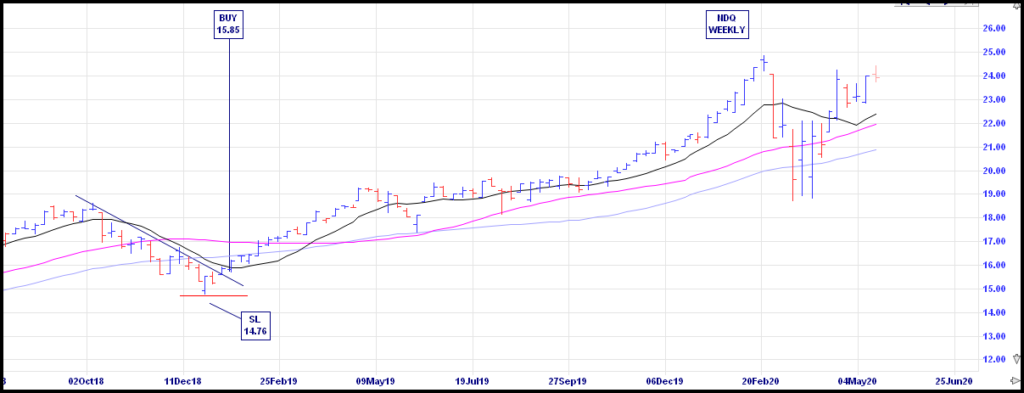

Despite a few downturns, mostly in recessions (shaded grey columns above), being invested in technology has really delivered. Betashares, an Australian company, offers simple exposure to the top 100 companies in the NASDAQ through NDQ, their Australian listed NASDAQ ETF. Slack Investor owns some US Listed shares directly and the hassle of different currencies, maintaining a US Broking account, and filling out US taxation forms make the NDQ ETF Management Expense Ratio (MER) of 0.48% seem reasonable. Morningstar also offers a Global technology ETF TECH. Good global technology access for a 0.45% management fee.

The use of technology to connect people and develop new businesses has been well demonstrated during the COVID-19 crisis – these tech businesses are growing. Slack Investor has a big amount of technology stocks – over 35% of his Portfolio. NDQ has grown over 50% in the 18 months since the original Slack Investor buy.

One of the things that Slack Investor has learned over the decades is that a high PE is OK, providing that there is a lot of growth involved. Stamped on the little Slack Investor brain is that technology is becoming increasingly important in our lives – this sector is definitely growing.

The NASDAQ index usually has a relatively high average PE Ratio – but as of May 13 2020 it has slipped down to a very reasonable 20.55. There is also a decent trailing dividend yield of 1.73% – the dividend is showing an increasing trend.

This is not advice, as Slack Investor has no divine guidance on what will happen in the next 12 months. – but, with a 2-3 year time frame, will Slack Investor invest more into NDQ or TECH as funds become available? You bet your geekin’ life he will!