… It’s going to rain and it’s going to blow

But it’ll be all right, it’ll be all right, it’ll be all right in the long run …

Excerpt from the “Long Run” lyrics by Redgum (John Schuman) released in 1980.

Slack Investor looks at the shares that he owns occasionally and has a bit of a tinker. Earlier this year I had a portfolio review that saw a dumping of managed funds and high fee ETF’s. I also made an attempt to exit shares that I thought might be severely affected by gloomy economic times. However, sometimes it is good to lift the sights to the horizon and forget about the short term pricing of the market.

“Over the 210 years I have examined stock returns, the real return on a broadly diversified portfolio of stocks has averaged 6.6 percent per year.”

Jeremy J. Siegel, Stocks for the Long Run

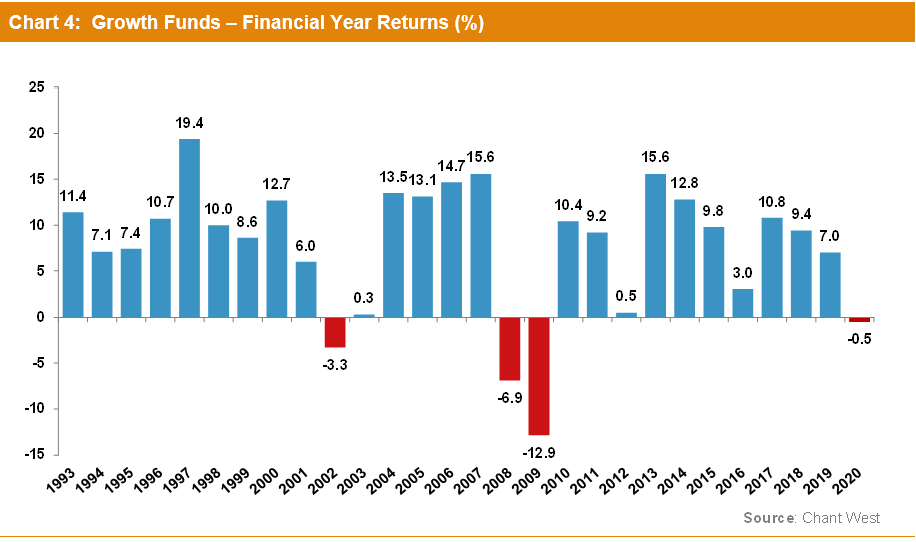

Although the last financial year was a bit bleak for the median of super growth funds (-0.5%), Slack Investor has been around long enough to know that the gloomy times are periodic, and that, “In the Long Run” shares are a very good investment – as can be seen on the 28-year performance chart below.

During my portfolio review I realised that over half my portfolio is in several companies that I would never sell – unless circumstances changed greatly! These companies usually have great management, a plan for growth, and an established track record in increasing Earnings per Share (EPS). Prices may go up and down, but great companies ride though all this and figure out a way to keep growing.

Coles (COL)

COL (2022 ROE 36%, 2022 PE 23) – With around 30% of all supermarket sales, Coles is one of the lucky retailers classified as essential and is getting a boost from COVID-19. This boost wont last forever, and, I cant see any big growth ahead. But, I can’t see myself selling this company as I visit it twice a week to “kick the tyres” and they are doing a good job. There is also the perverse satisfaction of knowing that if I am waiting at the checkout for a time … that it must be good for the bottom line!

Altium (ALU)

ALU (2022 ROE 32%, 2022 PE 56). The PE ratio of Altium has it priced for big future growth and it would be a stretch to buy it now. But this printed circuit board designer is a company for the times and it has a well defined, and so far achievable, global growth strategy.

Although relatively expensive (Forecast PE 56), Altium has no debt, a decent cash balance and keeps growing its profit margin and market share. In 2019, Altium spend 14% of its revenue on Research and Development – This is a commitment to growth in a changing industry.

Commonwealth Serum Laboratory (CSL)

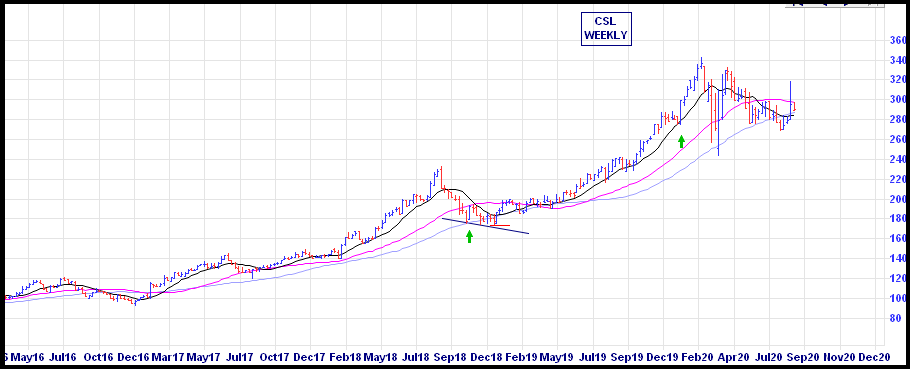

CSL (2022 ROE 29%, 2022 PE 38) – Slack investor first bought into this company 10 years ago at around $30 and I have had the good fortune to add to my holding (at much higher prices!) along the way. CSL is expensive at a forecast PE of 38, but I can remember at my initial purchase in 2010, I thought it was expensive then! With great companies, sometimes you just have to hold your nose and jump in – they are rarely cheap! If it wasn’t already such a large part of my portfolio, Slack Investor would buy more CSL if I could get it below $300. The price chart below is reassuring.

Alphabet – (GOOGL)

(GOOGL – 2022 ROE 18%, 2022 PE 24). Alphabet is listed on the US-based NASDAQ exchange and needs an International Broker to invest directly (Commsec will set you up for a cost of 0.31% for trades above USD $10,000). For a growth company, Alphabet is not outrageously expensive with a forecast Price to Earnings Ratio of 24.

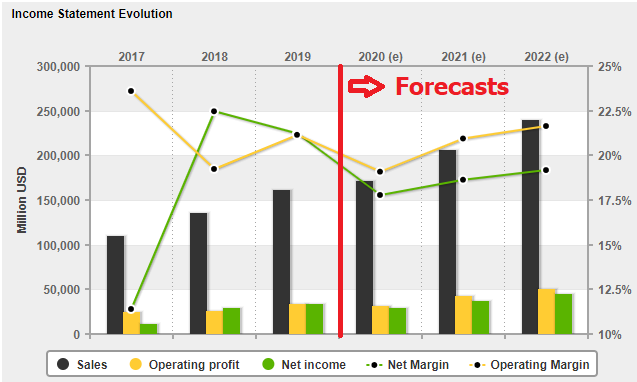

One of the first charts I look at before buying a stock is how its income has evolved – Thank you Market Screener. The GOOGL income chart below is typical of how I like to see them. A steady track record of 3 years growth of sales/income, and then a plan to grow income over the next 3 years.

A common theme amongst companies that I am reluctant to sell is their willingness to invest in new projects that might feed back into the earnings of the company. Alphabet spent a staggering US$ 16.2 Billion on research and development – 14.6 % of its revenue in 2018

BetaShares NASDAQ 100 ETF – (NDQ)

(NASDAQ Index – Current ROE 14%, Current PE 23) – Australian exposure to this index comes at a cost (MER of 0.48%) through the NDQ Betashares ETF, but Slack Investor thinks this is well worth it – my costs in owning GOOGL directly are around 0.43%. This ETF is Slack Investors favourite way to own International Tech stocks. With NDQ, you get exposure to 100 of the world’s best tech companies. The NASDAQ Index is a collection of growing household tech names e.g. Apple 13.9%, Microsoft 11.2%, Amazon 10.9%, Alphabet 7.2%, Facebook 4.5%. With a forecast PE of around 23, it still looks reasonably priced if tech world keeps growing.

August 2020 – End of Month Update

Slack Investor remains IN for Australian index shares, the US Index S&P 500 and the FTSE 100. Rises all round for Slack Investor followed overseas markets this month ( ASX 200 +2.2%; FTSE 100 +1.1%) In Crazy Brave USA, the S&P 500 had a monthly rise of an astonishing 7.0%.

At the end of August, the US S&P 500 had a 12-month trailing PE Ratio of 30.09 . The mean and median values are 15.81 and 14.83.

In the real world, the US economy entered a recession in February 2020 and Slack Investor has his stop losses live for all Index funds.

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index).