“He said, “If you’re gonna play the game, boy

You gotta learn to play it right …You’ve got to know when to hold ’em

Excerpt from “The Gambler” written by Don Schlitz and recorded by Kenny Rogers.

Know when to fold ’em

Know when to walk away

And know when to run

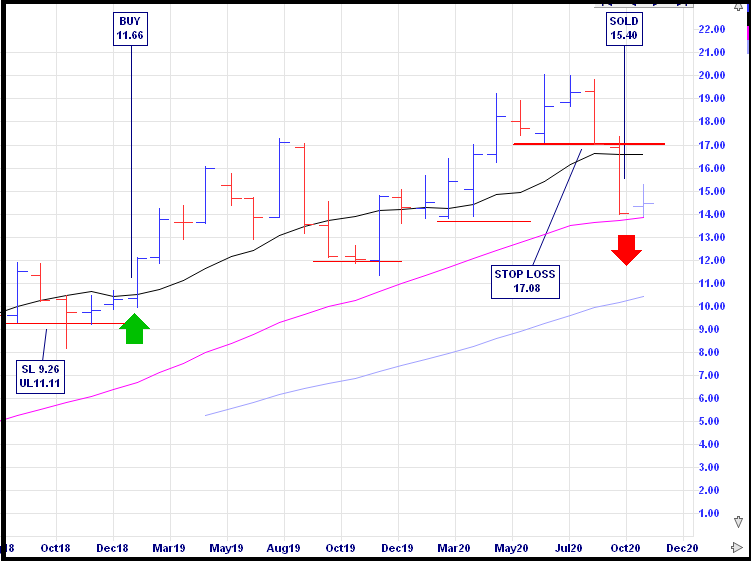

Kenny makes this sound easy, but selling shares is tricky and Slack Investor does not always get this decision right – and I’m OK with that. The Slack Investor art is just to attempt to get things “mostly right”. There are some stocks that I will hold for the long run, and their weekly and monthly charts are not of a big concern to me. However, about half of my portfolio is on a weekly or monthly watch – I review the Incredible Charts output for each of these stocks on the weekend or at the end of the month.

I pay particular attention when the stock price falls below my stop loss on the monthly chart. In hindsight, I should have been more alert back in August. A2M is a good company with a unique product and has shown excellent growth in the last 5 years. However, earnings season is always a bit volatile for the growth sector.

The FY20 results showed a record profit but there were some question marks about FY21. The real catalyst for a downward price move was the later release of an acquisition and that members of the board and senior executive team had sold over 1.8 million shares. Selling by insiders is not always bad, as the executives might just be diversifying their portfolios – However, in this case, the market took a dim view. Overall, the A2 Milk Company Ltd (ASX: A2M) share price has slumped more than 15% since the release of its FY21 outlook.

I am not known for my fast work and have tended to take the couch rather than make a decision in the past. However, in the spirit of incremental improvement, I didn’t wait till the end of the month and pounced on the sell button on the day that the A2M fell more than 10%, 28th September 2020.

I am not put off A2M forever. The end of month share price was $13.67. There is now a reasonable case for re-investing given the growth pathway beyond 2021 and the Market Screener , relatively low, 2023 predicted PE of 19. There has now been a downward trend of 3 months and Slack Investor’s favourite pattern has started to emerge … “The Wedgie”. If there is a break above “the Wedgie”, I will reinvest and hope the share price resumes an uptrend.

” … the secret to survivin’

Further … from The Gambler

is knowing what to throw away,

and knowing what to keep …”

Ooooh Kenny … the secret to investing is simple to describe, but harder to do … but you knew how to tell a good story!

October 2020 – End of Month Update

Slack Investor remains IN for Australian index shares, the US Index S&P 500 and the FTSE 100. However, the US and UK charts are hovering close to their monthly stop losses.

The state of recent COVID-19 surges in Europe and the US seems to be worrying punters and monthly falls were recorded in these markets (S&P 500 -2.8%; FTSE 100 -4.9%). In Australia, the governments are handling the response to the virus in a constructive fashion and the ASX 200 rose 1.9%.

On the ASX 200 Index monthly chart, a new “Higher Low” was established and this gave me the opportunity to move up my monthly stop loss to 5763.

The US economy entered a recession in February 2020 and Slack Investor has his stop losses live for all Index funds.

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index).