Cripes … it seems that even cyber criminals with circuit board faces wear hoodies!

Slack Investor has had minor issues with PC viral infections over the years – these types of virus seem very benign in current circumstances. I also had a distant brush with a more organized form of cyber hacking back in 2015 with my previous employer.

“I can confirm reports that the Bureau of Meteorology suffered a significant cyber intrusion which was first discovered early last year”

Prime Minister Malcolm Turnbull in 2016 – the ABC News

Were the Chinese after my 30 years of sea breeze wind data? Probably not. This breach triggered an injection of government funds to try and combat cyber attacks. More recently, the current Australian government is talking about a huge $1.35 billion investment to increase Australia’s cyber security capabilities, Even smaller businesses are having to invest in cyber security as technology invades our lives.

As well as worrying about cybersecurity, the COVID-19 crisis lurches on. It is not just the retailers that are suffering, In the US, major companies such as Hertz and several US airlines have recently filed for bankruptcy due to COVID-19. At the moment, many companies are drawing down on available credit, standing down their staff, delaying projects and taking advantage of government relief programs.

It will be a delicate dance by national governments trying to support the economy with limited funds until a viable vaccine is established. When they halt these stimulus programs, each company will start burning through their cash. That’s when bankruptcy cases are likely to soar and stay elevated.

… this year (2020) will easily set a record for so-called mega bankruptcies — filings by companies with $1 billion or more in debt … the number of merely large bankruptcies — at least $100 million — to challenge the record set the year after the 2008 economic crisis.

Edward I. Altman, Professor Emeritus of Finance at New York University’s Stern School of Business – from Intelligencer

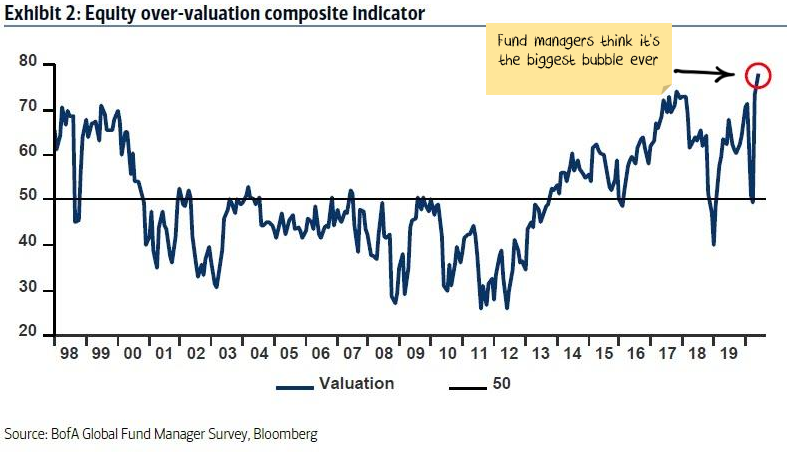

Slack Investor has been a big fan of some of the companies in the technology sector – as these shares are exposed to growth. This internet thing keeps increasing its grip on our lives. The recent “recovery rally” has led to stock prices being “fully” or “over valued” – particularly in the US. It is difficult to argue against this in these uncertain times as estimates for future US earnings decrease.

In an environment when many sections of the economy are in big trouble, in many ways, it might be a good time to take a bit of risk off the table and build up a little cash. However, not all tech companies are tied to the consumer economy and there will be a continuing need for individual companies and governments to make investments for the protection of their internet structures. Cyber security is now the fastest growing technology sector.

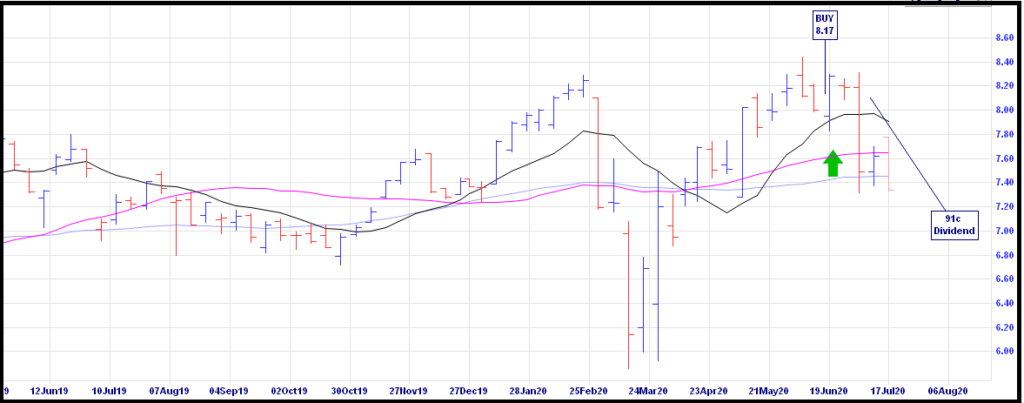

BetaShares Global Cybersecurity ETF (HACK)

HACK is a BetaShares ETF that provides exposure to the leading companies in the global cybersecurity sector. Most of these companies are based in the US (87%). HACK is currently invested in 49 companies that include well known names such as Broadcom and Cisco. There are many other companies that Slack Investor has never heard of such as Crowdstrike, Splunk and OKTA – and, I assume the fund managers know much more about the sector than I do.

The management expense ratio is high at 0.67%. I will “suck this up” while it is performing well. Can’t argue with past yearly HACK performance – over 1-year (+19.9%) and 3-years (+20.3%). Probably not the best time to buy, but Slack Investor can’t help himself – this must be close to a recession-proof section of the economy. I dived in last month as I can’t resist a growing industry!

I would put more faith in that ‘exhibit 2’ chart if it had given any warning of the 2007/8 bubble and GFC crash.

Covid-19 will definitely be causing lower GDP, higher unemployment, and a spate of company bankruptcy during the next 1-2 years, but balanced against expected lower company dividends is the reality that interest rates have been dropped to effectively zero around the world and are likely to stay there even as company profits rebound (for the survivors) in 2-3 years time. So whether current stock valuations (which are after all a PV estimate based on future dividends, capital gains and the risk-free interest rate) are a ‘bubble’ will depend (as always) on how things play out in 2021 and beyond.

A good point on the chart Enough Wealth … I also puzzled on why the valuations prior to the GFC were not high … I will have to dig deeper at the original source. I agree, it is a complicated mix at the moment and the low cost of money does support higher valuations – but there is always a point where things become unstuck. Nice to hear from you! Your most excellent blog was the first Australian finance blog that I ever engaged with – An inspiration to me! I look forward to your future posts … Cheers, Slack Investor.