Like Sally, one day the realization will come that your best interests rely on you steering your own bike – in the direction that you want to go!

The ultimate goal is to get your three substantial piles going – house, income and investments. But before any of this happens you have to develop a mindset … I want to be in control of my financial life.

You must gain control over your money or the lack of it will forever control you. —

Dave Ramsey – Author of The Total Money Makeover

If you don’t take control, perhaps you’re plan is to take all your affairs to a financial adviser one day. Most people will feel the need for financial advice at some stage but only 20% of Australians have a financial advisor. The current structure makes getting advice a difficult step – and it’s not the financial advisors fault.

The pricing problem of Financial Advice in Australia

64% of survey participants agreed that financial advisers were too expensive.

ASIC Survey August 2019 – Financial advice: What consumers really think

The Australian Government passed a piece of legislation known as the Future of Financial Advice (FoFA) in 2012. FoFA was a series of laws that were supposed to improve the quality and transparency of financial advice. One of the main purposes was banning conflicted remuneration – where advisers were recommending products that gave them good commissions. While FoFA and the Hayne Royal Commission were well intended and vital in restoring some trust in the sector – there have been some unintended consequences.

(The Financial Services Royal Commission) identified the problem of conflicted remuneration without providing a mass market solution.

Graham Hand, Firstlinks – FoFA, the Failure of Financial Advice

There has been a huge rise in regulatory red tape and the associated compliance costs for financial planners. A combination of these costs, the big banks dumping their financial advice arms, and the need for upgraded qualifications has put this sector in crisis. The total number of licenced advisers is set to drop by a third in the next few years.

There is broad recognition that financial advisors have expertise that the normal punter does not have. However, the biggest barrier to getting financial advice is the expense. One of the big problems is that when you engage a financial advisor, they are obligated to present you with a full Statement of Advice (SOA). On the surface this makes sense, the client would want a document that takes into account your own circumstances and outlines the fees and risks of each strategy. However, according to one planner, the SOA has turned into pages of jargon, repeated disclosure and boring generic graphs. These statements are weighty tomes that take many hours to prepare. Sadly, they seem to confuse the actual advice and provide no real value to the client.

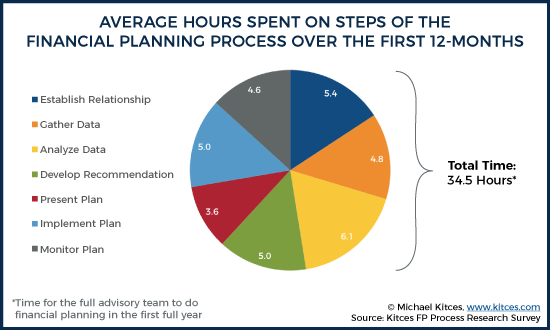

A full Statement of Advice (SOA) runs over 100 pages and the need to review all circumstances and develop a plan takes 10 to 15 hours and costs between $3,000 and $5,000 depending on complexity.

Graham Hand, Firstlinks – FoFA, the Failure of Financial Advice

James Kirby from The Australian uses the example of paying annual adviser fees fees of $3000 and he supposes that the structured advice that you receive will match the 4.3% pa return of the new Magellan retirement income product Magellan FuturePay (FPAY). He points out that for an investment of $500 000 and an expected FPAY return of $21 500, your advice fees would be 14% of your earnings. This does not make sense to him … or Slack Investor.

James Kirby suggests that a better model for the regulators to adopt would be that you could approach a financial adviser for advice that you need at the time … and pay the financial adviser for this “niche” advice. This is not possible under current legislation.

Take charge

So, with full service financial advice gravitating towards high net wealth clients, what is the average punter supposed to do? Robo-advisors such as Stockspot could be part of the solution. This automated service can provide help with allocation of assets other services that will suit your age and risk profile. But there are so many more financial questions you might want to handball to your financial adviser if you could afford one. Well, if you can’t … it’s up to you.

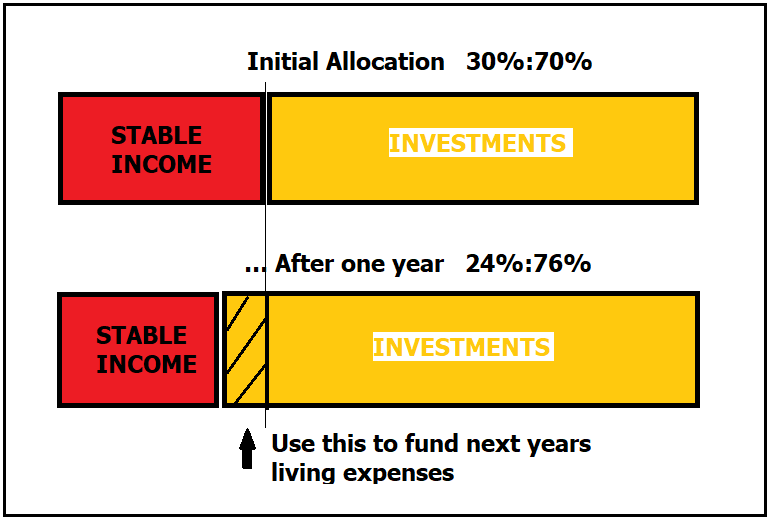

Decide what you want to achieve in the finance sense. Go through the savings basics and get your savings rate up. Take charge on where your money goes, get your superannuation set, reduce any unnecessary fees that you are paying, set a target on your financial piles.

Educate yourself on things financial. There are some great books. The Barefoot Investor is an excellent start. Some fabulous podcasts The Australian Finance Podcast will get you going and there are heaps of other Slack Investor favourites. Get involved and start to enjoy the immense freedom and satisfaction of riding your own bike.

Happiness is not in the mere possession of money; it lies in the joy of achievement, in the thrill of creative effort.

Franklin D. Roosevelt