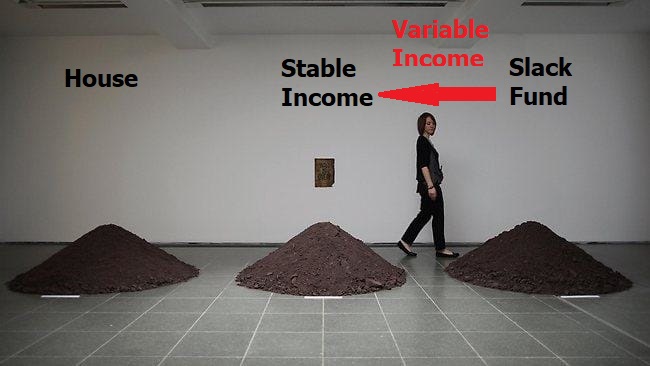

Slack Investor presented his version of a bucket strategy – The “Three Pile Theory”. It is the three pillars of a House, Stable Income, and Investments that have supported me through most of my working life and now the three piles are still supporting me in early retirement.

These piles have been continually interacting with each other as I was trying to build them all up. At the start, the Prince of all piles was a good income and, as I have very poor entrepreneurial skills, the key for me to get a good income was to have a good education. I was lucky enough to have parents that encouraged me to go as far as my wit would take me.

Without education you’re not going anywhere in this world

Malcolm X

When originally talking about three pile theory, I glossed over the retirement phase and how the investment and stable income piles can keep you going … hopefully, for a long time. By retirement, if possible your house will be paid off – and this will be left as a dormant house pile which keeps giving back in lots of ways … but only as a last resort will you use it to fund your lifestyle in retirement!

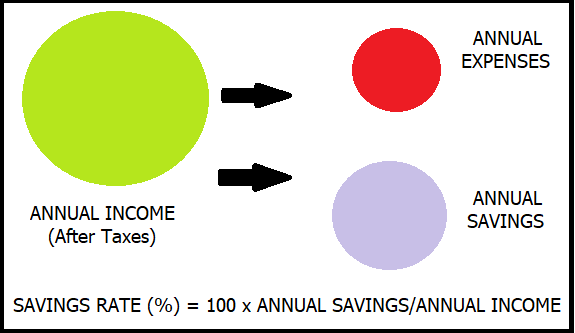

Lets do the sums on just two piles – Your Retirement Fund

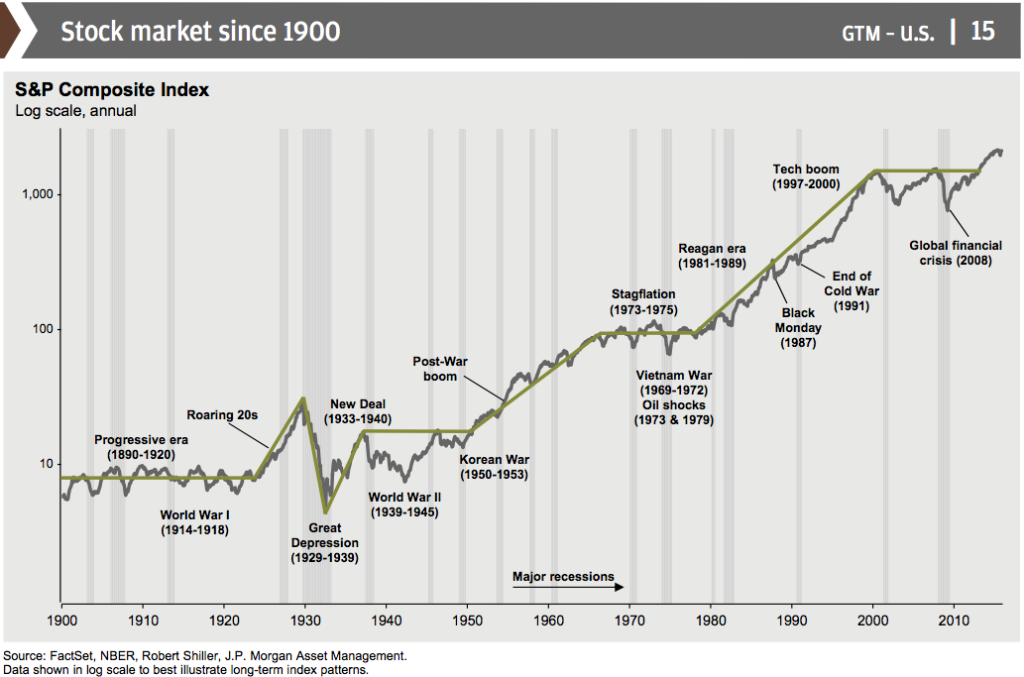

Consider a retirement fund with just two piles – Stable Income and Investments. In order to generate 4% of income per year, you need have most of your retirement fund in investments rather than stable income. According to his two pile theory, Rob Berger from Forbes Magazine recommends that you should have between 50% and 75% of the retirement fund in the investments pile 0f equities (stocks). Decide on a ratio of stable income to investments that you can sleep well with – a higher amount investments will mean potentially more growth … but definitely more volatility.

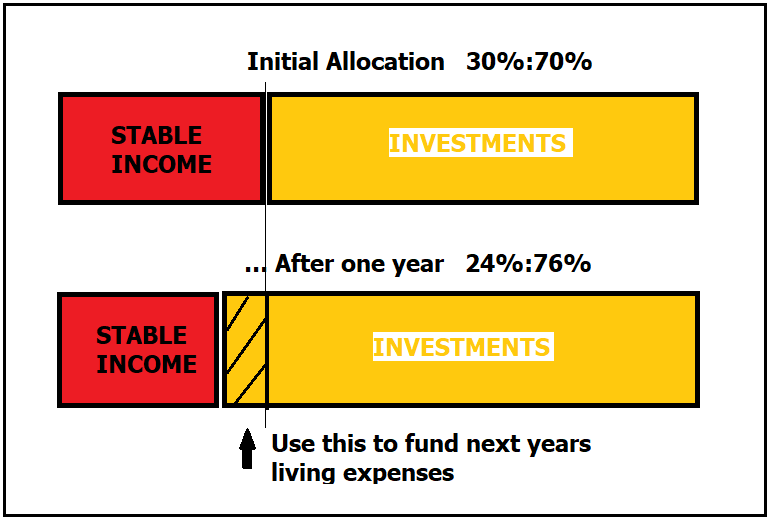

A bit of mathematics here … my original ratio of house:stable income:investments was 30%:20%:50%f Net Worth. When taking my house out of the calculations, my ratio of Stable Income: Investments is about 30%:70% – this is just the numbers that I am comfortable with.

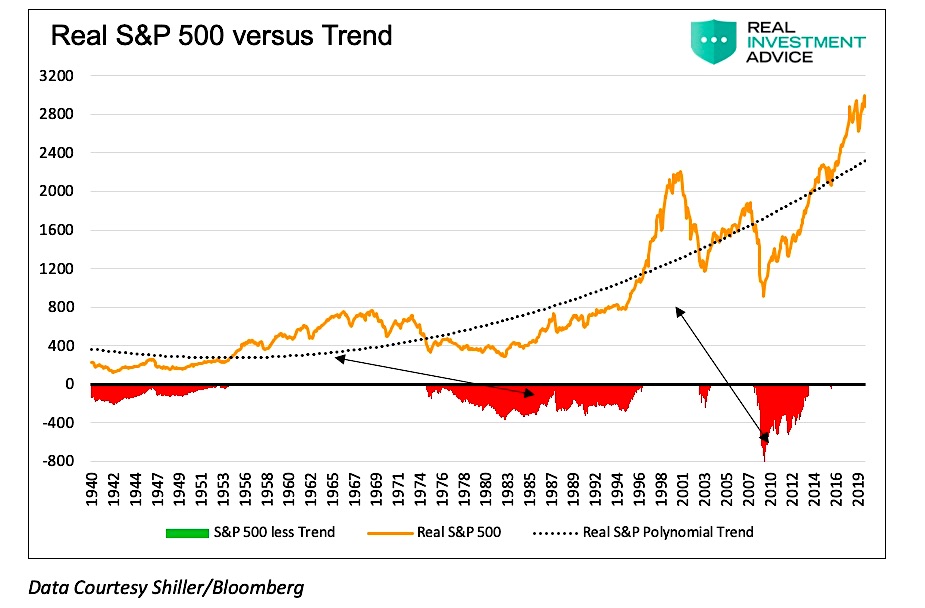

My original plan was to use dividends and interest from the two piles of my retirement fund to give me income. That means taking out money from both piles every year – even when stock markets have fallen. Rob Bergen points out that this is exactly the wrong approach. Taking dividends out reduces the investments pile – it has the same effect on your investments pile as if you sold some of your stocks. In a down-trending stock market, for your long-term investments pile, you want to use those dividends to reinvest in a stock market that is undervalued.

(Using the traditional bucket strategy), assets are taken from (Investments) when market prices have fallen, which is exactly when dividends should be reinvested.

Rob Berger – outlining the folly of taking money out of your Investments account when the market is falling.

How to make your piles last in retirement phase – Rebalancing the Retirement Fund

This heading has Slack Investor lapsing into what my mother called “Plumber’s Humour”. Using the Rob Berger simple strategy, you maintain your piles. Even though you have the competing interests of wanting to withdraw annual amounts for a great lifestyle, and yet, keeping enough in your retirement fund to generate future income for many many years. There are lots of articles on buckets to fund your retirement but, it can get complicated – I really like the clarity of Rob Berger’s approach. He explains in detail how the traditional bucket strategy is flawed.

By the time you retire, you will have a good idea of your expenses, While you are healthy and fit, add a good chunk of income to fund some travel. At the start of the financial year, this amount gets withdrawn to your cash account to fund yearly living expenses. The remainder is your retirement fund comprising of Stable Income pile (Annuities/Bonds/Term Deposits/Fixed Interest) and Investments pile. Slack Investor is happy with 70% of his Retirement Fund in Investments (Equities/Stocks).

In a good year for investments (outlined above) your next years annual income requirements can be withdrawn from the investments pile. If you get a bad year for investments, then dip into the stable income pile. Take out enough from each pile so that after your yearly expenses withdrawal, the initial allocations are roughly intact – I should do some algebra here to make this easier … but you can do it for your homework!

Using this method, you are always selling from your investments pile when the market is high and buying when the market is low – masterful investing, Warren Buffet would approve!

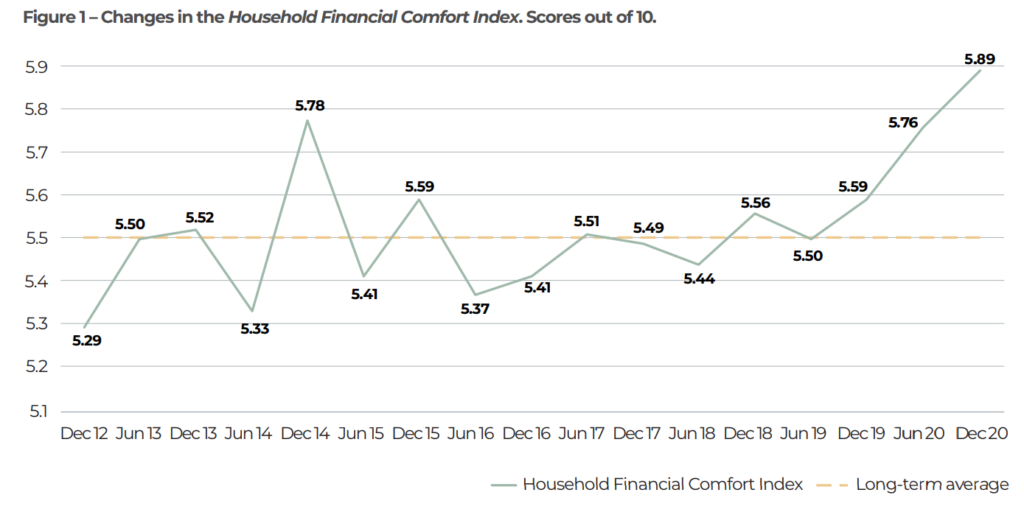

May 2021 – End of Month Update

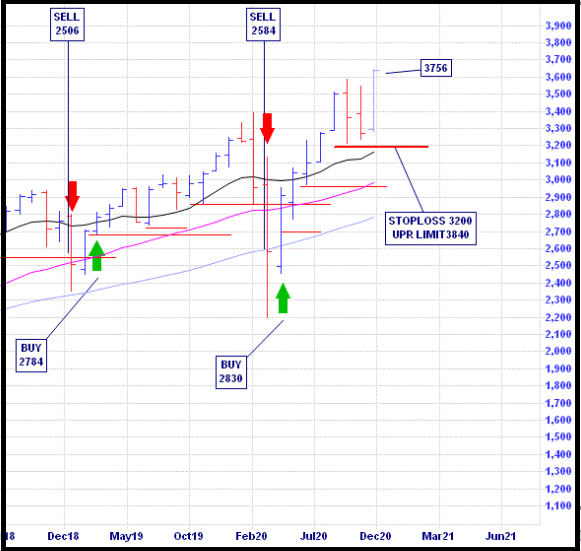

Slack Investor remains IN for Australian index shares, the US Index S&P 500 and the FTSE 100.

There were modest rises in all followed overseas markets (S&P 500 +0.6%, and the FTSE 100 +0.8%). The Australian stock market is powering on (ASX 200 +1. 9%) despite Slack Investor and the state of Victoria being in a (hopefully only one week!) COVID inspired lock down. All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index).