Slack Investor remains IN for US, UK and Australian index shares.

Slack Investor remains IN for US, UK and Australian index shares.

The Australian Index (+0.5%) has been a bit of a laggard with the banks still generating bad news and signs of the Australian property market starting to slow. The UK Index (+2.3%) and the US index (+2.2%) have continued to have solid growth.

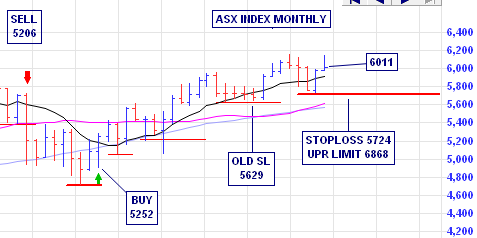

The good news on the Australian Index (ASX 200) is the opportunity for Slack Investor to crinch up his stop loss from 5629 to 5724. A small movement upwards, but I always like doing this as it means that the Index has now set a new “higher low” The explanation for this technical stuff can be found here. A new “low” (or minimum) has been established at 5724 and this is my new stop loss on the monthly chart

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index).

Productivity Commission gives the Super Industry a bit of a “Ginger Up”

I have been a fan of Australia’s Productivity Commission (PC) ever since I read their 2010 report into the sorry state of Gambling in Australia. The report is full of thought provoking and shameful material like- Australia is the world leader in number of poker (slot) machines per capita and Australia leads the world in gambling losses per person – but I digress…

The “Ginger Up” refers to an ancient horse racing practice that I wont elaborate on here – but it does make me squirm! The PC have just delivered their draft report on the state of Superannuation in Australia. God bless them .. they have put in “black and white” the rorts that exist in Australia’s good but not great superannuation system – and they have created a new Slack Investor hero.

The lead author in the report is the Productivity Commission deputy chair Karen Chester who has delighted Slack Investor with the following refreshing quote. Ms Chester’s attitude was like a snowball in the face after the my last depressing post on the mostly self interested world of banks and financial advisers.

“the only thing I care about is member outcomes” from source

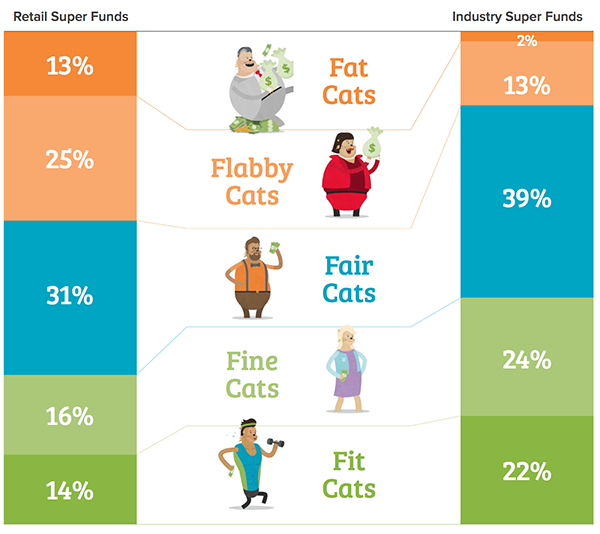

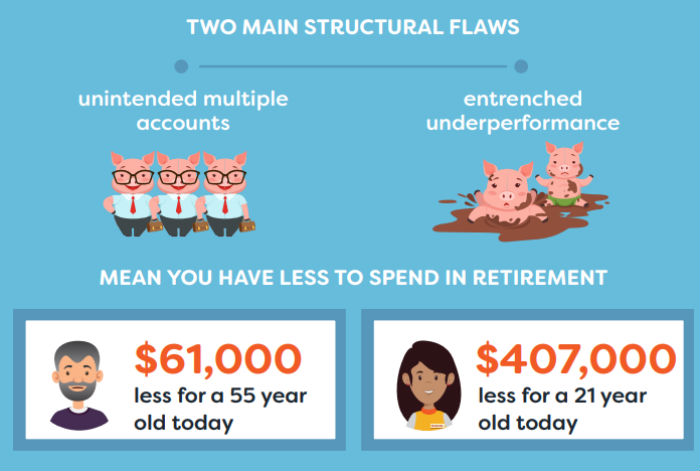

The Productivity Commission identifies two structural problems with Australia’s super model. The unintended creation of multiple accounts and the entrenched underperformance of some of the super funds that are allocated to the employee.

“Members are really lost in the weeds of product proliferation with 40,000 products. They’re bamboozled by poor disclosure and … poor advice.” Karen Chester from source

I am hoping that Ms Chester will get the final report out with haste. Slack Investor loves the smell of the draft report. The Federal Government would do well to take up her recommendations. The info graphic above puts some real world figures on what might happen if the PC recommended changes to Australia’s superannuation model are adopted.

It is a promising sign that the current Finance minister seems to recognize the problem.

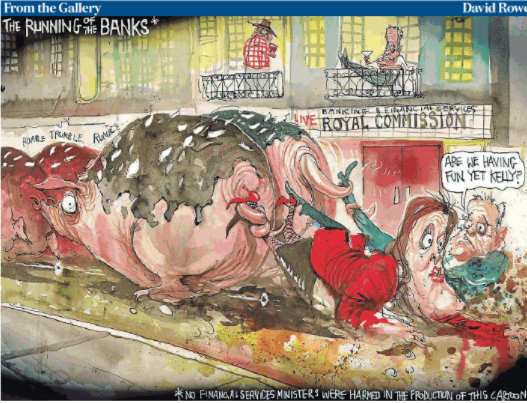

“Super has become worse than a honey pot; it’s a trough.” – Financial Services Minister Kelly O’Dwyer source

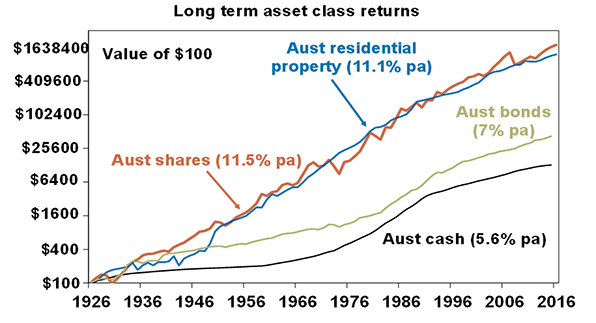

Slack investor will look at the “trough” and PC draft recommendations in the next post. There are things you can do right now to protect your super.