Slack Investor is a little bit saddened to discover that the great combination of the “fearless girl” and the “Charging Bull” in New York City was only a temporary thing. The girl was removed at the end of November 2018 due to an artistic dispute with the Bull creator Arturo Di Modica. The “Charging Bull” remains in Manhattan as a reminder of the inspiration that a bull market can bring after a market crash.

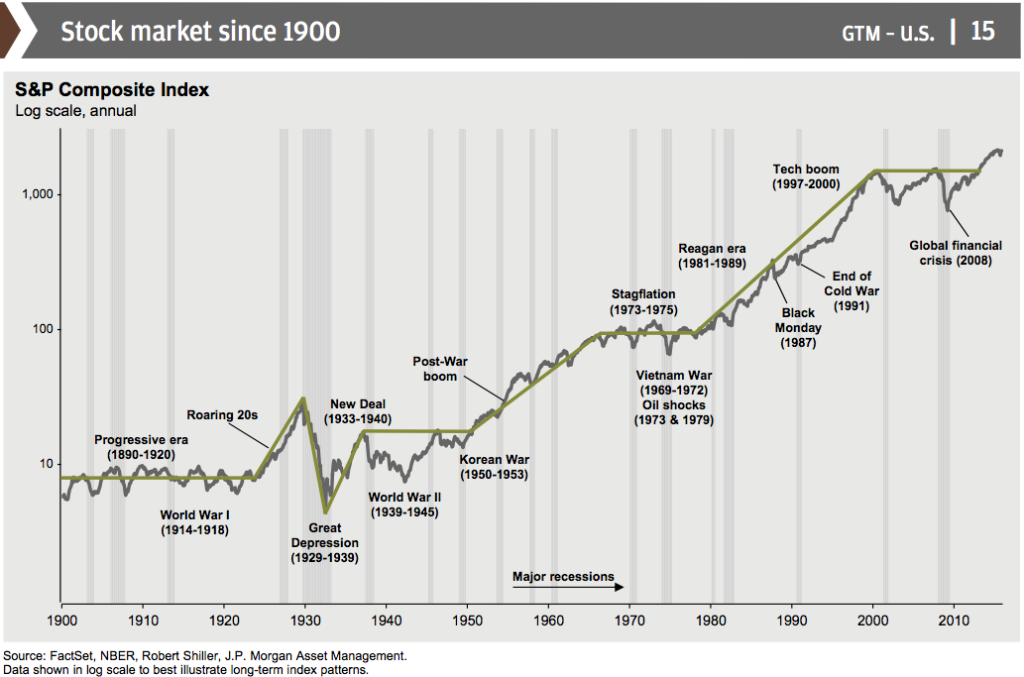

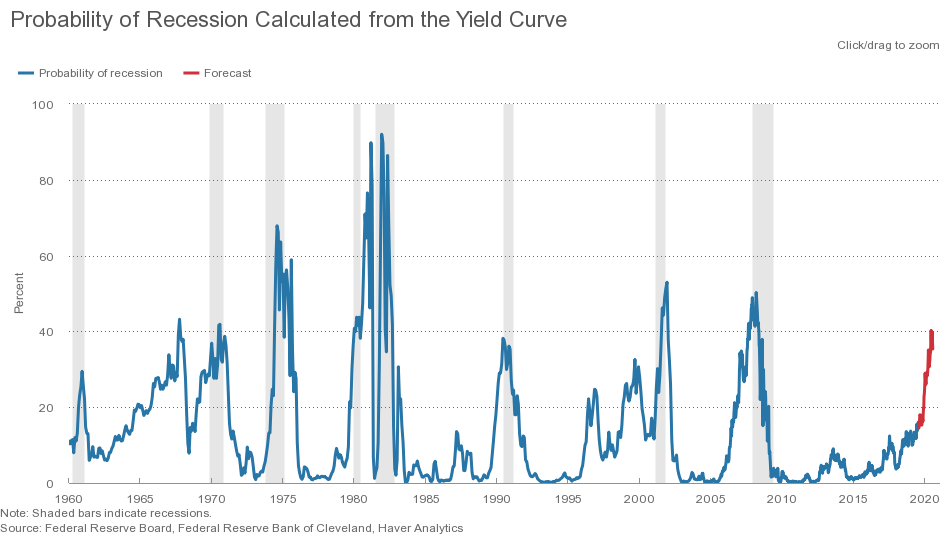

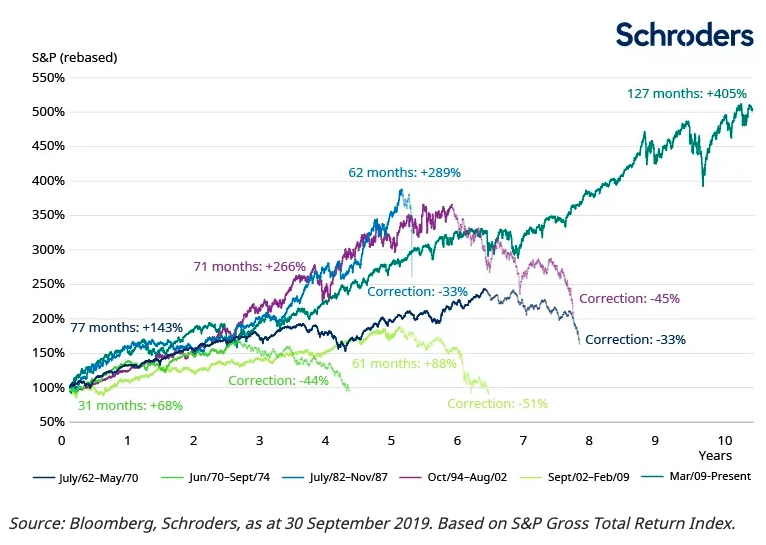

Bull Markets start when there is a 20% rise in the stock market from a previous low point. The current Bull Market has been a whopper – although there have been a few “corrections” along the way, it has now lasted over a decade and is setting new records (see chart below). The reasons behind this magnificent rise are obvious in hindsight – a mixture of the rise of technology stocks and a slow-but-steady economic growth, record corporate profits and record low interest rates.

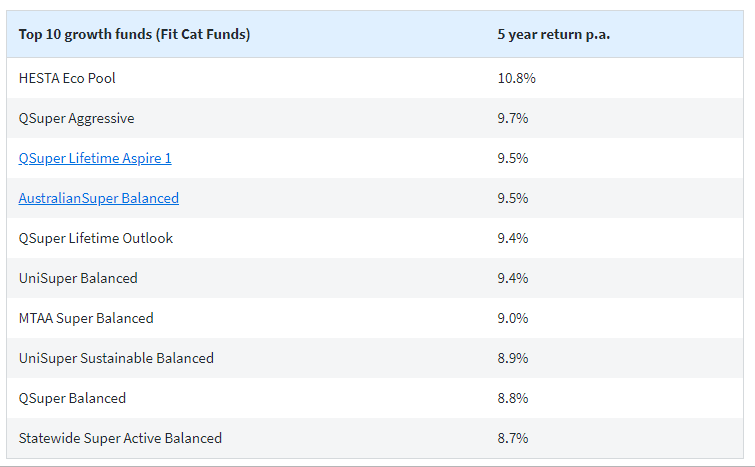

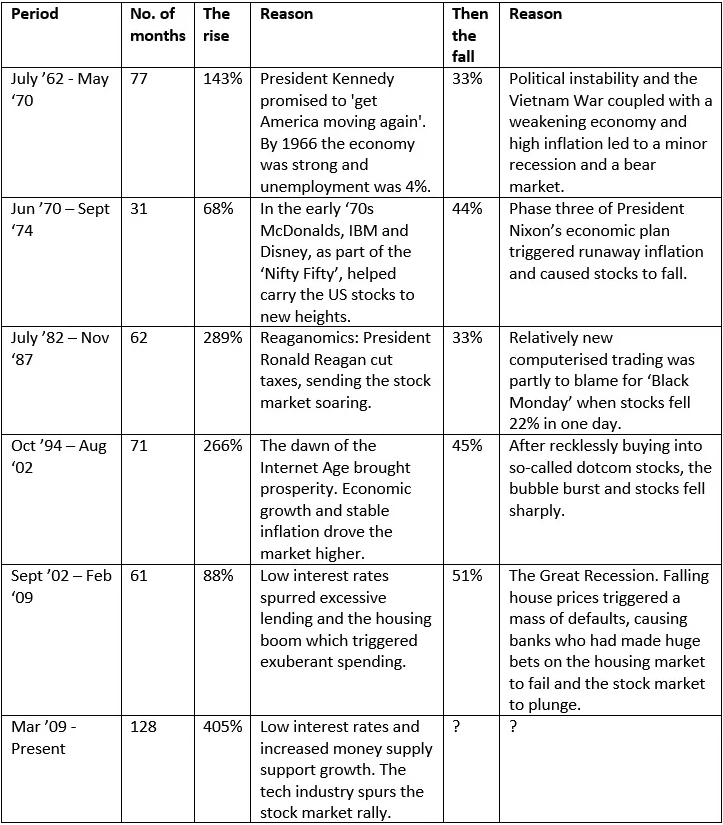

A reminder of some of the spectacular bull markets in the past 60 years is in the table below prepared by Schroders.

The table above outlines the reasons for the end of each bull market and their is usually a trigger, prior to a market collapse.

- a weakening economy, or an increase in the cost of money (higher interest rates)

- “irrational exuberence” – where buyers are paying grossly inflated prices for assets

- a cataclysmic world event

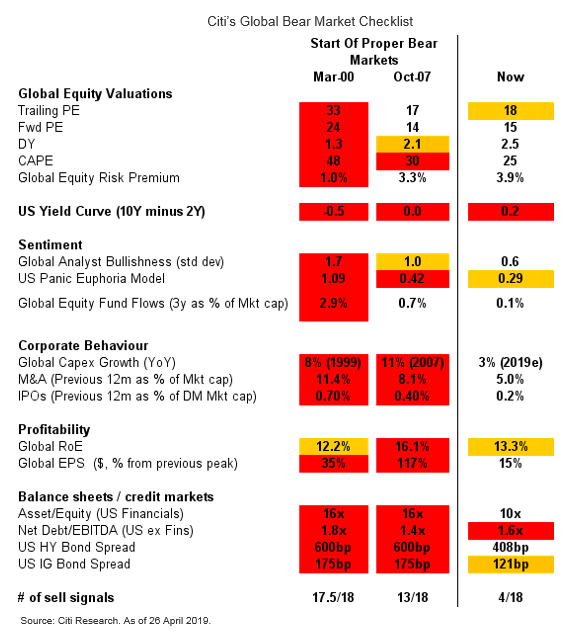

I can’t rule out the last one … but the US economy seems to be rolling along alright. Over the past week there have been a couple of events that bode well for the bull market to continue. In the UK, “buffoon in chief” Boris Johnson, has beaten the unelectable Labour candidate Jeremy Corbyn and now a quick Brexit looks on the cards. Stock markets generally love the removal of the uncertainty that elections present. The Trump/China trade deal seems to have also made some progress with a “phase one” deal announced. This should avert an escalation of the trade war. Low interest rates seem to around for quite some time. Stock valuations are high but not crazy high.

Slack Investor eases back onto the couch. There has to be really good reasons for Slack Investor to exit the world of high earning companies with products that the world wants.

Slack Investor is off on a bike riding adventure in Vietnam over Christmas and New Year. My usual End of Month Update will be delayed until about January 7, 2020. In the meantime, be fearless .. but also aware! The stock market moves in inevitable cycles. I am optimistic in the short term – and will enjoy my holiday. The good news is that even if the Slack view is wrong, there is always the subsequent “Higher Highs”as the market recovers. Good companies will survive any downturn and eventually return to a fair price.

The best of the fest … and a happy new year to all!