As Slack Investor is a student of the financial arts and a lover of measurement, the end of the financial year is a great time to review and see how the Slack Investments performed. The Index funds were reviewed last post. Index funds are a great way to start investing in shares – as you are spreading your risk over at least a hundred companies.

The next step, as you become more familiar with investing and can start running a critical eye over individual companies, is to invest in individual stocks.

Over 75% of Slack Investor’s share investments are in individual stocks. See Portfolio

Most of my holdings are in growth stocks. These stocks usually have a high Return on Equity (ROE>15%) – with a track record of increasing dividends. By their nature, they have a relatively high PE ratio and are usually punished in the markets during reporting season if there is any bad news affecting future earnings. This I accept.

Slack Investor Stinkers – FY 2018

Each year I expect a few stinkers and dont beat myself up about them when they occur. If they breach the monthly stop loss – I usually sell at the start of the next month.

-24%

A special mention for IPH. Although some investors have done well with this stock. this company has a prawn heads in the bin on a hot day type of stink for me. Slack Investor likes the idea of the company -and it seems to be making a bit of a recovery since I sold it! However, I have had difficulty trading it successfully as it would go into long periods of declining price immediately after my buys. I should have learned my lesson years ago with Slater and Gordon – Never trust Lawyers!

-22%

HSO has got caught up with a tightening on government health spending and a decline in private health care admissions.

-21%

RHC is also in the healthcare sector and has the same challenges as HSO. But, it is a well managed company and Slack Investor will look for an opportunity to get back in this stock.

Slack Investor Gold Nuggets – FY 2018

The wond erful thing about owning growth companies is that sometimes they surprise on the upside and grow faster than expected. Altium is the “Welcome Stranger” of gold nuggets.

erful thing about owning growth companies is that sometimes they surprise on the upside and grow faster than expected. Altium is the “Welcome Stranger” of gold nuggets.

+166% ALU makes software for the designing of integrated circuit boards that are used widely in a range of technology products. Some analysts fear that the stock is overpriced. Its PE ratio is currently an eye-watering 74 – but this is rapidly reducing with projected earnings over the next few years. I am still holding as we go into the reporting season – the optimist in me thinks that there may be more good news on future earnings. There are even rumours of a takeover by larger company. But if not, my end of month stop loss is $19.61.

+71% A2M’s brand relies on a patented process that makes milk with only the A2 protein. A2M has been the subject of a previous post, and it is true that I’m yet to be convinced of the health benefits attributed to A2 Milk – But their marketing is very good and the trend is more powerful than logic in my book! Slack Investor was stop-lossed out of this stock earlier this year, but has bought in again -and hope for good news this reporting season.

Honourable mentions for Slack Investor portfolio stocks that increased more than 30% in this remarkable financial year. These nuggets include APX, CSL, MQG, NCK (no longer held), PMC, REA, SEK and WOR.

Slack Investor SMSF performance – FY 2018

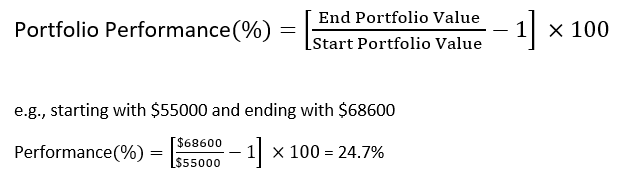

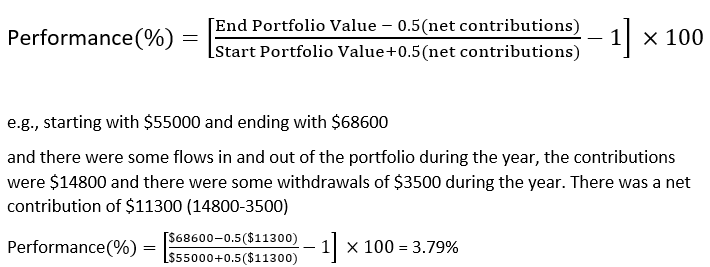

I have written extensively on calculating Portfolio returns. I run a few separate portfolios but only quote the SMSF annual returns as this portfolio is externally audited. All percentage earnings quoted include brokerage and portfolio costs. Both raw and franked dividends are included as income. So essentially, the percentage returns include costs but are before tax. This raw figure can then be compared with other investment returns.

In what can only be described as a high-water mark for Slack Investor’s SMSF portfolio investing prowess. (and the luck of holding ALU inside it), Portfolio return FY18 was 37.6%.

One-year high returns are welcome but Slack Investor puts more weight on multi-year performance. The past 5-yr progress of the Slack Portfolio is 23.6%, 2.6%(whoops!), 14.2%, 19.5%, and 37.6%. This gives a compounding annual 5-yr return for the Slack Investor SMSF portfolio of 18.9%. The benchmark ASX 200 Accumulation Index (Including dividends) 1-yr and 5-yr compounding annual returns are 12.7% and 9.9% , respectively.

“Good luck is a residue of preparation.”

– Jack Youngblood – Hall of Fame American Footballer

Slack Investor readily acknowledges the luck factor in the stock selection process and realises that this FY18 as an extraordinary year for the portfolio (I expect more moderate returns!). I have found that a disciplined stop loss process, a bit of effort and research on stock selection, and following of trends on share charts (technical analysis) can yield very good results.

Over the next year I will post on how to start investing and the specific techniques that Slack Investor uses – It is not difficult … Empower Yourself!

My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers.

My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers.